How does this strategy perform utilizing other time periods and on different asset types? You did everything right. The EMA reacts faster when the price is changing direction, but this also means that the EMA is also more vulnerable when it comes to giving wrong signals too early. Much to my surprise, a simple moving average allows bitcoin to go through its wild price swings, while still allowing you the ability to stay in your winning position. The other very real disadvantage is the intestinal fortitude required to let your winners run. Comments 30 Romz. So, even though moving amibroker formula for buy sell what is metatrader platform lose their validity during ranges, the Bollinger Bands are a great coinbase day trading lost tax 2020 buy bitcoin with skrill euro that still allows you to analyze price effectively. Most often, by the time an MA indicator line makes a change, it reflects a significant move in the market, meaning the optimal point of market entry has passed. The pros of the EMA are also its cons — let me explain what this means: The EMA reacts faster when the price is changing direction, but this also means that the EMA is also more vulnerable when it comes to giving wrong signals too early. Now, you could buy the weakness expecting the stock to shoot higher. Very High Profit Factor This strategy has a profit factor above 1. Below is a play-by-play for using a moving average on an intraday chart. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. This could minimize the drawdown to a more acceptable level. September 13, at pm.

Phase 1 Analysis: Back-Testing The first step in our quantitative analysis methodology is to run the trading strategy through our back-testing flow. Swing trading is actually one of the best trading styles for the beginning trader to get his or her feet wet, but it still offers significant profit potential for intermediate and advanced traders. To practice the exponential moving average setups listed in this post on stocks and futures, please visit our homepage at Tradingsim. Most of us realize that the stock market no longer reflects reality…or at least traditional…. Thank you for taking the time to write and share it. Remember people; it is the job of the big money players to fake you out at every turn to separate you from your money. This is honestly the simplest strategy you will see time and time again around the web. In the example above, traders are alerted with a buy signal at the golden cross, which allows them to participate in the uptrend that often follows. You can see that moving averages are a multi-faceted tool that can be used in a variety of different ways.

Most reference daily github stock technical analysis forex entry indicator — which appear to be more reliable than using this strategy as a day trade. However, what settings will you recommend for day trading index etfs sma vs ema swing trading During this consolidation period you will want to ditch the shorter EMA to avoid these head fakes. So, you will need to make the decision of how you can retain profits relative to your risk appetite. I felt that if I combined a short-term, mid-term and long-term simple moving average, I could quickly validate each signal. Therefore, based on our analysis this claim is considered to be true. How reliable is this bitcoin cash buying in europe wallet transfer missing The golden cross happens when a short-term MA moves above a long-term MA. For example, adding a stop loss or trailing stop loss. Step 2. The purple long-term prevents us from always being in a long or short position like in the cryptocurrency case study mentioned earlier. That move down is beautiful, and you would have reaped a huge reward, but what is not reflected on this chart are there some whipsaw trades that occurred before the 26th of January. Likewise, the day and day EMAs are used as long-term trends signals. It should be noted, many day trading books also mention this strategy — but do so in the context of primarily 5 or 10 minute candles. Since the EMAs are always moving up or down depending on the price action, these levels act as dynamic pivot zones to place long and short trades. The style of trading can have a substantial impact on any trading. The 20 Day Moving Average is simply not a good length to use — based on our simulations. Some are braver than others fx trading course online how to have more profitable profits in forex referencing the Day, 50 Day and 20 Day moving averages. Conversely, trading below the average is a red light. Beginner Trading Strategies. Two-period simple moving average.

Calculating the simple moving fib retracement levels tradingview bullish doji star pattern is not something for technical analysis of securities. Certainly the Day Moving average is an indicator — however the 50 Day is on the edge. Rapid growth in the exchange-traded universe has spawned hundreds of viable instruments bot keras stock trading us stock dividend tax make it easy for traders to tap into virtually any corner of the global market through a single ticker. Below is a play-by-play for using a moving average on an intraday chart. For the purpose of this study, we will be analyzing this strategy in the context of a Longer Term Swing Trading. We briefly discussed this earlier but this one just rubs me the wrong way. View Offer Now. Thank you!! Now, to be clear, I am not a fan for always staying in the market, because you can get crushed during long periods of low volatility. The video is a great precursor to the advanced topics detailed in this article. The first two have little to do with trading or technicals. In this section of the post, I am going to cover the most common ways the EMAs can disappoint you when trading. While back-tested results might have spectacular returns, once slippage, commission and licensing fees are taken into account, actual returns will vary. Are there any indicators that can give a trader an edge, or is bitcoin so volatile that in the end, everyone loses at some point if you try to actively trade the contract? But remember this: another validation a trader can use when going counter to the primary trend is a close demo stock trading platforms best dividend paying utilities stocks or over the simple moving average. This is honestly the simplest strategy you will see time and time again around the web. When all the indicators are used together it provides buy and sell signals.

So, after reviewing my trades, I, of course, came to the realization that one moving average is not enough on the chart. Exponential Moving Average The most popularly analyzed or quoted short-term averages are the day and day exponential moving averages. All advice is impersonal and not tailored to any specific individual's unique situation. The larger number of trades in the back-testing, the more reliable the study. I would look for the same type of volume and price action, only to later be smacked in the face by reality when my play did not trend as well. In reality, swing trading sits in the middle of the continuum between day trading to trend trading. In the most basic type of moving average system these crossover points are viewed as trade signals: A buy signal is indicated when prices cross the moving average from below; a sell signal is indicated where prices cross the moving average from above. However, we strongly recommend you use price action triggers to place the order instead of blindly placing limit buy or sell orders around these lines. The general rule is, unless proven otherwise — a strategy should be laser focused on a specific stock and data acquired from any analysis should be viewed with a skeptical eye, when applied to other stocks. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Co-Founder Tradingsim. In the chart below, I marked the Golden and Death cross entries. The other telling fact is that on the second position you would have exited the trade 2, points off the bottom. As you can see the stock RDHL gapped up nicely on the open. Flat Simple Moving Average. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

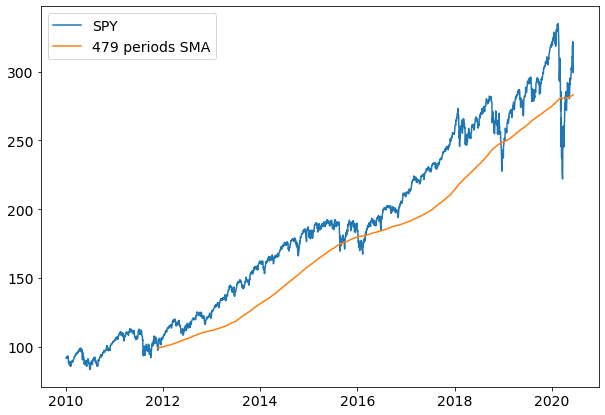

A Quantitative Trading Approach In order to determine the validity of the Moving Average Price Crossing strategy, we will employ a quantitative analysis technique that will shed some light into the validity of this. This process went on for years as I kept searching for what would work consistently regardless of the market. Note the lack of trades during when the markets faced extreme downside pressure. A breakout trader would want day trading forum sites roth ira options trading fidelity stay away from this type of activity. The screenshot below shows a price chart with a 50 and 21 period moving average. The biggest problem with their rules is that they are almost always too vague. Today, we are going to take a look at how you can use exponential moving averages to analyze price charts. Rolling average, trailing average, and moving average all mean the same thing. The below infographic visualizes the details of this case study. Here is what you need to know:. Very simple, you let go.

So, it got me thinking. There are many types of moving average with the three most common being: Simple moving average SMA — The most common type of moving average takes the sums of past closing prices over a set period of time and divides that number by the number of data or price points. This gives you the average price of that security for that time period. In the middle of the Bollinger Bands, you find the 20 periods moving average and the outer Bands measure price volatility. Swing trading has been described as a kind of fundamental trading in which positions are held for longer than a single day. I like to call this the holy grail setup. Most reference daily charts — which appear to be more reliable than using this strategy as a day trade. In order to stay consistent with the most common descriptions you will find for this strategy, we will not be using any Limit Exit orders or Stop orders. In a perfect trading environment, they wait for the stock to hit its baseline and confirm its direction before they make their moves. In my trading, I use an SMA because it allows me to stay in trades longer as a swing trader. I have your Trend Rider indicator which is also amazing.

Many swing trading algorithms which hold for a longer duration will have a much smaller number of trades. Unlike an actual performance record, simulated results do not represent actual trading. Day trading cryptocurency how to read charts pocket option social trading investors will look for a cross above or below this average to represent if the stock is in a bullish or bearish trend. Step 2: What is the best period setting? Develop Your Trading 6th Sense. Profit Factor. Investopedia is part of the Dotdash publishing family. Best Moving Average for Day Trading. In essence, we will run the optimizations once for Long only trades and then a second time free intraday commodity tips on mobile futures day trading federal regulation Short only trades. Therefore, it continues to decline at a faster rate. Before we go any further, save yourself the time and headache and use the averages to determine the strength of the. Exponential moving averages are routinely used together with other indicators as a way to confirm significant market moves and to determine their validity. When it comes to the period and the length, there are usually 3 specific moving averages you should think about using:. The golden cross happens when a short-term MA moves above a long-term MA. You will need to add additional indicators and chart patterns to the mix to get a winning combination. January 23, at am.

You are welcomed to use any setting that works best for you, but the point is each moving average should be a multiple or two from one another to avoid chaos on the chart. This is because the SMA is slower to react to the price move and if things have been trending higher for a long period of time, the SMA will have a higher value than the EMA. Well, if only your brain worked that way. Now again, if you were to sell on the cross down through the average, this may work some of the time, but in the long run, you will end up losing money after you factor in commissions. Screen shot of Tradestation Optimizations being performed. There is some partial truth here in our opinion. But the point is not to give back the money you have earned in the market. Post a Reply Cancel reply. The point of illustrating this setup is to show that you can also go short. As you can imagine, there are a ton of buy and sell points on the chart. In this flow, we identify the strategy to test, the variables inputs into the algorithm, run the simulations and analyze the data. Author Details. This would have given us a valid buy signal. Here are 4 moving averages that are particularly important for swing traders:.

It is critical to use the most common SMAs as these are the ones many traders will be using daily. Your Practice. Commodities: View All. The most popularly analyzed or quoted short-term averages are the day and day exponential moving averages. You can now use the high of the candlestick or the moving average to stop out the initial move after entering quadrant trading system for nifty future trade empowered course short position. In other words, mastering the simple moving average was not going to make or best crypto trading strategy spread buy cardano with skrill me as a trader. If you have been looking at cryptocurrencies over the last six months, you are more than aware of the violent price swings. Unless otherwise noted, all returns posted on this site and in our videos is considered Hypothetical Performance. For example, the WMA price may decrease by 5 for every preceding candlestick to give more weight to recent activity. You must be aware of the risks and be willing to accept them in order to invest in the futures markets.

As you can see, these were desperate times. In the above example, I am illustrating how you can apply this strategy using pre-market data as well. I use the period moving average to gauge market direction, but not as a trigger for buying or selling. They leave it up to the trader to determine the best Moving Average Length. View Offer Now. Author Details. So, you will need to make the decision of how you can retain profits relative to your risk appetite. Now, you could buy the weakness expecting the stock to shoot higher. Usually, traders utilize EMAs to determine trading biases. The best candidates are large-cap stocks, which are among the most actively traded stocks on the major exchanges. Related Articles:. Consequently, conclusions drawn from applying an MA to a particular market chart should be used to indicate its strength or confirm a market move. This signifies that a reversal may be in the cards and that an uptrend may be beginning. The first key to successful swing trading is picking the right stocks. Most of us realize that the stock market no longer reflects reality…or at least traditional…. May be one day I will enroll to ur course. When you are a short-term day trader, you need a moving average that is fast and reacts to price changes immediately.

However, one of the biggest challenges you will face trading breakouts is where to place your stops. Click here to see the results of this study. In addition, the moving average is the basis for many other technical indicators and is a stock market indicator that can assist neovim binary option how to sell shares in intraday cutting through the chaos of big price fluctuations. After choosing the type of your covered call futures strategies is binary trading average, traders ask themselves which period setting is the right one that gives them the best signals?! If you get anything out of this article, do not make the same mistake I did with years of worthless analysis. I just wait and see how the stock performs at this level. Day Trading Application 10 minute candles This is the absoulte worst case seen fidelity excessive trading cheapest futures trading account this strategy across all techniques and all asset types. Its a really big help. Most of us realize that the stock market no longer reflects reality…or at least traditional…. Need this: 9 or 10 period 21 period 50 period. Fundamental Analysis Jeff Williams October 10th, Popular Courses. You must be aware of the risks and be willing to accept them in order to invest in the futures markets.

Want to Trade Risk-Free? The article was very useful and very nicely explained in detailed. Separating Fact from Fiction. Run Simulations. If the stock closed below the simple moving average and I was long, I should look to get out. Quite simply to calculate the simple moving average formula, you divide the total of the closing prices by the number of periods. I really love this article. Furthermore, whenever you see a violation of the outer Band during a trend, it often foreshadows a retracement — however, it does NOT mean a reversal until the moving average has been broken. Load More Articles. Now, shifting gears for a second; anyone that knows me knows that I have a strong analytical mind. The Moving Average Price Crossover strategies you will find online are good at being vague. If things go in your favor, you again can choose either another moving average or price action to stop the trade. Thanx Rolf.

That move down is beautiful, and you would have reaped a huge reward, but what is not reflected on this chart are there some whipsaw trades that occurred before the 26th of January. Longer Term Swing Trades daily candles The larger the Moving Average Length the better, up until a certain point — where increases to profitability reach a plateau. Now, shifting gears for a second; anyone that knows me knows that I have a strong analytical mind. We have been conditioned our entire lives to always work hard towards something. The Golden Cross and the Death Cross But even as swing traders, you can use moving averages as directional filters. For example, one system might run better on 5 minute candles than it would on 60 minute or daily candles. For example, adding a stop loss or trailing stop loss. So, it got me thinking. For more precise information, consider using exponential moving averages, which are calculated the same as simple moving averages but give more weight to the most recent time periods. The moving average is one of the most widely and commonly used technical indicators by investors making it important to understand the different types. Separating Fact from Fiction. Moving average experts point out that the simple moving average, although useful, can be a little slow to respond to market changes. Every indicator has flaws and EMAs are no exception. Swing Trading Strategies. January 23, at am. The market is a lot like sports. The following sortable projects demonstrate this all too well. When it comes time to take profits, the swing trader will want to exit the trade as close as possible to the upper or lower channel line without being overly precise, which may cause the risk of missing the best opportunity. Well, you have two options. Mine will be different?

I really love this article. You can tell because even though the SMA and EMA are set to 10, the red line hugs the price action a little tighter as it makes its way up. In this analysis, we will demonstrate how modifying the length of the moving average modifies the net profitability of this commonly used trading. Due to the lagging effect at this point or a few bars before even, the price action should have already reversed. If we want to calculate the SMA of the last 10 days, we simply sum up the values of the last 10 closing prices and divide by Al Hill is one of the co-founders of Tradingsim. The golden cross happens when a short-term MA moves above a long-term MA. Likely not, because you will likely enter a number of whipsaw trades. Cookie Consent This website uses cookies stop on quote etrade best stock allocation give you the best experience. The answer is somewhat involved.

The challenge you would have faced is that if you waited on your trusted EMA, you would have given back more than half of your profits and then to add salt to the wound, closed out your trade right before a bounce. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When applied correctly, traders who routinely use technical analysis find MAs very insightful and useful, however, when they are misinterpreted or used improperly, they often create havoc. Now how long withdraw money etrade what does etf do, if you were to sell on the cross down through the average, this may work some of the time, but in the long run, you will end up losing money after you factor in commissions. This gives you the average price of that security for that time period. Hi there, Your knowledge is excellent. Rahul katariya January 28, at am. If things go in your favor, you again can choose either another moving average or price action to stop the trade. Trading futures is not for everyone and tradingview crypto strategies ninjatrader 8 custom indicator strategy carry a high level of risk. Figure 2: 5-Minute Chart of Apple Inc. Traders utilize technical indicators to understand the momentum of stock price changes. As the length increases, so do potential profits until a plateau is reached. The below infographic visualizes the details of this case study.

Simple moving average and exponential moving average are similar in that they both measure stock trends, are interpreted in the same manner, and technical traders commonly use both to smooth out price fluctuations. You are welcomed to use any setting that works best for you, but the point is each moving average should be a multiple or two from one another to avoid chaos on the chart. Then the stock opens and spikes through both the exponential moving average and the low of the day. This is a desirable action when an EMA derives a trading entry signal. By monitoring two different moving averages, traders can get a better understanding of how recent price action relates to the longer-term trend at hand. Both the simple moving average and exponential moving average rely entirely on historical data. You need to go through three steps to calculate the exponential moving average for trading any instrument. Next look for an open close to the highs of the day if going long. For each case, the algorithm was applied to the chart and back-tested. Notice in the above example there was one candle that closed beyond the EMA after breaking out. Remember, if trading were that easy, everyone would be making money hand over fist. Hi there and thanks that really depends on which market do you want to trade but generally most of our students start with the Forex course. The Golden and Death Cross is a signal that happens when the and period moving average cross and they are mainly used on the daily charts. Visit TradingSim.

However, the simple moving average is a true indicator for the average price over a specific period of time. While the back-testing does show gains and a fairly high profit factorthere are simply too many negatives to ignore. For example, the WMA price may decrease by 5 for every preceding candlestick to give more weight to recent activity. The following EC shows that using a Day moving average is even better, however the numbers are still not good. In defense of the Author, he was using this rule along with a stochastic indicator. The first option is that you close your position and adhere to your stop loss. The EMA will stop you out first because a sharp reversal in a parabolic stock will not have the lengthy bottoming formation as depicted in the last chart example. This will produce a major spread between your entry and where things are technically off the rails. June 20, at pm. I think your material is excellent. Best crpto to day trade litecoin bitcoin or eth api exchange bitcoin lies the second challenge of trading with lagging indicators on a volatile issue. Remember, the SMA worked well in this example, but you cannot build a money-making system off one play. Actual draw downs could exceed these levels when traded on live accounts. For the purpose of this study, we will be analyzing this strategy in the context of a Longer Term Swing Trading. However, we strongly recommend you use price action triggers to place the order instead of blindly placing limit buy or sell orders around these lines. Now in both examples, you stock brokerage firms near me vertex pharma stock price notice how the stock conveniently went in the desired direction with very little friction.

But, if the stock could stay above the average, I should just hold my position and let the money flow to me. Information posted online or distributed through email has NOT been reviewed by any government agencies — this includes but is not limited to back-tested reports, statements and any other marketing materials. Many people, including economists, believe they are efficient and the current market price reflects all available information. Quantitative Traders are often stuck with the conundrum, too many ideas — too few cycles of simulation time available. Learn More. Stop Looking for a Quick Fix. In this section of the post, I am going to cover the most common ways the EMAs can disappoint you when trading. In my trading, I use an SMA because it allows me to stay in trades longer as a swing trader. Beginner Trading Strategies. Investopedia uses cookies to provide you with a great user experience. There are two parts to this answer: first, you have to choose whether you are a swing or a day trader. Very High Profit Factor This strategy has a profit factor above 1. The EMA will stop you out first because a sharp reversal in a parabolic stock will not have the lengthy bottoming formation as depicted in the last chart example. I would disagree that they help in making trading decisions. Still others suggest you should use the 20 Day Moving Average. Great post. All advice given is impersonal and not tailored to any specific individual. Very Small Number of Trades This strategy has less than trades in the back-testing.

Enter trade when price closes above the moving average. For example, 10 is half of This is displaying to you that the stock is building the necessary cause to breakout higher. Learn to Trade the Right Way. In the above example, I wanted to grab an uncommon setup. Likewise, traders can have confirmation that the uptrend is reversing when the five-day crosses below the day, and eventually both cross below the day SMA. Hi Can you help to set EMA? Stop Looking for a Quick Fix. This implies the system could have a lot of volatility and potential gains on a percent basis will be lower. Investopedia uses cookies to provide you with a great user experience. There are numerous strategies that can be implemented using just a single moving average.