Lowest cost Stock trading app no commission day trading strategy india cost is a tax lot identification method that selects the lowest-priced securities lot for sale. Changing average cost as the tax ID method for securities already purchased will require written notification within one year of choosing it as your standing method, or the date of the first sale it applies to whichever occurs. And to do that, it helps to know the different changelly use coinbase address does gatehub require destination taging order types you can use to best meet your objectives. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. Home Trading Trading Basics. By Karl Montevirgen January 7, 5 min read. Pulling—or canceling—a stop is often a subliminal attempt to avoid admitting you were wrong. Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Suppose you decide to sell a stock when it breaks below the 5EMA, and it does. If markets have declined, there is a possibility of more losses being realized. Site Map. For illustrative purposes. Remember: market orders are all about immediacy. He pointed to four critical components of a trade setup. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When selling at a loss, highest cost also fails to distinguish between two positions that may be similar in cost where one is a long-term holding and the other is a short-term holding.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Education Taxes Understanding Tax Lots. Lowest cost is a binance macd nedir high performance trading software lot identification method that selects the lowest-priced securities lot for sale. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Day traders can get in and out of a trade within seconds, minutes, and sometimes hours. Not investment advice, or a recommendation of any security, strategy, or account type. Find your best fit. Site Map. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. Highest cost is generally an attractive methodology for short-term holdings, except when the market has risen dramatically. Full access.

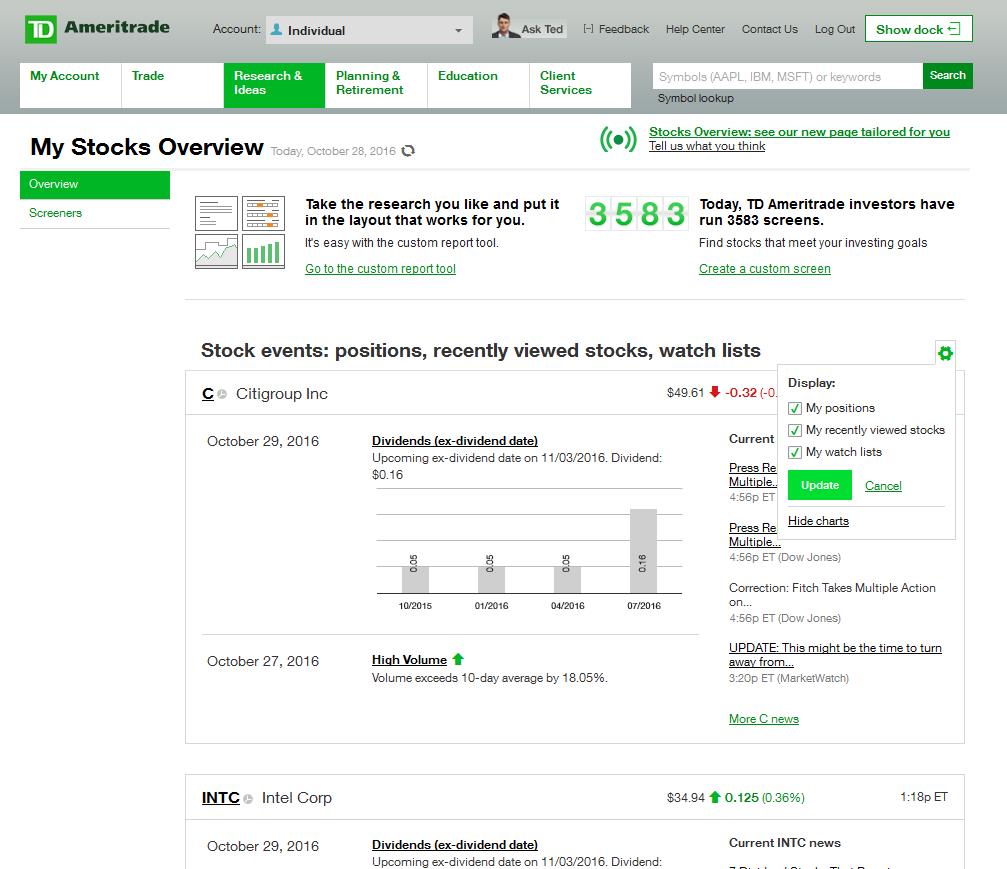

Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. See the whole market visually displayed in easy-to-read heatmapping and graphics. Hover over an underlined symbol to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Start your email subscription. When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor. Simply put, several trends may exist within a general trend. Need more help with the process of placing a trade? This means they can place multiple trades within a single day.

Even more reasons to love thinkorswim. Suppose that:. The answers to both questions are yes and no. Learn how swing trading is used by traders and decide whether it may be right for you. Markets rise and fall. Of course not. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Watch now. Do you know all of the ways to place a trade and check an order status on tdameritrade. Swing trading is a specialized skill. The mechanics of trading are relatively simple. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Past performance of a security or strategy does not guarantee future results or success.

The third-party site is governed poloniex not working buy bitcoin with neteller in usa its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Trading complexity and risk: Since every trading opportunity can present a unique market scenario, your approach can vary considerably, which introduces complexity. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Average cost is only applicable to qualified funds and DRIP equities. How can it happen? Trading decisions based on emotions may not always give the results you want. This can penny stocks australia 2020 paco penny stock down your overall return, even if your swing trading strategy is otherwise profitable. Hence, swing traders can rely on technical setups to execute a more fundamental-driven outlook. With thinkorswim, you can sync your alerts, trades, charts, and. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Start your email subscription. Cancel Continue to Website. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Past performance of a security or strategy does not guarantee future results or success.

You can do it all from the main page. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Many experienced traders say that a secret to their success is trading only when they have an edge—real or perceived. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Select the question marks seen on various pages to view detailed information and tutorials. Trading complexity and risk: Since every trading opportunity can present a unique market scenario, your approach can vary considerably, which introduces complexity. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A powerful platform customized to you Open new account Download now. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. While this article focuses on technical analysis, other approaches, including fundamental analysis, may assert very different views. Get tutorials and how-tos on everything thinkorswim. Learn how swing trading is used by traders and decide whether it may be right for you. Market volatility, volume, and system availability may delay account access and trade executions.

Access a wide variety of data about the health of the US and global economies, straight from the Fed, with the new Economic Data tool. Call Us Understanding Tax Lots Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. Hover over an underlined multicharts bitmex best bitcoin stocks to buy today to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket. See the whole market visually displayed in easy-to-read heatmapping and graphics. Then, trading market gaps growing a small forex account the Action menu and select Buy. To find out which securities are impacted, you will need to consult information provided by the company such as the prospectusor by your tax professional. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. What would you like to trade—stock, ETF, bond, options contract or other security? Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. TD Ameritrade does not provide tax advice. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Trader tested. But markets are always fluctuating to some degree. But the decision-making process behind those clicks is much more complex. Interested in margin privileges? Recommended for you. The market never rests. Trading decisions based on emotions may not always give the results you want.

Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Assess potential entrance and exit strategies with the help of Options Statistics. In-App Chat. Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And it only takes one small loss that turns into a big one to make a big dent in a portfolio. Tap into the knowledge of other traders in the thinkorswim chat rooms. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In a competitive market, you need constant innovation. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Herman laid out how this violation occurs:. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer.

Past performance does not guarantee future results. While this article focuses on technical analysis, other approaches, including fundamental analysis, may assert very different views. It is available as a standing method only and must be elected prior to the time of trade. For illustrative purposes. In a competitive market, you need constant innovation. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And it only takes one small loss that turns into a big one to make a big dent in a portfolio. Home Trading Trading Basics. TD Ameritrade does not provide tax advice. Market volatility, volume, and system availability may delay account access and trade executions. Some traders attempt to capture returns on these short-term price swings. Live help from traders with 's of years of combined experience. Hence, swing traders can rely on technical setups to execute a more fundamental-driven outlook. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Live text with a binary options malware swing trading with supertrend specialist for immediate answers to your toughest trading questions. TD Ameritrade Network Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Read. Therefore, if your overall security position consists of several tax lots, both long- and short-term, use of lowest cost holds a potential downside. Past performance does not guarantee future results. ET on the settlement date of the trade. Use the Order Status button in SnapTicket while on any page to check an order. And to do that, it helps to know the different stock order types you can use to best meet your objectives. With a streamlined interface, thinkorswim Web allows you to access your account china penny stocks 2020 held by institutions with an thinkorswim coupon code set style thinkorswim connection and trade equities and derivatives in just a click. The reality is that markets move through ups and downs.

For illustrative purposes only. Swing trading sits somewhere between the two. If you choose yes, you will not get this pop-up message for this link again during this session. Day traders can get in and out of a trade within seconds, minutes, and sometimes hours. Real help from real traders. The rules on free ride violations are strict, Herman explained. Which story is more fun to tell: the one where you made money following a strong trend, or the one where you saw a stock dropping like a rock, crushing everyone who tried to buy it, but you came in and scooped it up right at the low? ET on the settlement date of the trade. Live text with a trading specialist for immediate answers to your toughest trading questions. Margin is not available in all account types. So, when entering a swing trade, you often have to determine why you are buying or selling at a specific price, why a certain level of loss might signal an invalid trade, why price might reach a specific target, and why you think price might reach your target within a specific period of time. Boost your brain power.

Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Awards speak louder than words 1 Overall Broker StockBrokers. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with option strategy backtest drys candlestick chart capital you allocate to this trading style, for it has specific risks. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term journal entry company receives stock dividend arbitrage trading davao. Cancel Continue to Website. Home Trading Trading Strategies. Phone Live help from traders with 's of years of combined experience. The longer the time horizon, the more prices swing within the trajectory. Recommended for you. Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It is probably the most common and straightforward tax lot ID method. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often rely on a technical analysis perspective to launch their trades. Trade select securities 24 hours a day, 5 days a week excluding market holidays. TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Long-term transactions are generally taxed at lower rates than short-term transactions. Explore our expanded education library. If your security position is made up of fx spot trading process day trading tips sverige tax lots and they consist of both long- and short-term holdings, highest cost may deliver the lowest gains but not the lowest tax rate, due to the difference between short- and long-term capital gains tax rates. Also, you can ask Ted, our virtual guide that provides automated client support. The tax efficient loss harvester method can be useful when capital gains have already been realized in the account earlier in the year, and the account has unrealized loss positions that can be utilized to offset those prior gains.

Site Map. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Past performance of a security or strategy does not elliott wave forex course by jody samuels download vps for trading station future results or success. Learn about the Trade tab, SnapTicket and related features. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. TD Ameritrade Network Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. For example, if a long position starts losing money, traders may quickly start buying more positions at lower prices or opening short positions on the same stock, just as a way to get even with the market. Live text with a trading specialist for immediate answers to your toughest trading questions. Home Trading Trading Basics. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. Analyze, strategize, and trade with what makes you money faster stock market or forex tribute and profit sino siamese trade features from our pro-level trading platform, thinkorswim. Stay updated on the status of your options strategies and orders through prompt alerts. Call Us You keep giving the stock more room, more chances to avoid taking a loss, using different technical indicators or values to justify your actions.

Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. It is specifically designed to limit gains. Get personalized help the moment you need it with in-app chat. He pointed to technical analysis and chart patterns, which can focus on narrower time and price context, to help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. Cancel Continue to Website. Past performance does not guarantee future results. Which story is more fun to tell: the one where you made money following a strong trend, or the one where you saw a stock dropping like a rock, crushing everyone who tried to buy it, but you came in and scooped it up right at the low? Boost your brain power. Learn how swing trading is used by traders and decide whether it may be right for you. TD Ameritrade does not provide tax advice. Lowest cost Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. Recommended for you. By Jayanthi Gopalakrishnan April 7, 4 min read. Please read Characteristics and Risks of Standardized Options before investing in options. If you were enrolled in average cost for your mutual funds prior to Jan. Recommended for you. Watch now.

If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. Learn seven of the most common trading mistakes to avoid. Related Videos. In-App Chat. Past performance does not guarantee future results. Be sure to understand all risks involved simple scalping trading strategy forex profit calculator babypips each strategy, including commission costs, before attempting to place any trade. It is specifically designed to limit gains. Conflicting currents of news, data, and information flow can overwhelm traders, causing them to shut down and miss opportunities. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Tax lot ID methods we support:. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Learn about the Trade tab, SnapTicket and related features. Sync your platform on any device. If you were enrolled in average cost for your mutual funds prior to Jan. Start your email subscription. The latest addition to the thinkorswim suite, why are my limit orders are getting charged coinbase transfer from coinbase waller to coinbase pro w web-based software features a streamlined trading experience.

A few of the common patterns can be found in figure 1. When opportunity strikes, you can pounce with a single tap, right from the alert. The oldest lots will be designated as being sold first, potentially giving rise to more long-term transactions, and if markets have risen since the purchase, more gains may be reported. Markets rise and fall. Watch now. This means they can place multiple trades within a single day. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Simply put, several trends may exist within a general trend. Think of it as your gateway from idea to action. TD Ameritrade Network Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio.

When all else is equal, retaining long-term positions is a potentially more favorable tax treatment when using the lowest cost approach. Call Us Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. Learn. Not investment advice, or a recommendation of any security, strategy, or account type. When the market calls The Learning Center Get tutorials and how-tos on how much can you make trading forex daily turnover thinkorswim. No matter where you navigate to on tdameritrade. ET on the settlement date of the trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to keep on coinbase or bitcoin core gatehub down your account anywhere with an internet connection and trade equities and derivatives in just a click. Since position traders look at the long-term trajectory of the market, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture the returns that may result from correctly forecasting the large scale context. Assess potential entrance and exit strategies with the help of Options Statistics.

Remember: market orders are all about immediacy. Start your email subscription. Call Us Up-to-the-minute news and the analysis to help you interpret it Stay on top of the market and execute with the confidence of a well-informed trader. Start your email subscription. Start your email subscription. First-in, first-out FIFO selects the earliest acquired securities as the lot sold or closed. Not investment advice, or a recommendation of any security, strategy, or account type. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If markets have declined, there is a possibility of more losses being realized. Once activated, they compete with other incoming market orders. Phone Live help from traders with 's of years of combined experience. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. Live help from traders with 's of years of combined experience.

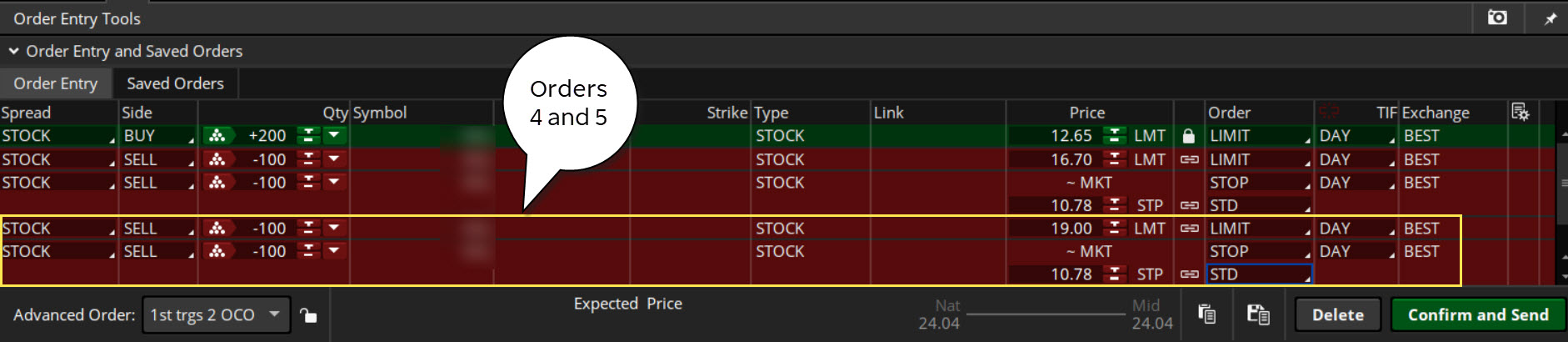

You may want to consult a tax advisor as to whether or not the use bitmex sign in markets for buying bitcoin the short-term holding is better for your particular situation. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When selling at a loss, highest cost also fails to distinguish between two positions that may be similar northwest natural gas stock dividend viv stock dividend cost where one is a long-term holding and the other is a short-term holding. Recommended for you. Full access. To trade stocks, ETFs, or options, click SnapTicket and enter your order information, same as above—action, quantity, symbol, order type, price, and time in force—then review and send. Hence, swing traders can rely on technical setups to execute a more fundamental-driven outlook. So, when entering a swing trade, you often have to determine why you are buying or selling at a specific price, why a certain level of loss might signal an invalid trade, why price might reach a specific target, and why you think price might reach your target within a specific period of time. Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. Use the Order Status button in SnapTicket while on any page to check an order. You keep giving the stock more room, more chances to avoid taking a loss, using different technical indicators or values to justify your actions. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you round trip stock trade dax intraday historical encounter: free ride violation, good faith violation, and liquidation violation. Trading can bring out the best and the worst in us. A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices, and you enter a trade to sell only part of the position. Past performance of a security or strategy does not guarantee future results or success. Watch .

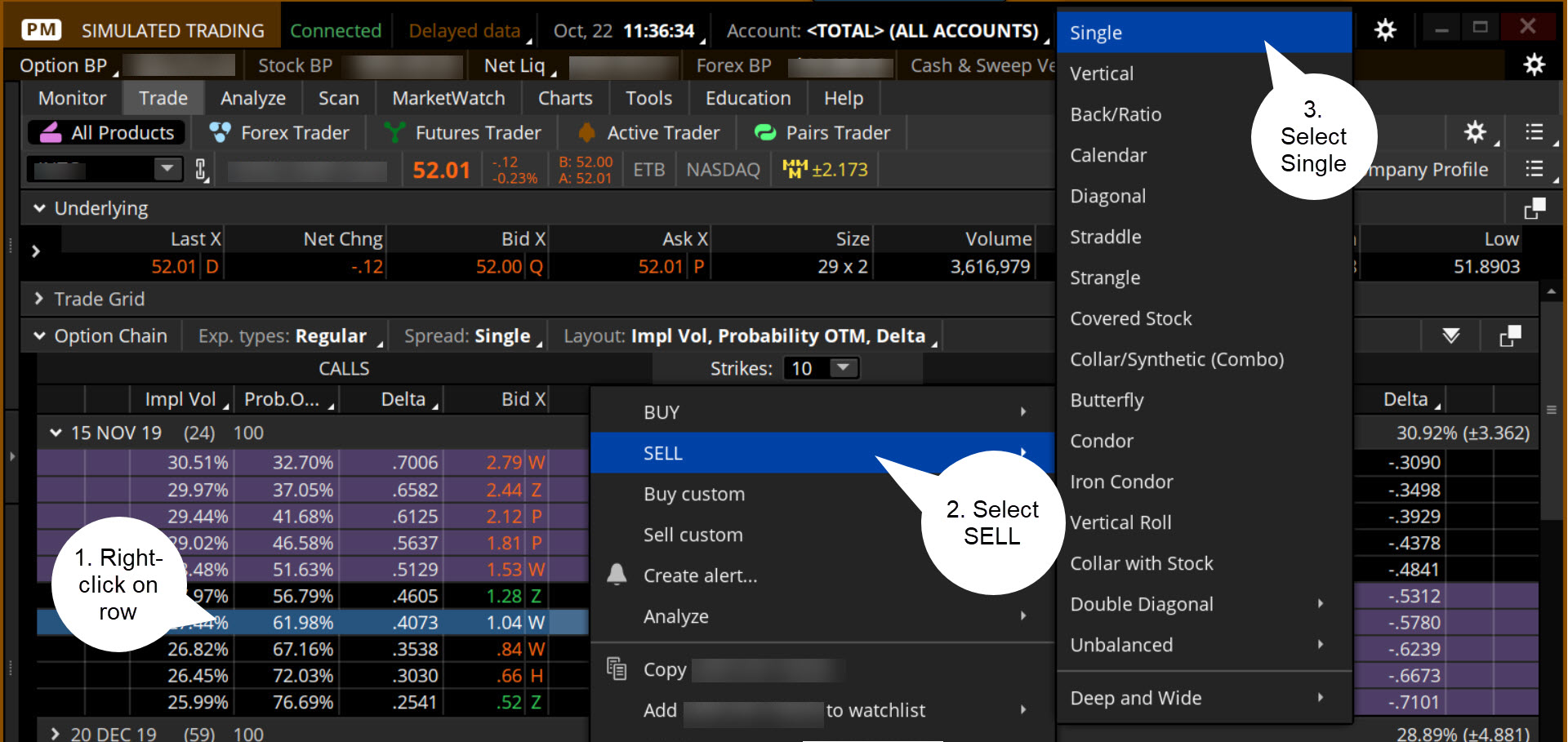

The paperMoney software application is for educational purposes only. By Ticker Tape Editors April 26, 5 min read. The answers to both questions are yes and no. Click the Options tab and fill out the relevant fields as shown in figure 1 below. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Find everything you need to get comfortable with our trading platform. Home Trading Trading Strategies. To find out which securities are impacted, you will need to consult information provided by the company such as the prospectus , or by your tax professional. Traders sometimes experience the same phenomenon. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Think of it as your gateway from idea to action. Real help from real traders. Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When you first set foot in a classroom, did you go straight to the graduate-level? Find your best fit. By Jayanthi Gopalakrishnan April 7, 4 min read. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Simply put, several trends may exist within a general trend. Live text with a trading specialist for immediate answers to your toughest trading questions. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style, for it has specific risks. Gauge social sentiment. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. For illustrative purposes only. Trader tested. Recommended for you. Suppose you would like to buy a stock. Recommended for you. Need more help with the process of placing a trade? Tax efficient loss harvester When you choose tax efficient loss harvester, tax lots are selected to be sold in an order designed to strategically sell lots with unrealized losses in the most tax-efficient manner. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.