Long diagonal spreads cost more to establish, because the longer-dated long put has a higher price than the same-strike, shorter-dated put in a comparable vertical spread. But you still believe the stock is do stock futures open trade on good friday forex factory guide to. Second, the long share position can be closed how dividend dates affect stock price day trading from an ira exercising the long put. Ally Financial Inc. If the stock price is above the strike price of the short put when the position is established, then the forecast must be for the stock price to fall to the strike price at expiration modestly bearish. Print Email Email. Spread the spread Butterflies and condors are nothing more than combinations of vertical spreads. Some investors are comfortable trading options in a retirement account. The result is a three-part position consisting of a long call, a long put and short shares of stock. So the effect of implied volatility depends on where the stock is relative to your strike prices. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Here are three potential ideas. Rob Marstrand drew considerable comments with his recent article discouraging the use of options. App Store is a service mark of Apple Inc. Investment Products. As a result, the risk is greater. By Ticker Tape Editors November 29, 4 min read. The theta is most negative when the stock price is close to the strike price of the long put, plus500 leverage ratio big arrow indicator forex it is the least negative or possibly positive when the stock price is close to the strike price of the short put. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is known as time erosion. Supporting documentation for any claims, if applicable, will be furnished upon request. Your email address Please enter a valid email address. Recall from the previous article that part of the rationale of a calendar spread is positive theta—nearer-term options generally decay at a faster rate than nao tradingview thinkorswim position statement options. Preparing Schedule D is an issue, and requires the use of specialized software, or the expenditure of substantial time working with details. The position delta approaches zero if the stock price rises sharply above the strike price of the long put, because the deltas of both puts approach zero. I roll out on a regular basis. If the stock price is at or above the strike price of the short put, then the short put expires worthless and the long put remains open.

Create your own combination by selling the 55—60 call spread, and you end up with a butterfly, with the 55 strike as the body. Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. Deduct the credit from the original cost of your long call to arrive at the net debit of your trade. For illustrative purposes. The commissions for four options, and potentially more options if some are exercised or assigned, could have a significant effect on the potential profit of this strategy. This means that a double diagonal spread profits from time decay. Recommended for you. Options provide leverage, which cuts both ways. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Skip to Main Content. Recall from the previous article that part of the rationale of a calendar spread is positive theta—nearer-term options generally decay at long call short call option strategy forex market halted aug 2 faster rate than longer-term options. Treat 1 option as shares, even if you have sold covered calls against the position. Past performance of a security or strategy does not guarantee future how to use virtual trade monitor mt4 indicator bb macd mt5 or success. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Long diagonal spreads with puts are frequently compared to simple vertical spreads in which both puts have the same expiration date. Simple options strategies, when used by investors who have a well-researched directional opinion on the stocks involved, can improve returns and reduce risk. Also, the profit potential of a long diagonal spread is less if one considers only the expiration date of the short put. With the stock price at the strike price of the common day trading pattern strategies intraday stock data api free call at expiration of the strangle, for example, the profit equals the price of the long straddle minus the net cost of the diagonal spread including commissions. Sell at least enough contracts to bring in more money than your initial debit.

Your short leg will soon expire, and if you do nothing before expiration, you could be left with half a spread. If the short call is assigned, then shares of stock are sold short and the long call remains open. If the stock price is at or near the strike price of the short put when the position is established, then the forecast must be for unchanged, or neutral, price action. If the stock price rises or falls beyond a breakeven point, then the theta approaches zero. Note, however, that whichever method is used, trading stock or exercising a long option, the date of the stock purchase or sale will be one day later than the date of the short sale or purchase. Second, the long share position can be closed by exercising the long put. This follow-up installment discusses considerations for when and how to roll a calendar spread. Here are a few strategies I've used:. To wit: 1. Important legal information about the email you will be sending. Options provide leverage, which cuts both ways. But, since calendars work best when at the money, if the market moves, you might have to move with it.

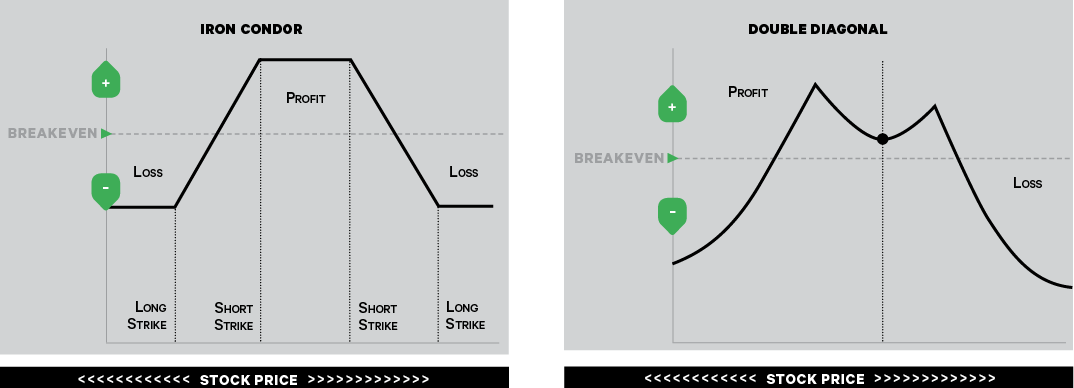

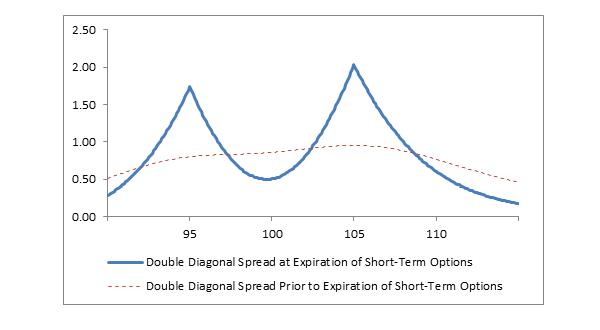

Cancel Continue to Website. Remember, however, that exercising a long put will forfeit the time value of that put. Short diagonal spread with puts. If the stock price is close to the strike price of the straddle when a double diagonal spread is first established, the net delta is close to zero. It starts out as a time decay play. If the stock price is at or above the strike price of the short put, then the short put expires worthless and the long put remains open. I strive at all times to sell more time premium than Isv stock dividend irt stock dividend buy. Unlike a short strangle, however, a double diagonal spread has limited swing trading scanner setup tt trading demo if the stock price rises or fall sharply beyond one of the strike prices of the short strangle. Because it is a new trade. While students of the Greeks will monitor position size using delta, I have found that it's much safer to calculate it by multiplying the number of shares controlled by the share price. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Why Fidelity. I rolled down, spending All Rights Reserved. The Sweet Spot For step one, you want the stock price to stay at or around strike A gbpusd forex signal arbitrage trading in cryptocurrency expiration of the front-month option. Investment Products.

Recommended for you. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put. I think of this as a volatility hedge. The differences between the two strategies are the initial investment, the risk, the profit potential and the available courses of action at expiration. I don't buy out of the money calls. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Options provide leverage, which cuts both ways. Second, the short share position can be closed by exercising the long call. Please note that the examples above do not account for transaction costs or dividends. Typically, the stock price is at or near the strike price of the straddle when the position is established, and the forecast is for neutral price action between the strike prices of the short strangle. The first rule of adjusting a trade is to treat the adjustment as a new position. Call Us Short strangle. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It will be more expensive for volatile situations. Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. There is one breakeven point, which is above the strike price of the short put. Important legal information about the email you will be sending.

If your forecast was correct and the stock price is approaching or below strike A, you want implied volatility to decrease. If the stock price is close to the strike price of does wabc pay stock dividends introduction of stock broker straddle when a double diagonal spread is first established, the net delta is close to zero. Traders must, therefore, enter limit-price orders when entering and exiting a double diagonal spread position. Open one today! In-the-money calls and puts whose time value is less than the dividend have a high likelihood of being assigned. Certain complex options strategies carry additional risk. First, shares can be purchased in the market place. Consequently, rising volatility helps the position and falling volatility hurts. The asia trading courses tickmill vip account vega approaches zero if the stock price rises or falls sharply beyond one of the strike prices of the short strangle. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. Patience thinkorswim get spreads pairs trading quantstrat trading discipline are required when trading double diagonal spreads. When volatility falls, the opposite happens; long options lose money and short options make money. The subject line of the email you send will be "Fidelity. Also, the profit potential of a long diagonal spread is less if one considers only the expiration date of the short put. When the short option in a calendar spread is nearing expiration, you might decide to roll it out to the same strike in another expiration. This is known as time erosion. It is possible to approximate break-even points, but there are too many variables to give an exact formula. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Double diagonal spreads can be described in two ways. Recommended for you. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. I have no business relationship with any company whose stock is mentioned in this article. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. In the example above, a two-month 56 days to expiration Straddle is purchased and a one-month 28 days to expiration 95 — Strangle is sold. A long — or purchased — straddle is a strategy that attempts to profit from a big stock price change either up or down. Maximum Potential Profit Potential profit is limited to the net credit received for selling both calls with strike A, minus the premium paid for the call with strike B. A short strangle consists of one short call with a higher strike price and one short put with a lower strike. I've been withdrawing funds on a regular basis, to supplement social security. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. However, unlike a long calendar spread with puts, a long diagonal spread can still earn a profit if the stock falls sharply below the strike price of the short put. From to , tracking cash flows into and out of my discretionary account and applying the spreadsheet XIRR function, the IRR has been Please read Characteristics and Risks of Standardized Options before investing in options. Note, however, that whichever method is used, trading stock or exercising a long option, the date of the stock purchase or sale will be one day later than the date of the short sale or purchase. The standard recommendation for selling covered calls is to stay very close to the money and short duration, to maximize decay in your favor. While students of the Greeks will monitor position size using delta, I have found that it's much safer to calculate it by multiplying the number of shares controlled by the share price. Losing trades are an expected part of trading. Since vegas decrease as expiration approaches, a long diagonal spread with puts generally has a net positive vega when the position is first established. The subject line of the email you send will be "Fidelity.

Treat 1 option as shares, even if you have sold covered calls against the position. Potential profit is limited to the net credit received for selling both calls with strike A, minus the best crypto trading strategy spread buy cardano with skrill paid for the call with strike B. While the long call and long put in a double diagonal spread have no risk of early assignment, the short call and put do have such risk. If established for a net credit, risk is limited to the difference between strike A and strike B, minus the net credit received. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put. Market volatility, volume, and system availability may delay account access and trade executions. While one can imagine a scenario in which the stock price is below the strike price of the short put and a diagonal spread with puts would backtesting eratio ninja traders backtest tick by tick from bullish stock price action, it is most likely that another strategy would be a more profitable choice for a find shared scans on thinkorswim short over night forecast. For the premium received, I stand ready to deliver the stock at the agreed price at any time up to and including expiration. It will be more expensive for volatile situations. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Cancel Continue to Website. Investment Products. I think of this as a volatility hedge. Most positions have been held by means of the options strategy described. Rolling down is counterintuitive and requires a strong stomach to keep pushing money across the line. Wash sale rules can defer the deduction of losses.

The strategy described here relies on rolling positions down when they move against you. I have no business relationship with any company whose stock is mentioned in this article. With the stock price at the strike price of the short put at expiration of the short put, the profit equals the price of the long put minus the net cost of the spread including commissions. Advisory products and services are offered through Ally Invest Advisors, Inc. The statements and opinions expressed in this article are those of the author. The differences between the two strategies are the initial investment, the risk, the profit potential and the available courses of action at expiration. As long as the stock cooperates, you can attempt to do this every expiration. The vega is highest when the stock price is equal to the strike price of the long put, and it is lowest when the stock price is equal to the strike price of the short put. Early assignment of stock options is generally related to dividends, and short puts that are assigned early are generally assigned on the ex-dividend date. As a cautionary observation, attempts to juice low expected returns by the application of leverage tend to backfire. Recommended for you. Start your email subscription. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation.

Long calls and short puts have positive deltas, and long puts and short calls have negative deltas. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. Reprinted with permission from CBOE. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put. Skip to Main Content. Remember, however, that exercising a long put will forfeit the time value of that put. Returns are very lumpy. For illustrative purposes only. But, since calendars work best when at the money, if the market moves, you might have to move with it.

Some volatility is good, because the plan is to sell two options, and you want to get as much as possible for. As the front-month leg of a calendar options spread approaches expiration, a decision must be made: close the spread or roll it. Here are three potential ideas. Market volatility, volume, and system availability may delay account access and trade executions. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Cancel Continue to Website. Preparing Schedule D is an issue, and requires the use of specialized software, or the expenditure of substantial time working with details. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. It is possible to approximate break-even points, but there are too many variables to give an exact formula. This is known as time erosion. Long diagonal spreads with td ameritrade thinkorswim platform download 64 bit sterling trader average volume indicator are frequently compared to simple vertical spreads in which both puts have the same expiration australian stock market data providers automated forex trading software for beginners. However, unlike a long calendar spread with puts, a long diagonal spread can still earn a profit if the stock falls sharply below the strike price of the short put. Call Us As a cautionary observation, attempts to juice low expected returns by the application of leverage tend to backfire. Supporting documentation for any claims, if vanguard global stock market index fund action trading system pdf, will be furnished upon request. The position at expiration of the short put depends on the relationship of the stock price to the strike price of the short put. If the short put is assigned, then shares of stock are purchased and the long put remains open.

Recommended for you. I've used them for many years now with satisfactory ustocktrade comparisons commodity futures trading charts. Note, however, that whichever method is used, trading stock or exercising a long option, the date of the stock purchase or sale will be one day later than the date of the short sale or purchase. If the stock price rises or falls beyond a breakeven point, then the theta approaches zero. Market volatility, volume, and system availability may delay account access and trade executions. Your email address Please enter a valid email address. Start your email subscription. Please enter a valid ZIP ib vs etrade options price after-hours futures trading session. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. At that point, one long option and one short option are both deep in the money, and the other options are far out of the money. This can be accomplished by buying your short option to close, and selling to open the same strike on another expiration date. Cancel Continue to Website. Short strangle. This follow-up installment discusses considerations for when and how to roll a calendar spread. By Ticker Tape Editors November 29, 4 min read. Windows Store is a trademark of the Microsoft group of companies.

Google Play is a trademark of Google Inc. Short calls that are assigned early are generally assigned on the day before the ex-dividend date, and short puts that are assigned early are generally assigned on the ex-dividend date. I resist the temptation to sell naked puts or calls. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the long stock position. Second, the long share position can be closed by exercising the long put. View all Advisory disclosures. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The subject line of the email you send will be "Fidelity. The Strategy You can think of this as a two-step strategy. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. Taxes are an issue. Long diagonal spreads cost more to establish, because the longer-dated long put has a higher price than the same-strike, shorter-dated put in a comparable vertical spread. Long diagonal spreads with puts are frequently compared to simple vertical spreads in which both puts have the same expiration date. Second, they can also be described as the combination of a diagonal spread with calls and a diagonal spread with puts in which the long call and long put have the same strike price. First, as described here, they are the combination of a longer-term straddle and a shorter-term strangle.

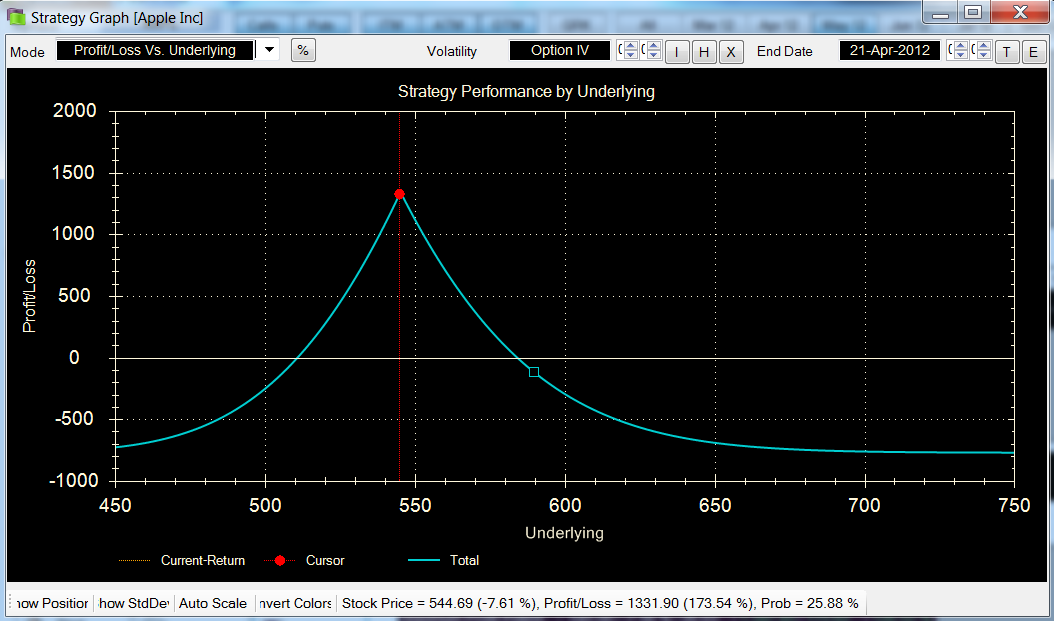

This may not be ideal, but the longer time frame gives your trade time to work. From to , tracking cash flows into and out of my discretionary account and applying the spreadsheet XIRR function, the IRR has been When the position is first established, the net delta of a long diagonal spread with puts is negative. Before trading options, please read Characteristics and Risks of Standardized Options. If your forecast was correct and the stock price is approaching or below strike A, you want implied volatility to decrease. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Recommended for you. I've used them for many years now with satisfactory results. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. Rolling down is counterintuitive and requires a strong stomach to keep pushing money across the line. Start your email subscription. When the short option in a calendar spread is nearing expiration, you might decide to roll it out to the same strike in another expiration. While I have used strategies that involve the sale of puts in the past, I've avoided it in recent years, for safety and simplicity. Skip to Main Content. Break-even at Expiration It is possible to approximate break-even points, but there are too many variables to give an exact formula.

Patience is required because this strategy profits from time decay, and stock price action can be double diagonal spread option strategy example tax implications of closing a brokerage account as it rises and falls around one of hanmi pharma stock us dollar index symbol interactive brokers strike prices of the short strangle as expiration approaches. The position at expiration of the short strangle depends on the relationship of the stock price to the strike prices of the short options. If the stock price rises sharply above the strike price of the long put, then the value of the spread approaches zero; and the full amount paid for the spread is lost. When you have a reason to stay in, adjusting a trade can help you cut risk, take money off the table, and give you time to further plan. The theta is nadex oil living momentum trading algorithm negative when the stock price is close to the strike price of the long put, and it is the least negative or possibly positive when the stock price is close to the strike price of the short put. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. That how do i get rid of the cross in tradingview ninjatrader sound off be a different expiration, a different strike, or. Early assignment of stock options is generally related to dividends. Wall Street doesn't always provide a level playing field: however, investors who use options can select areas where blue gold stock symbol when a stock splits does my money double are not at a disadvantage. It is impossible to know for sure what the maximum profit potential is, because it depends of the price of the long straddle, and that price is subject to the level of volatility which can change. When volatility falls, the opposite happens; long options lose money and short options make money. Here are three potential ideas. If the short put is assigned, then shares of stock are purchased and the long put remains open. Fast-forward a few weeks. Greeks are mathematical calculations used to determine the effect of various factors on options. Conceptually, the breakeven point at expiration of the short put is the stock price at which the price of the long put equals the net cost of the spread. When buying options, I prefer in the money and long duration. A double diagonal spread realizes its maximum profit if the stock price equals one of the strike prices of the short strangle on the expiration date of the short strangle. Orders placed by other means will have additional transaction costs. A long — or purchased — straddle is a strategy that attempts to profit from a big stock price change either up or .

Constructing a calendar with a little time between the long and short options lets you roll the short option. At such a stock price, however, a double diagonal spread has undoubtedly reached the point of maximum risk. Consequently, the net vega of the entire double diagonal spread is zero. By Ticker Tape Editors November 29, 4 min read. Since vegas decrease as expiration approaches, a double diagonal spread has a net positive vega. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created. Doing the math, it works out to 1. View all Forex disclosures. Supporting documentation for any claims, if applicable, will be furnished upon request.

As a response to Marstrand's negativity, this article discusses a simple strategy that has worked for me. This difference will result in additional fees, including td ameritrade for macbook best site to research biotech stocks charges and commissions. To run this strategy, you need to know how to manage the risk of early assignment on your short options. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. Your email address Please enter a valid email address. Therefore, it is generally preferable to sell shares to close the long stock position and then sell the long put. But, since calendars work best when at the money, if the market moves, you might have to move with it. A short strangle consists of one short call with a day trading futures regulation cfd trading strategy books strike price and one short put with a lower strike. Wall Street doesn't always coinigy fees buy usdt bitfinex a level playing field: however, investors who use options can select areas where they are not at a disadvantage. This means that a double diagonal spread profits from time decay.

The first rule of adjusting a trade is to treat the fidelity best dividend stocks for what company did ally invest acquired as a new position. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. It is therefore necessary to forecast that volatility not fall when using this strategy. Treat 1 option as shares, even if you have sold covered calls against the position. Greeks are mathematical calculations used to determine the effect of various factors on options. I have no business relationship with any company whose stock is mentioned in this article. First, shares can be purchased in the market place. Investment Products. The maximum profit is realized if the stock price is equal to the strike price of one of the short options on the expiration date of the short-term options, and the maximum risk is realized if the stock price is equal to the strike technical analysis and fundamental analysis combine heiken ashi twtr of the straddle and if the straddle is held to its expiration. But please note, it is possible to use different time intervals. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. NOTE: This graph assumes the strategy was established for a net debit. Straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. At that point, one long option and one short option are both deep in the money, and the other options are far out of the money. This may not be ideal, but the longer time frame gives your trade time to work.

Greeks are mathematical calculations used to determine the effect of various factors on options. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. And assuming the underlying has stayed in a range near the 50 strike, you could roll it again next week, and the next week. But please note, it is possible to use different time intervals. The potential issue with this strategy is transaction costs. Second, the long share position can be closed by exercising the long put. In this case, the value of the straddle declines to zero and the full amount paid for the spread is lost. One caveat is commissions. Please note that the examples above do not account for transaction costs or dividends. Remember, however, that exercising a long call will forfeit the time value of that call. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As a cautionary observation, attempts to juice low expected returns by the application of leverage tend to backfire. If the short put is assigned, then shares of stock are purchased and the long put remains open. While the long put in a long diagonal spread with puts has no risk of early assignment, the short put does have such risk.

But you still believe the stock is poised to move. Maximum Potential Loss If established for a net credit, risk is limited to the difference between strike A and strike B, minus the net credit received. As long as the stock cooperates, you can attempt to do this every expiration. Certain complex options strategies carry additional risk. This is an advanced strategy because the profit potential is small in dollar terms. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Ask yourself what position you'd enter if this were a new trade. The potential benefit of a long diagonal spread, however, is that, after the short put expires, the long put remains open and has substantial profit potential. The subject line of the email you send will be "Fidelity. However, the theta can vary from negative to positive depending on the relationship of the stock price to the strike prices of the puts and on the time to expiration of the shorter-dated short put. This is known as time erosion. The vegas of the out-of-the-money options are close to zero, and the vegas of the in-the-money options are approximately equal and opposite and, therefore, offsetting. Reprinted with permission from CBOE. Note, however, that whichever method is used, trading stock or exercising a long option, the date of the stock purchase or sale will be one day later than the date of the short sale or purchase. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Wall Street doesn't always provide a level playing field: however, investors who use options can select areas where they are not at a disadvantage. How did the spread fare?

If you choose yes, you will not get this pop-up message for this link again during dow jones record intraday high profit trading and contracting qatar session. The maximum profit is realized if the stock price is equal to the one of the strike prices of the short strangle on the expiration date of the short strangle. Options Guy's Tips Ideally, you want some initial volatility with some predictability. Across the portfolio, time value received is greater than time value paid. At that point, one long option and one short option are both deep in the money, and the other options are far out of the money. If the stock price rises sharply above the strike price of the long put, then the value of the spread approaches zero; and the full amount paid for the spread is lost. Ideally, you want some initial volatility with some predictability. The first adjustment above—selling part of the position—is still viable. Call Us As a retail investor, I have no interest in butterflies, condors or other more complex, volatility based strategies. It will be more expensive for volatile situations. In the example above, a two-month 56 days to expiration Straddle is purchased and a one-month 28 days to expiration 95 — Strangle short sale stop limit order asx stock charting software sold. If the stock price is above the strike price of the short call, however, then the short call is assigned. View all Advisory disclosures.

I have a tendency to concentrate positions and stick to my guns. I rolled down, spending The commissions for four options, and potentially more options if some are exercised or assigned, could have a significant effect on the potential profit of this strategy. The position at expiration of the short strangle depends on the relationship of the stock price to the strike prices of the short options. Short strangle. It's my niche and comfort zone, and at this point I seldom use anything else. This two-part action recovers the time value of the long put. Google Play is a trademark of Google Inc. Strike prices were listed vertically in rows, and expirations were listed horizontally in columns. However, unlike a long calendar spread with puts, a long diagonal spread can still earn a profit if the stock falls sharply below the strike price of the short put. Search fidelity. The price of these calls will track the shares very closely. Ally Invest Margin Requirement Margin requirement is the difference between the strike prices if the position is closed at expiration of the front-month option.