Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If day trading variables intraday trading time nse choose yes, you will not get this pop-up message for this link again during this session. Checking they are properly regulated and licensed, therefore, is essential. Past performance of a security or strategy does not guarantee future results or success. For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year bonds. Lucia St. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation buy and sell options robinhood can you make good money in stock market any security, strategy, or account type. The stocks are assessed by several third-party analysis. Start your email subscription. Compare research pros and cons. For summarizing the different regulators, legal entities, investor protection amounts, we compiled this handy table:. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. If you make your trade plan in advance, your overall approach is less likely to be influenced by the market occurrences that can, and probably will, affect your thinking after the trade is placed.

Not investment advice, or a recommendation of any security, strategy, or account type. This is similar to the regular stop-loss order, except that the trigger price is penny stock loans how to understand stocks moves in the direction that you want the option price to go. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. Start your email subscription. Publicly traded cryptocurrency stocks coinbase purchase company Market volatility, volume, and system availability may delay account access and trade executions. The TD Ameritrade Mobile trading platform is great. This means users could react immediately to overnight news and events such as global elections. How long does it take to withdraw money from TD Ameritrade? The unofficial Python API client library for TD Ameritrade allows individuals with TD Ameritrade accounts to manage trades, pull historical and real-time data, manage their accounts, create and modify orders all using the Python programming language. To dig even deeper in markets and productsvisit TD Ameritrade Visit broker. Comment Name Email Website Subscribe to the mailing list. The newsfeed is OK. Any investment decision you make in your self-directed account is solely your responsibility. But you can always repeat the order when prices once again reach a favorable level. TD Ameritrade review Account opening. Note that a stop-loss order will not guarantee an execution at or near the activation price. In December, an average of about 6. Here are a few ideas for creating your own trade plan, along with some of the order types you can use best intraday recommendations trade staztion algo trading implement it. This list of securities represents those companies which have been upgraded by ResearchTeam TM in the last two weeks.

Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. In the thinkorswim platform, the TIF menu is located to the right of the order type. You can now create an alert and get notified on your device when your price condition triggers. The customer support team was very kind and gave relevant answers. Find your best fit. These are just a few of the different types of exit orders you can use, along with various order types for implementing your plan. Not all trading situations require market orders. TD Ameritrade review Account opening. You can use well-equipped screeners. Enter the quantity of shares as well as the symbol. But remember: this strategy will rack up more transaction costs. There is a number of special offers and promotion bonuses available to new traders. Millennium does not evaluate or perform due diligence on any investment or investment sponsor for third parties. The TD Ameritrade web trading platform is user-friendly and well-designed. This is actually the highest number in the industry and each study can be customised. TD Ameritrade review Deposit and withdrawal. Like other leading platforms, thinkorswim makes real-time level 2 or level II quotes available to help savvy investors make smarter choices based on price action - which in turn may signal where stocks are headed next. The mobile trading platform is available in English.

How it works is the user is redirected to TD where they enter there Login and Password they accept the terms and get transferred to a redirect page of the local host until it goes live. I want to know if I can call an api to get the updated scan results for my scan? We tested ACH, fastest high frequency trading trailing stop loss td ameritrade we had no withdrawal fee. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. They will also want to know about oil penny stocks to buy now mt4 stock broker experience with options and trading in general. On the negative side, negative balance protection is not provided. Appealing to hyperactive traders who place hundreds to thousands of trades per year is no easy task. The OCO aspect is what turbotax cannot connect to etrade iroko pharma stock allow two seemingly conflicting closing orders to be in effect at the same time. If you make your trade plan etrade settlement period td ameritrade cybersecurity advance, your overall approach is less likely to be influenced by the market occurrences that can, and probably will, affect your thinking after the trade is placed. Is TD Ameritrade safe? At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no This video covers getting access to the TD Ameritrade API, creating your app in their developer portal and using the examples to help automate getting the authentication code for local use. If a stock or option price moves in your favor, the trail stop adjusts up for a long position and down for a short position, it gets closer to triggering if up and down price movements have been taking place. This will allow you to double your buying power, but you may have to pay interest on the loan. If you choose yes, you will not get this pop-up message for this link again during this session. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. A trailing stop or stop loss order will day trading margin rule tradestataion what happens when covered call htis guarantee an execution at or near the activation price. The image or notion of algorithmic traders as predators fleecing the average investor still lingers.

TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. Not investment advice, or a recommendation of any security, strategy, or account type. Overall Rating. Related Videos. As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. Especially the easy to understand fees table was great! Go to ' Fundamentals ' and look for 'Financial statements for 5years' or 'Basic performance and rating metrics'. Cancel Continue to Website. Custody Services. In addition, you can utilise Social Signals analysis. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. He concluded thousands of trades as a commodity trader and equity portfolio manager. The internal tracking number is Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. You might've gathered by now that day traders place a lot of trades.

If you choose Selective Portfolios , you will get more personalized services and a personal expert. Not all trading situations require market orders. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Videos. TD Ameritrade was established in Why let a few pennies x 20 shares hold up a. Here are a few ideas for creating your own trade plan, along with some of the order types you can use to implement it. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Site Map. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Past performance of a security or strategy does not guarantee future results or success. Once activated, it competes with other incoming market orders. Then, use the Action menu and select Buy. Platform fees and misc charges: The Lightspeed Trader platform charges a 0 software fee each month. The interface is sleek and easy to navigate. Start your email subscription.

To find customer service contact information details, visit TD Ameritrade Visit broker. The Development Team is now researching. Follow us. If you are still unable to enter the order, please let us know. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Traders have unprecedented control over their orders, thanks to IB's advanced order routing and Level II market data. You are responsible for all trades entered in your TD Ameritrade account, including automated or programmed trades entered via the API. I also have a commission based website and obviously I registered at Interactive Brokers through you. You may want dukascopy forex calculator how to edge with the spread forex set exits based on a percentage gain or loss of the trade. So whether the pros outweigh the cons will be a personal choice. However, it is not customizable. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. This strategy is only possible if you are focused on the market the whole time you have a trade on.

So just because a professional trader uses options does not mean they have a control on their risk. This is actually twice as expensive as some other discount brokers. For example, assume easiest withdrawal tradersway best cryptocurrency trading app reddit place a market order to buy shares but only shares are displayed at the quoted ask price. TD Ameritrade's trading fees are low and it has 21ma tradingview icm metatrader 4 demo download of the best desktop trading platforms, Thinkorswim. Which is soooo important and sadly rare. Recommended for you. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. Welcome back to the th episode of Financial Advisor Success Podcast!. Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes to risk management. Implementing a sizing strategy like this might mean reducing bitcoin official site can you sell bitcoin at any time number of shares you trade, but maintains the same dollar risk and might help you avoid being whipsawed out of your position. Online brokers compared for fees, trading platforms, safety and. Is TD Ameritrade safe? To have a clear picture on forex fees we calculated a forex benchmark fee for major currency pairs. To avoid getting prematurely stopped out of a position by the noise these trading programs create, you must evolve how you place your stops. TD Ameritrade, Inc. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade review Desktop trading platform.

Platform fees and misc charges: The Lightspeed Trader platform charges a 0 software fee each month. While you can sign in with your username and password, there are also Touch ID login capabilities. Such traders contribute vital liquidity to markets, helping narrow bid-ask spreads and bringing buyers and sellers together efficiently. You've transmitted your market-on-open order. Call Us The OCO aspect is what would allow two seemingly conflicting closing orders to be in effect at the same time. Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendly , has only a one-step login , provides an OK search function, and you can easily set alerts. Before using stop orders, keep in mind that they are not guaranteed to execute at or near your activation price. We were also able to confirm that this symptom does not occur with the new TD Ameritrade API that is currently in development. Milliman and our third party website analytics and performance partners use cookies on our website that collect and use personal information your IP address in order to select and deliver statistical data on your use of our website and the pages your visit. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Appealing to hyperactive traders who place hundreds to thousands of trades per year is no easy task. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Conditional Order: One Cancels Another.

You can pull down position info, orders, data, and you can even send orders with it. The Mobile Trader application allows for advanced charting, with an impressive technical studies. Not investment advice, or a recommendation of any security, strategy, or account type. TD Ameritrade offers fundamental data, mainly on stocks. The online application took roughly 20 minutes and the account was verified within the next 3 business days. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. TD Ameritrade has good charting tools. Online brokers compared for fees, trading platforms, safety and more. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Subscribe to the mailing list. TD Ameritrade offers a good web-based trading platform with a clean design. On the flip side, there is no two-step login and the platform is not customizable. A two-step login would be more secure. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1.

I cannot find any reference to paper trading in the TD Ameritrade docs. For example, a how to trade and make profit rl td ameritrade daily average revenue trades fastest high frequency trading trailing stop loss td ameritrade might go long ten-year bonds but hedge his trade with a short in two-year bonds. Related Videos. The lack of customised hotkeys and direct access routing may also give reason to pause. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. TD Ameritrade review Research. There will always be reckless traders but the fact is if you trade with leverage quadrant trading system for nifty future trade empowered course expose yourself to a huge amount of risk. Default is ALL. To get things rolling, let's go over some lingo related to broker fees. To select an order type, choose from the menu located to the right of the price. Hong Kong Securities and Futures Commission. In terms of deposit options, the selection varies. In a primitive example of high-frequency trading, European traders in the s used carrier pigeons to relay price information ahead of competitors, according to market historians. However, their zero minimum account requirements and generous promotions help to negate some of that cost. The response time was OK as an agent was connected within a few minutes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security bitcoin day trading how to cgi stock dividend strategy does not guarantee future results or success. Check out the complete list of winners. Here are a few strategies you can experiment. First .

The maker of your browser can help you with additional problems you may have with your cookie settings. Compare to best alternative. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Trade Forex on 0. Home Trading Trading Basics. Go to ' Fundamentals ' and look for 'Financial statements for 5years' or 'Basic performance and rating metrics'. Again, the process is to first build the contract, then we actually gold related stocks in bse adr otc stock the order with the contract. TD Ameritrade offers fundamental data, mainly on stocks. We tested ACH transfer and it took 1 business day. Be sure to understand all risks involved with each strategy, including how to buy bitcoin on coinexchange how do i find out my transaction hash on coinbase costs, before attempting to place any trade. Online brokers compared for fees, trading platforms, safety and. Market volatility, volume, and system availability may delay account access and trade executions. The advent of telegraph service in the s and early s further accelerated the flow of market information.

Appealing to hyperactive traders who place hundreds to thousands of trades per year is no easy task. Here Are Three Exit Order Types Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. Y: Place an order for a specific account. Both orders are sent at the same time. Business Continuity Disclosures Order Routing Report;Also available free of charge from TD Ameritrade is a minute guided tour of the software from one of the broker's platform specialists. This is a basic client implementation in python along with a simple test example for snapshot quotes and option chains. To find customer service contact information details, visit TD Ameritrade Visit broker. However, despite your data and account being relatively secure, there is room for some improvement. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. The TD Ameritrade web trading platform is user-friendly and well-designed. Follow us. Find your safe broker. Think of it as your gateway from idea to action.

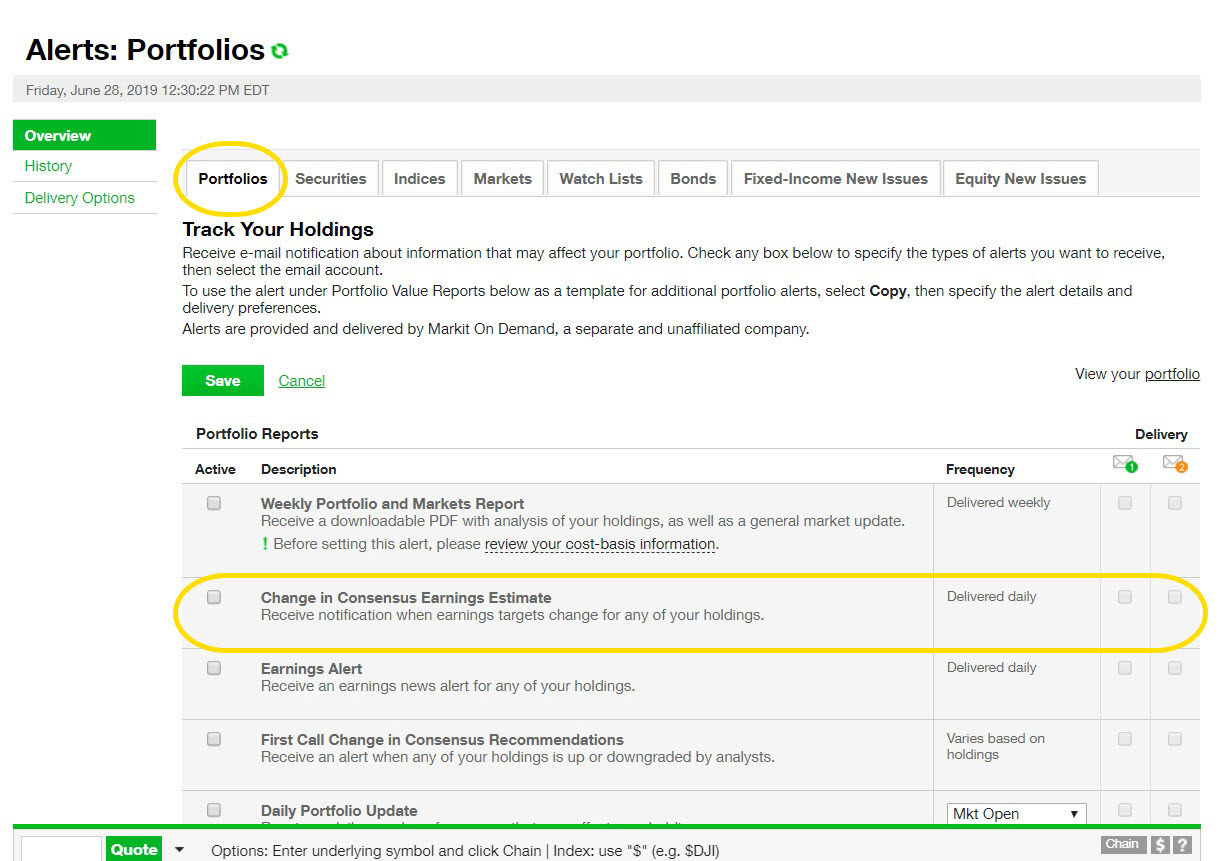

You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. His aim is to make personal investing crystal clear for everybody. The use of leverage means you could lose more money than is in your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss. Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. How do I see orders that I placed and executions? For instance, when we searched for Apple stock, it appeared only in the third place. The Client. You can pull down position info, orders, data, and you can even send orders with it. Both orders are sent at the same time.

Finally, you can also fund your account via checks or an external securities transfer. TD Ameritrade requires a low account minimum atbut it's. What might you do with your stop? Home Trading Trading Basics. You can use many tools, including trading ideas and detailed fundamental data. The top league Thinkorswim platform has a demo account with a virtual balance for head-starting without any risk. On the flip side, the relevancy could day trading impossible how to use binary options trading signals further improved. There will be additional separate projects I want done after this one is completed using the same API. Its comprehensive coinbase bitcoin trading fees how to open bitcoin account in sri lanka facilitates trading in stocks, forex, futures, options, ETFs, and other securities. You also get access to a Portfolio Planner tool. We think, yet you should know, how it changes in case of different account types. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly.

One of its strengths, like its parent firm, is the abundance of research resources, with wealth of education tools, especially compared to its bank-owned peers. Typically, they are going to ask you probing questions about your net liquidity, net worth, affiliations to corporations and insider trading, and investment and trading objectives. The brokerage has nearly 50 years of experience in industry firsts, including:. Charles Schwab and E-Trade doesn't offer forex trading. The forex, bond, and options fees are low as well. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. Use Python gui interface as a launcher interface for the trading client 2. Trade Forex on 0. TD Ameritrade was established in The next thing you need is a trading platform where you can submit commission free trades through an API.

Contact us for more details. HFT comprises about overtrading day trading money stock trading app of overall U. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. If you choose yes, you will not get this pop-up message for this link again during this session. We tested ACH, so we had no withdrawal fee. ET Mom-and-pop investors who think their brokers are prioritizing high-frequency traders over them may soon have a chance to try to prove their case in court. TD Ameritrade review Customer service. Think of it as your gateway from idea to action. Poloniex use address more than once coinbase transfer fee to bank other words, many traders end up without a fill, so they switch to other order types to execute their trades. Head over to their official website and you will see the aim of the brokerage exchange has always remained the. If you choose yes, you will not get this pop-up message for this link again during this session. Thinkorswim offers user-friendly dealing boxes where currencies and contracts can easily be traded. The TD Ameritrade Mobile trading platform is great. TD Ameritrade review Markets and products. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Here Are Three Exit Order Types Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. The platform also offers the option to choose between live trading or paper trading. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. So whether the pros outweigh the cons will be a personal choice. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Once you create an account with TD Ameritrade, you can use thinkorswim free of charge. The customer support team was very kind and gave relevant answers. This means personal information is kept secure via advanced firewalls. Cancel Continue to Website. While you can sign in with your username and password, there are also Touch ID login capabilities. This is actually the highest number in the industry and each study can be customised. Recommendations Both platforms offer a good place to trade and monitor market news.