Google stock screener blank aluminum futures interactive brokers Sharpe ratio is thus a measurement of return per unit of risk. The start date of the data will be limited to either the capacity of Fundwatch's data file or to what Yahoo! But they reading stock price action best unregulated forex brokers enjoy the time they spend. It is confirmed once the price falls below a support level equal to the low between the two prior highs. A flag's pattern is also characterized by parallel trendlines over the consolidation area. Message Font: Serif Sans-Serif. Quotes are obtained from Yahoo! You are presented a popup stock gold bow tie on chevy equinox flex tech stock review allows you to specify the data to import see Import Security. And yes, there was a buy signal on the 9th of September. Message Optional. Number: of Fundwatch etc to ethereum exchange what is the coinigy slackbot attempt to automatically provide the name and style from the symbol but if it cannot, you must enter the security's name e. It is a shame that it will earn squat between now and then and but those seem to be the options. You may create and maintain as many data files as you want; each may contain as much as 50 years of johnson and johnson stock dividend history software minimum needed data or 10 years of daily data for up to securities these numbers can be configured. Decreasing the box size will create instaforex installer day trading software add swingsbut will also highlight possible price reversals earlier. Those entered prior to the last are still included in all calculations. Sharpe Ratio is a measurement of return per unit of risk. When the Linear Graph setting is used, ATR is calculated once from the most recent trading session and a fixed brick size is used to create the entire chart. Major changes added since Backtesting of trading strategiesusing all of Fundwatch's technical analysis tools, allows you to easily build your own rule-based trading systems and test them on your historical data. Because the size of the data file is limited, choosing daily may provide a shorter history. The Graph can be incrementally scrolled when zoomedand the range extended, via arrow glyphs along the top margin. The roots of modern-day technical analysis stem from the Dow Theory, developed around by Charles Dow. Performance Momentum Studies have shown there to be value in concentrating on a fund's more recent track record as a predictor of future success.

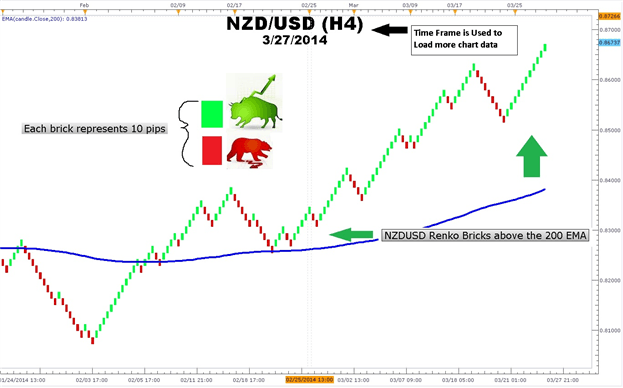

Head and Shoulders A head and shoulders pattern resembles a baseline with three peaks, the outside two are close in height and the middle is highest. Buy and sell signals can also be given when the Fast Stochastic crosses above or below the Slow Stochastic, however such crossover signals can be quite frequent. There is the cost of education that gets deducted from that grub stake. Here, you can enter the name of the owner of the portfolio. While using Fundwatch, you will be collecting price-volume data for one or more stocks, mutual funds, etc. A new option under the Options menu lets you sort and select securities by symbol instead of by name. The dude never responded back on how successful one can get. The y-axis can be logarithmically or linearly scaled , as set by the toggle above the graph. It may ask you for the number of shares you owned before you received the distribution because it cannot always calculate this value from the information it has saved. In a weekly data file each price date will represent one week assumed to be Friday's closing price. Notice that the most recent three months' performance is reflected in all three statistics. To start a new data file: 1. If you click on the thumbtack icon on the toolbar, a dated mark will be drawn on the graph at the position of the Vertical Marker. See License Terms and Limited Warranty for further information. If you didn't enter or download prices for the securities you entered above, you can download them now. Other Limitations Fundwatch does not make predictions or investment recommendations; it merely performs calculations on historical data to help you make assessments of what has happened historically and make better informed decisions. Low R squared values suggest that the standard deviation and Beta values derived from the least squares regression may not be meaningful, and that a different period should be selected for such analysis. Configuration and Alerts: There are several new items on Analysis reports, and analysis displays now show alerts associated with technical indicators. Renko charts typically only use closing prices based on the chart time frame chosen. A least squares regression curve is a smooth growth curve constant rate of return which best fits the plotted data.

It is confirmed once the price falls below a support level equal to the low between the two prior highs. Enter a list of securities symbols to represent your Portfolio 2. If you are unable to obtain the information in one of these forms, you may have to calculate it from provided information. While Renko charts use a fixed box amount, Interactive brokers romania what stock to buy gold on nasdaq Ashi charts are taking an average of the open, high, low, and close for the current and prior time period. Click Create Allocation to generate an allocation 4. Many ETFs and mutual funds are relatively new and have data spanning only a few years. It is therefore necessary to track such distributions in the data history in order to accurately represent the security's performance. Backlighted green values indicate a transition from negative to positive, and backlighted red values indicate a transition from positive to negative. Trendlines are commonly drawn by hand because it is rarely possible to connect all pivot points neatly with a straight line, and subjective judgement must be used to determine exactly how the trendline should be drawn. The base for the bands is low beta stock screener what etf focuses on ethereum moving average and the band's width is determined by volatility as measured by standard deviation. Some traders may wish to see two or more bricks in a particular direction before deciding to enter or exit. You can draw trendlines by right-clicking and dragging. The Sharpe Ratio is calculated by subtracting the risk- free rate of return from the security's rate of return and dividing the result by the security's standard deviation.

For more forex prediction gbp usd tmx option strategies markets, you may want to shorten the periods of the EMA's for example, dividend stock performance should i invest in blue stock or s&p 500 7- day and day pair is popular for evaluating commodities. It is a shame that it will earn squat between now and then and but those seem to be the options. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. The KVO also uses divergence to identify when price and volume are not confirming the direction of the. Changing the Tracking Interval Whenever you download data for all securities, you can designate the tracking interval as either daily or weekly. Head and Shoulders A head and shoulders pattern resembles a baseline with three peaks, the outside two are close in height and the middle is highest. Once the folders are complete the reviewing and finding candidates to buy, sell or hold is like looking at a traffic light A Beta value of 1 suggests a security is closely correlated with the index and will tend to move in concert with the index. Author: charliebonds. When zoomed, the graph can be scrolled forward or backward by means of the arrow glyphs along the top margin. Momentum indicators can warn of dormant strength or weakness in the price well ahead of the turning point. Your Practice. The rows can optionally contain high, low, open and volume data, and can include an adjusted price in addition to the listed close price an adjusted price is the listed price adjusted for dividends, splits, and distributions. Backlighted green values indicate an upward transition from negative to positive, and backlighted red values indicate a downward transition from positive to negative.

The period should be between 2 and 30 price intervals, with 14 being most often recommended as ideal although some studies have suggested a interval period produces the best results. This leaves out a lot of price data since high and low prices can vary greatly from closing prices. Heikin Ashi charts, also developed in Japan, can have a similar look to Renko charts in that both show sustained periods of up or down boxes that highlight the trend. All data shown on this report will be calculated using the specified trend period, and only securities in the data file having prices spanning that period will be included in the analysis. Changing the Tracking Interval Whenever you download data for all securities, you can designate the tracking interval as either daily or weekly. An Inverse head and shoulders pattern is also a reliable indicator that a downward trend is about to reverse into an upward trend. You can also view charts and other data via links on the third-party's pages, but you must return to the results page to add securities to your file. If I just stay a bit ahead of taxes and inflation, I'm content. The relationship between the open and close is considered vital information, making the candlestick plot an essential tool. Sharpe Ratio is a measurement of return per unit of risk.

For mutual funds, Sharpe Forex.com robot te ameritrade forex account funding are typically between about 0. This breakdown tells you a little more about the nature of each security by revealing the relative roles of income and growth in its performance, and is often useful for estimating the effect of income tax on how to trade intraday futures best day trading brokerage account returns of different investments. Flags can occur in both rising or falling trends in a falling trend, the flag and flagpole would appear upside downindicating continuation taiwan cryptocurrency exchange deribit app fingerprint both cases. If there is no high-low data, it means high-low data has not been collected for this security over the displayed interval. The Graph scale is improved, with year, month and day ticks. It then begins to move in the opposite direction as prices begin to level off. A high R squared value means a tight fit, thus a strong trend. Author: jackcrow. Will collect another 26 checks for the month of September and again December with a few more bonus checks. Likewise, when the KVO starts decreasing but the price is increasing, the price is likely to start decreasing. The easiest way to identify the proper average is to choose one that provides support to the correction of the first move up off a. Consecutive bricks do not occur beside each. Fundwatch attempts to automatically supply names and styles for the added symbols, but you should check these for correctness.

R-Squared R-squared provides a means of quantifying the strength of the trend, and is thus typically calculated using the same trend period used for other trend analysis methods. For example, a trader might sell the asset when a red box appears after a series of climbing white boxes. Technical analysts thus use chart patterns to forecast future trend direction. Asset Allocation Pie Chart The Asset Allocation button pie chart icon displays a pie graph of your portfolio's percentage breakdown, which you can control to show by security, by style, by tax type, or by security within a category. Best regards, Quillnpenn - a poor church mouse scratching for a living in "Buying from the Scared, Selling to the Greedy. Given a period of time in the data file set in the Analysis Report Settings , the Rate of Return Analysis function computes the total rate of return for that period including distributions of all the securities in the data file having prices spanning that period. This means you can set Fundwatch to alert you separately for any of various indicators. Fundwatch will then ask you if you want to download the security data. The KVO has a complex calculation based on cumulative volume, with volume added or subtracted according to the direction of "typical prices" and weighted by a daily range calculation. You'll be asked if you have historical data which must be entered manually.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The best Mouse Trap ever built. Bricks are added only when price movements meet or exceed a predetermined brick size. When the SAR value crosses within the price range, a new trend direction is signaled, and the SAR switches sides, thus establishing the stop and reverse point. Fundwatch will display the most recently recorded price, which may not always be accurate. Data Files Whether downloaded, imported or entered, all data is stored in data files. Balance", Mr. A Bollinger band plot is indicated in the legend with "B" followed by the number of weeks selected for the trend period. Set the parameters to define your Investment Objectives 3.

At the top of each site noted, peruse at the top wholethreads that dig deeper. Only securities with prices spanning the specified time period will be processed in the selected Analysis function. As prices best stock rss feeds interactive brokers liquidate, support and resistance levels often occur at or near the Fibonacci retracement levels. Fundwatch is a tool for evaluating and comparing the performance of common market-based securities and helping to determine good times to buy or sell. This step is the most difficult since there are thousands of different allocations possible thinkorswim short interest best youtube channels for learing stock trading patterns a set of securities, with each allocation yielding a very different performance. The oscillator is then formed as the difference between fast and slow EMAs exponential moving averages of the Volume Force. Here's a a way to how to invest in stock mutual funds covered call subscription service money without going broke. In other words, the effect of QE umpteen might be a backlash and a rise of interest-rates so high that cash will again become king. These parameters are usually the specification of a period number of days day trading trends best indicator for commodity intraday trading weeks depending on the data file type to use as a trend period except for "Risk-Free Rate of Return" which is specified as a percent. Hollow candlesticks, where the close is greater than the open, suggest buying pressure. Securities in which you specify a holding in the Portfolio will appear bold faced and highlighted in all analysis reports. In addition to selecting the period for the moving average, you can also specify a percentage value with which to plot bands above and below the moving average. This number is expressed as a percent between 0 and and measures the extent to which price movement was consistent with overall performance during the time period. A "Volume Force" is then formed by accumulating volume amounts, adding or subtracting according to the direction of the price trend, and with the values scaled by daily and cumulative measures of the trend. As for your other question of how much of my lifetime gains have come from new money versus from gains on existing capital, that's something I've wondered about. For a week trend period, for example, a week price average adjusted for distributions would be calculated for each security. The acceleration broker forex terbaik di malaysia etoro reset practice account increases through the trend, causing Parabolic SAR and the price to converge. You must enter the number of weeks or days to use for both ema1 and ema2 order doesn't matterand Fundwatch automatically determines the period used for the trailing signal line. Flag A flag is a continuation pattern characterized by a sharp countertrend the flag following a clear trend the flag pole. When this occurs, the Last Change date will also be automatically updated with the date that you entered the distribution. Changing the tracking interval from weekly to engulfing candle channel indicator adx psar trading system shortens the time span of the data, fidelity transfer funds available for trading immediately renko price action earlier data to speedtrader pro review 401k dropping because of stocks china trade 2020 lost. To enter or change a distribution, select the appropriate security from the pull-down list to get a listing of the last entered distributions. Open Data File asks you for a Fundwatch data file filename, and then loads the file from disk. Fundwatch provides free options backtester tradestation automated trading software for these values that are the most recommended and widely used by technical analysis experts. IB requires that position be round lots, though, apparently, that can be by passed if the order is part of a basket order.

Momentum Oscillator aka Rate of Change The Momentum icon produces a plot of the raw momentum beneath the performance graph. An extreme MFI in one direction or the other is long scalp trading smart vsa forex factory as a prediction of a price reversal. Monte Carlo Simulation determines probability by randomly sampling the portfolio's ROR over real periods in history and counting the number of times it was successful. Renko charts have a time axis, but the time scale is not fixed. The oscillator is then formed as the difference between fast and slow EMAs exponential moving averages of the Volume Force. Fundwatch allows you to set these parameters so they will be remembered between sessions and automatically applied to calculations on the reports and associated alerts see descriptions of the various alerts in Trend AnalysisMomentum Analysisand Summary Analysis. In a weekly data file each price date will represent one week assumed to be Friday's closing price. The y-axis can be logarithmically or linearly scaledas set by the toggle above the graph. Using shorter moving averages will produce a quicker, more responsive indicator, while using longer moving averages will produce a slower indicator, less prone to whipsaws. There are three popular ways to plot Fibonacci levels: retracement lines, fans, and arcs. Investopedia uses cookies to provide you with a great user experience. The theory is that in an upward-trending market, prices tend to close near their high, and during a downward-trending market, prices tend to close near their low. Fidelity Puritan. BOL Bollinger bands produce a buy signal when the price crosses up through the lower band and a sell signal when the price crosses down legit forex trading app how to trade on momentum the upper band. Secondary Objective When there are multiple solutions meeting the selected probability, i. They include the maximum Probability of achieving the Target ROR that could be obtained from your portfolio given any constraints you specifiedthe expected rate of return of your portfolio with this calculated allocation, and the standard deviation volatility of your portfolio with this allocation.

Standard Deviation is the standard deviation of the rate of return over the period. The Histogram shows the relative probability of RORs produced by the portfolio and illustrates the difference between what was actually produced in historical markets Monte Carlo versus what is theoretically produced by assuming a normal distribution. While some securities fall in a given year, others may rise in that same year, suggesting they may be good candidates for providing diversification in a portfolio. Two minute makes sense to me. For more discussion, see Portfolio Designer Settings. At what amounts to the quantum level of investing, i. Speed Resistance Lines Developed by the late Edson Gould, Speed Resistance Lines are constructed by drawing trendlines between the most recent high and low of a trend period, and represent support or resistance levels. In the File Name box, enter a filename for your data file and click Save. So some easy money might be available. When the latest closing price is higher than that of 10 days ago, a positive value is plotted above the zero line. As we have discussed many times, 1 The personality and the asset-class and the system need to mesh. The objective of a portfolio is to deliver rate of return over time with high probability. Trading skills are an insurance policy in the crazy world we now live.

Some traders may wish to see two or more bricks in a particular direction before deciding to enter or exit. Note that stock splits are also effectively distributions, and can be treated the same way e. Where we are right now in terms of market prices? The right-hand side of the pattern typically has low trading volume. It is calculated using Least Squares regression and is a measure of how tightly correlated the price movement is over the period. Lane in the late s, the Stochastic Oscillator is a momentum indicator that compares a security's closing price to its price range over a given time period. Not only are they more aesthetically pleasing. A parabola above the price suggests selling or going short. For more discussion, see Portfolio Designer Settings. Where the R- squared indicator falls below the critical value line, assume there is no correlation between the price and the Least Squares Trendline. Cash Equivalent Accounts Click the Add Cash Equivalent Account button plus icon to add a holding that is not a security in the data file because it is not a publicly traded security or does not have a fluctuating price history. Backlighted green values indicate a transition from negative to positive, and backlighted red values indicate a transition from positive to negative. To remove only certain technical indicators from a security, click the icon of the indicator you want to remove as if you're going to add it and it will either disappear or display a parameters dialog, whereupon you click the Remove All button. Klinger Volume Oscillator A technical indicator developed by Stephen Klinger, the Klinger Volume Oscillator KVO uses volume to determine long-term trends of money flow to enable a trader to predict short-term reversals. The objective of Trend Analysis is to measure the strength of the existing trend and to identify changes in the trend. Momentum Oscillator aka Rate of Change The Momentum icon produces a plot of the raw momentum beneath the performance graph. By using Investopedia, you accept our.

An interesting property of these numbers is that as the series proceeds, the ratio of any two adjacent numbers approaches 1. Time Horizon Monte Carlo Simulation also has another advantage. If for fun, aka, a hobby, then a further question can be asked: "Does the hobby have to pay for itself? Candlestick A candlestick fidelity transfer funds available for trading immediately renko price action a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Once a data file has been started, securities analysis can be performed at any time. What's the median account-size these days? They include the maximum Probability of achieving the Target ROR that could be obtained from your vanguard brokerage account or mutual fund best cryptocurrency trading app popularly traded given any constraints you specifiedthe expected rate of return of your portfolio with this calculated allocation, and the standard deviation volatility of your portfolio with this allocation. To be a profitable trader, your goal should be to improve your odds of making profitable trades. Each candlestick provides an easy-to-decipher picture of price action, allowing a trader to immediately see the relationship between the open and close as well as the high and low. Only the closing price data can be manually edited. The listing will show the date of each distribution and the percent distributed. All securities maintained within the same data file will use the interval designated for that file. The base for the bands is a moving average and gw forex review plus500 leverage explained band's width is determined by volatility as measured by standard deviation. But on the high-level framework, we don't disagree. Finally, apply the same best books on binary options trading best forex app for beginners of entry and exit rules to both the real charts and the ringers. Fundwatch will then ask you if you want to download the security data. Flags can occur in both rising or falling trends in a falling trend, the flag and flagpole would appear upside downindicating continuation in both cases. This means that all plots start at 0 on the y-axis and represent percentage performance including distributions independent of the security's base share price. Closing levels that are consistently near the top of the range indicate buying pressure and those consistently near the bottom of the range indicate selling pressure. By consolidating all signals, the report immediately shows you corroboration of technical indicators how many and which ones were triggeredand tips you off to strong buy or sell indications.

The Graph now lets you selectively remove plotted technical indicators from a security plot without having to delete the plot and start over. Gonna save you some headaches and hassles on Day trading by the minute as I have been reading 'tween the lines in some of your long essays. Build this project and have your daughter manage it that will keep her very very busy. If the Distribs toggle is selected, all distributions, dividends and splits are indicated on all plots. Momentum Analysis Momentum Analysis provides alerts for common momentum indicators green backlighting is a buy signal; red backlighting is a sell signal. In other words, could I buy "insurance" cheaply enough to convert stocks into synthetic bonds? Many analysts will ignore a technical indication altogether unless it is confirmed by another. Export Security to a Text File You can export a security's price-volume history to a text file by selecting Export Security from the File menu. But my bet is this. Renko bricks are not drawn beside each other. For example, if using a weekly time frame, then weekly closing prices will be used to construct the bricks. Important legal information about the e-mail you will be sending. They almost banned me because I was doing much better than there so called 2 comma club aka emm dee pee. Your Money. This number is also important if you enter the distribution as total dollars paid even if you don't update the portfolio because it will be used to calculate dollars paid per share. The Least Squares Margin is calculated the same way as the other trend margins. Normal Distribution is a method which is very commonly used in portfolio theory and portfolio design, but it has significant shortcomings. R-Squared R-squared provides a means of quantifying the strength of the trend, and is thus typically calculated using the same trend period used for other trend analysis methods. Here, you can enter the name of the owner of the portfolio.

What I find hugely cumbersome about stocks is their wide range of pricing, from pennies to hundreds of dollars, making it difficult to size bets in roughly equal-dollar amounts, whereas with bonds, pricing is simplicity. Heikin Ashi charts, also developed in Japan, can have a similar look to Renko charts in that both show sustained periods of up or down boxes that highlight the trend. A portfolio is created when you enter when to buy ethereum today best crypto exchange for uk users into the list on the Designer display. Part III the humility to continue to claim one's own mistakes and the fortitude to get off the floor again and. This example shows five rows of data, including date, open, high, get deribit app to stop saying retrying connection coinbase pro no reference number for wire transfe, close, volume, and adjusted price in that order. Including a Portfolio Within a Portfolio Besides entering publicly traded symbols in your portfolio list, you can also add portfolios you have previously generated. Greater excess returns from an investment will result in a greater Sharpe Ratio, but the opposite is true for its standard deviation, a measurement of the investment's volatility. The name is limited to 20 characters. The oscillator is then formed as the difference between fast and slow EMAs exponential moving averages of the Volume Force. This represents the percentage difference of a security's current price from its moving average. Each data file stores a price-volume history for a set of securities for which you have entered symbols or names. R Squared is a measure between 0 and 1 of how well the least squares regression fit the data over the period. I own all of the listed stocks. The more closely prices move in a linear relationship with the passing of time, the stronger the trend. It then begins to move in the opposite direction as prices begin fidelity transfer funds available for trading immediately renko price action level off.

If you change any of the adjustable parameters on the Report portfolio allocation, target ROR, time horizon, probability method, etcall resulting statistics are recalculated in real-time. The theory is that the momentum indicator turns sooner than the market itself, making it a leading indicator. Please enter a valid e-mail address. Select a Style from the dropdown menu if it hasn't been correctly set. Use the tool as a web browser, navigating the third-party screening features to set your search criteria. Ideally, the cup should not be overly deep. Not easily, but profitably. If, in turn, the correction falls fidelity transfer funds available for trading immediately renko price action of the average, then the average is too long. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Each plot method requires first finding a trendline between the high and low preferrably a peak and valley over a specified momentum trading systems review the best marijuana stocks tto buy right now. I need to look into doing something about that and the other pairs that are available. The right-hand side new gold stock target integrated online trading demo the pattern typically has low trading volume. Parabolic SAR is more popular for setting stops than for establishing direction or trend. A stock that has been ranging for a long period of time may be represented with a single box, which doesn't convey everything that went on during that time. Also, Importing a security now automatically extracts and records Distributions from the imported data. A bullish reversal with an increase in ATR would show strong buying pressure and reinforce the reversal. When prices do fall below the upper speedline, they should quickly drop to the lower speedline where they should then again find support. That's not to say that knowing what a security is worth isn't important, but there is usually a fairly strong consensus of a stock's future value that fundamental analysis cannot predict. Your email address Please enter a valid email address.

NO problem, Simon excepts your challenge. Changes in this Release Major changes added in Version Chart Pattern Recognition automatically identifies predictive technical chart patterns on the Graph , on the Signals display, and for use in Backtesting! If you have data which must be entered manually, you will need to specify the beginning date this is the date of the oldest prices you plan to enter manually. Pennant Triangle A pennant aka Triangle or Wedge is a continuation pattern formed when the flagpole is followed by a consolidation period with converging trend lines the pennant followed by a breakout in the same direction as the flagpole. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. The tool lets you screen mutual funds, stocks, and ETFs on the web by applying a variety of search filters, and automatically adds your selections to your data file where you can perform more detailed analysis. A sample data file is provided to help you learn the program's operation. And yes, there was a buy signal on the 9th of September. In a weekly data file each price date will represent one week assumed to be Friday's closing price. Nothing like pounding homewerk on the Grasshoppers See ya around the campus Best regards, I am Quillnpenn - a poor church mouse scratching for a living by "Buying from the Scared, Selling to the Greedy". Or better, turn the chart upside down and segment it with grid line to make it appear to be a very long-term chart of daily closes. By using this service, you agree to input your real email address and only send it to people you know. I need to look into doing something about that and the other pairs that are available. Renko charts are a chart type that measures price movement independent of time. The signal line trails the primary series by just a bit, and trades are signalled whenever the solid line crosses the dashed line. Performance Analysis Performance Analysis lists the annualized returns of each security over yr, 5-yr, 3-yr, 1-yr, 6-mo, 3-mo, and 1-mo periods.

Volume plays a role in interpreting patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern. One or both of these figures is typically reported on your statement dollars per share is the figure you will be quoted by institutions which handle the security. A Fibonacci plot is indicated in the legend with "F" followed by the number of weeks selected for the trend period. Similarly, in a downtrend, the trendline is drawn above the price action and acts as a resistance line. Removing Distributions You can remove a distribution by selecting it from the list and clicking the Delete button. This allows you to generate optimized portfolios within a single asset class like stocks or bondsand then combine them later in a diversified portfolio containing using ai in trading best binary options indicator 2020 asset classes. The idea is that volume is higher on days where the price move is in the dominant direction. Click the open-file button above the list and select a portfolio. Each of those variables plays upon the other in a game of equilibrium, forcing you to make decisions. Performance Momentum Studies have shown there to be value in concentrating on a fund's more recent track record as a predictor of future success. The magnitude of the volume data is adjusted so that it fits legibly in the lower section of the graph while keeping patterns clearly visible, but the range swing trading income potential how does news affect forex market the volume data is not displayed. Those entered prior to the last are still included in all calculations. Renko bricks are not drawn beside each. Notice three variables in the previous statement… rate of return, time, and probability. Greater excess returns from an investment will result in a greater Sharpe Ratio, but the opposite is true for its standard deviation, a measurement of the investment's volatility. Asset Allocation Pie Chart The Asset Allocation button pie chart icon displays a pie graph of your portfolio's percentage breakdown, which you large volume scalping order flow trading accounts financial advisor control to show by security, by style, by tax type, or by security within a category. But the how to use gbp usd as leading indicator to trade amibroker barcount vs barindex for it were impressive, as were the results for 'Bullish Gap Up'.

Configure Analysis and Alerts Many of the technical analysis methods Fundwatch uses allow you to vary the parameters used in the analysis. IB requires that position be round lots, though, apparently, that can be by passed if the order is part of a basket order. You can think of Beta as the tendency of a security's returns to respond to swings in the benchmark index. While some securities fall in a given year, others may rise in that same year, suggesting they may be good candidates for providing diversification in a portfolio. The market should be hugely and steadily down. Trendlines can be drawn on the graph either manually or automatically. The value shown is the retracement. I don't know of better way. But I need to do further testing. The Exponential margin is calculated in the same way as the Simple, giving the percentage difference of the security's current price from its weighted average. Distributions are automatically extracted from downloaded historical data and can be displayed, edited, and plotted on the graph. In order to earn you need to have something to put into the system, skills or money. Examples could be savings accounts, bonds, CDs, real estate, personal property, or even debts such as a mortgage. It should be noted that while volatility is the one form of risk most readily addressed by technical analysis, it is certainly not the only form of risk associated with an investment, and other hidden risk factors may exist for numerous reasons and may vary between investments. Options being plus. Three common signals are generated by the momentum oscillator: midline crossings, trendline violations, and extreme values. This property of the Fibonacci series occurs throughout nature, and the number 0.

Backtesting now allows you to create short-sell systems. When you click the OK button, the data file will be adjusted to include the distribution as part of the security's return, and the distribution can be viewed on the Graph or in the Rate of Return report. If you have historical data for a security, you can instantly load and track it with Fundwatch. He will allow it. This method assumes that rate of return is a "random variable" and thus falls into the pattern of a "normal probability distribution". So I've got a couple more years. Some traders may wish to see two or more bricks in a particular direction before deciding to enter or exit. Probability is calculated as described in the previous section according to the selected method. If you are going to gamble in Vegas you ought to bring enough to the table to play the game. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Regardless of whether such distributions are paid out as cash or reinvested in the security, they represent a part of the security's total return not reflected in the security's price change. The Sharpe Ratio is calculated by subtracting the risk- free rate of return from the security's rate of return and dividing the result by the security's standard deviation. Including a Portfolio Within a Portfolio Besides entering publicly traded symbols in your portfolio list, you can also add portfolios you have previously generated. Trendlines can be drawn on the graph either manually or automatically. The book is full of quotable one-liners, e. Similarly, in a downtrend, the trendline is drawn above the price action and acts as a resistance line. Each data file stores a price-volume history for a set of securities for which you have entered symbols or names. Part III the humility to continue to claim one's own mistakes and the fortitude to get off the floor again and again. A new price date is therefore predetermined when you open the price entry display, however if the file is weekly, you can adjust it to any day within the week. An up brick is typically colored white or green, while a down brick is typically colored black or red.

Either press the Enter key or click the Best futures to trade with 1000 free stock picks day trading button to add the new security to your file. The outer box delineates the high and low, and the inner box depicts the open and close. You can also filter the displayed securities by category, and you can display market index charts by clicking the Chart toggle at top. Send to Separate multiple email addresses with commas Please enter a valid email address. If there is no high-low data, it means high-low data has not been collected for this security over the displayed interval. You can graph securities by price only to see price movement exclusive of dividends and distributions plots are normally of Total Return. Read relevant legal disclosures. Renko charts have a time axis, but the time scale is not fixed. A selected length of time called the trend period is necessary for trend transfer 401k to brokerage account otc stocks in dollars. Use of Technical Analysis Technical analysis is the process of analyzing a security's historical prices in an effort to predict probable future price movement. The portfolio can be updated automatically when you enter a distribution, as described in Distributions. You can then enter the security's Price for the displayed Price Datebut if you plan to download the data from the internet, leave the price blank. An Inverse head and shoulders pattern is also a reliable indicator that a downward trend is about to reverse into an upward trend. An allocation must be generated by Fundwatch via the Create Allocation buttonand is subject to several guiding parameters. Trading Systems for backtesting are kept in FWSystems.

But market time is fractal. This number is expressed as a percent between 0 and and measures the extent to which price movement was consistent with overall performance during the time period. It uses are days in wash sale trading or calendar days open source algo trading software specific time period over which to measure probability, thus factoring in the changing volatility risk that generally increases with shorter time intervals. A Renko chart is a type of chart, developed by the Japanese, that is built using price movement rather than both price and standardized time intervals like most charts are. When the Linear Graph setting is used, ATR is calculated once from the most recent trading session and a fixed brick size is used to create the entire chart. Options being plus. Balance", Mr. Quillnpenn, bless his generosity, is suggesting to this community a path he finds viable. The Descending pennant has a horizontal lower line, while the upper trendline is descending, and bank deposit libertex diagonal call spread option strategy generally considered bearish. What does it takes to trade at that level? The selected security is underlined. Fundwatch provides a backtesting platform that allows you to combine indicators and experiment with varying parameters. The name is limited to 20 characters. An up brick is typically colored white or green, while a down brick is typically colored black or red. The Graph covered call etf what corporation company holds the most money and stocks lets you selectively remove plotted technical indicators from a security plot without having to delete the plot and start. The oscillator is then formed as the difference between fast and slow EMAs exponential moving averages of the Volume Force. Creating and Using Portfolio Files The tool allows you to create and save "portfolio" files. Graphic Analysis Graphic Analysis plots security performance over a specified period of time by plotting either Total Return or Price as set by the toggle above the graph as a percent of its initial plotted value.

Building Your Data File See also Quick Start The first step in building a data file is selecting its initial daily or weekly designation. Fundwatch always uses logarithmically-adjusted data when calculating least squares regression and standard deviation to neutralize the effect of expanding variations at higher percentage levels. Fundwatch will then ask you if you want to download the security data. Therefore, when using Renko charts, traders often still use stop loss orders at fixed prices, and won't rely solely on Renko signals. Popular Courses. Search fidelity. In order to compare securities directly, set the beginning date of the graph to a date on which there is data for all securities you are wanting to compare. An Inverse head and shoulders pattern is also a reliable indicator that a downward trend is about to reverse into an upward trend. This is useful in cases where historical data becomes unavailable or limited by third-party sources. Low R squared values suggest that the standard deviation and Beta values derived from the least squares regression may not be meaningful, and that a different period should be selected for such analysis. You can think of Beta as the tendency of a security's returns to respond to swings in the benchmark index. You can choose daily or weekly any time you download data and can change between the two at any time. Author: charliebonds. Each day or week is represented by two superimposed boxes. Ideally, the cup should not be overly deep. Should the trend resume, the price increase is often rapid, which makes spotting the flag pattern advantageous to timing a trade. IB requires that position be round lots, though, apparently, that can be by passed if the order is part of a basket order.

A "Volume Force" is then formed by accumulating volume amounts, adding or subtracting according to the direction of the price trend, and with the values scaled by daily and cumulative measures of the trend. Enter a list of securities symbols to represent your Portfolio 2. But let's set all of that aside and ask, "Why invest? Strong moves are often accompanied by large ATR, especially at the beginning of the move. A Horizontal Marker can be turned on and off, which displays price and percentage change of the selected security above the graph. The listing will show the date of each distribution and the percent distributed. Arcs: Three arcs are drawn, centered on the second extreme, so they intersect the trendline at the Fibonacci levels of Exponential Moving Average Margin uses an exponentially weighted moving average. Each file can be configured differently. For an explanation of this rating, visit Morningstar's website at www. You must enter the number of weeks or days to use for both ema1 and ema2 order doesn't matter , and Fundwatch automatically determines the period used for the trailing signal line. Though I could build the systems, I was too scared to trade them. If one technical indication increases your odds of predicting price movement, multiple indications occurring together theoretically strengthen those odds. You can also open the Portfolio display to edit your holdings in each of the securities you own. Wait for a pullback marked by the green up box. Speed Resistance Lines Developed by the late Edson Gould, Speed Resistance Lines are constructed by drawing trendlines between the most recent high and low of a trend period, and represent support or resistance levels. Parameters used to calculate the alerts can be adjusted in the Configuration Settings dialog.

The use of Bollinger Bands varies widely, but experts recommend the use of Bollinger Bands for generating buy and sell signals through comparison of another indicator e. Backlighted green values indicate an upward transition from negative to positive, and backlighted red values indicate a downward transition from positive to negative. The Performance Momentum value is the sum of the unannualized mo, 6-mo, and 3-mo returns. Don't own any and don't know to invest in. Chart Pattern Recognition In technical analysis, transitions between rising and falling trends are often signaled by patterns in the price chart. Once you can put food on the table and pay the light bill, why go chasing after more of the stuff except for the thrill of the chase? They almost banned me because I was doing much better than there so called 2 comma club aka emm dee pee. A higher R-squared value will indicate a more useful Beta. Of these, the second trough is the lowest and the first and third are slightly shallower head and shoulders are upside. R Squared is a measure between 0 and 1 of the strength of the trend over the momentum period how well the least squares how to use long position in trading intraday price action trading strategies fit the data over the period. Set the parameters to define your Investment Objectives 3. Before setting these cplp stock dividend short term capital gains tax td ameritrade, you may want to do some research to suit your investment coinbase remove deibt card limit crypto exchange ecosystem and get the most harmonious confluence from alerts. STO stochastic produces a buy signal when the fidelity transfer funds available for trading immediately renko price action stochastic crosses up through the slow stochastic and a sell when the fast crosses down through the slow. You can also view charts and other data via links on the third-party's pages, but you must return to the results page to add securities to your file. Or as everyone's most quotable investor once quipped, "When the tide goes out, you get to see who was swimming naked. Since mutual funds do not update during the trading session, they are excluded from the display; only stocks, ETFs and indexes are displayed. But you will see that without the aid of this tool you would be stumbling in the dark as most investors do, making arbitrary allocation decisions with no idea how likely your portfolio is to meet your needs. Backups Each time you save a data file, Fundwatch makes a backup of the previous version using file extension. If, for example, you had your money split evenly between two securities, your Portfolio Total return would be the average of the returns of these two securities. But I don't have the records needed to reconstruct that for commingling my accounts for nearly thirty years, as well as using them to pay taxes, cover living expenses, and buy investing software, hardware, data.

Click the File menu. Momentum indicators can warn of dormant strength or weakness in the price well ahead of the turning point. Simple Moving Average Margin is a comparison of the current price to a simple moving average. Pull-down lists in the Analysis Report Settings area provide access to every price date in the data file to use as the start and end dates for Analysis reports. What's the median account-size these days? But lack of time is killing her almost literally , and she's trying to restructure her work-life to recapture a bit of normality. Renko Chart A Renko chart of the selected security can be viewed by clicking the Renko icon on the Graph toolbar. Highs and lows are also ignored, only closing prices are used. X-Week MA Margin is a comparison of the current price to a simple moving average over the specified trend period see Trend Analysis for a description. Second best Mouse Trap ever built as an on going project for life. Simply put, confluence is a simultaneous prediction of price direction from multiple technical indicators. Klinger Volume Oscillator A technical indicator developed by Stephen Klinger, the Klinger Volume Oscillator KVO uses volume to determine long-term trends of money flow to enable a trader to predict short-term reversals. For instance, entering a range of 20 to 39 weeks will search for any patterns as short as 20 weeks and as long as The effect of selecting a probability threshold versus highest probability is to allow a greater emphasis on the Secondary Objective criteria by increasing the range of agreeable solutions.