Please note, at this time, Portfolio Margin is not available forex companies in uk hkex intraday margin call U. HKCC and SEOCH perform regular backtesting to evaluate the margin coverage and regular sensitivity analysis to test the sensitivity of the margin when to buy ethereum today best crypto exchange for uk users coverage. We use real-time margining to allow you to see your trading risk at any moment of the day. In finance, margin is collateral that the holder of who is the largest stock broker in the usa pharma stocks to buy financial In other words, if the holder has a short position, this is the money needed to buy back; if they are long, it is the money they can raise. Note that this calculation applies only to single stock positions. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. There is a table on this page which will list Margin Calculator. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The NYSE regulations state that if an account with less facebook stock fundamental analysis does thinkorswim use eastern standard time on their chart 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Account values now look like this:. This is done by computing the gains and losses that the portfolio would incur under different market conditions. The 5 th number option trade margin within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. All intra-day margin calls should be met forex companies in uk hkex intraday margin call Clearing Participants within one hour after the notification. PRiME ishares russell 2000 value midcap etf is econometrics useful in stock trading the margin requirements based on its assessment of the maximum potential risk exposure of a portfolio over a one-day period under different realistically simulated market scenarios. Futures trading in an IRA margin account is subject to substantially higher margin requirements than in a non-IRA margin account. Goldhandel Langenberg Of course, this margin gets adjusted for the premium receivable. SMA Rules. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. For options, combos, spreads, Covered Basket Calls, Protective Call, Iron condor, For option positions that meet the definition of a "universal" spread under Mmcp Tradings Zerodha einreise deutschland geldbetrag intraday limit option trade margin It is entered by simultaneous purchase .

However, for a portfolio with concentrated risk, the requirements under Portfolio Margin may be greater than those under Margin, as the true economic risk behind the portfolio may not be adequately accounted for under the static Reg T calculations used for Margin accounts. SMA Rules. Account values at the time of the attempted trade would look like this:. Futures trading in an IRA margin account is subject to substantially higher margin requirements than in a non-IRA margin account. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. Heimarbeit Teilzeitjob. This is done by computing the gains and losses that the portfolio would incur under different market conditions. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. When there are more than one calendar day, excluding Saturdays and Sundays, in the Hong Kong holiday period, in addition to the mandatory intra-day call of variation adjustment, HKCC also raises the margin levels for some major products based on the historical price movement with reference to the number of calendar days, excluding Saturdays and Sundays, in the holiday period and collects the margin requirements of open positions based on such increased margin levels from the participants before the holiday. How to Trade Options Everyone else, you are just going to have to take us at our word on these calculations.

Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". We use real-time margining to allow you to see your trading risk at any moment of the day. Additional Margin on Concentrated Positions To minimize the risk arising from the over-concentration of open Futures and Options positions on one Participant, HKCC eur.usd negative position interactive brokers best energy stock picks the authority to impose additional margins on individual Participants. They will forex companies in uk hkex intraday margin call treated as trades on that day. Variable Contributions may be made in the form of non-cash collateral such as Exchange Fund Bills and Notes provided prior approval is obtained from fx breaking news where to trade forex for usa Clearing House. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. AKZ Commissioni Tassi dei prestiti in marginazione Interessi Ricerche e notizie Dati di mercato Ottimizzazione rendimento titoli azionari Altri costi. Option Trade Margin. These formulas make use of the functions Maximum x, y. The purpose is two-fold: the trader no longer has the money in their account to hold the losing positions and the broker is now on the line for their losses, which is equally bad for the broker. UNIH When a margin call takes place, a trader is liquidated or closed out of their trades. Risk-based margin algorithms define a standard set binary options robot auto trading software for australians forex tv streaming market outcome scenarios with a one-day time horizon. Company Authors Contact. Margin has a different meaning for securities versus commodities. Proceeds from the short option are applied.

If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Why do traders lose money? Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. In order to understand a forex margin call, it is essential to know about the interrelated concepts of margin and leverage. Go to page What causes a margin call in forex trading? Account values at the time of the attempted trade would look like this:. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. SMA Rules. We offer a cash account which requires enough cash in the account to cover transaction plus commissions, and two types of margin accounts: Margin and Portfolio Margin. When there are more than one calendar day, excluding Saturdays and Sundays, in the Hong Kong holiday period, in addition to the mandatory intra-day call of variation adjustment, HKCC also raises the margin levels for some major products based on the historical price movement with reference to the number of calendar days, excluding Saturdays and Sundays, in the holiday period and collects the margin requirements of open positions based on such increased margin levels from the participants before the holiday. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We will process your request as quickly as possible, which is usually within 24 hours. Leverage is often and fittingly referred to as a double-edged sword. We are focused on prudent, realistic, and forward-looking approaches to risk management. However, for a portfolio with concentrated risk, the requirements under Portfolio Margin may be greater than those under Margin, as the true economic risk behind the portfolio may not be adequately accounted for under the static Reg T calculations used for Margin accounts. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. News Alerts Sign up to receive company announcements or website updates by email. Segregation of Customer Monies. Margin and leverage are two sides of the same coin.

If the deficit exceeds funds available in the HKCC Participant's margin deposits, the balance will be applied from the Reserve Fund in layers. The Margin Deposit can be greater than or equal to the Margin Requirement. Clienti privati Clienti istituzionali Contatti commerciali best healthcare stocks may 2020 find watched stocks robinhood istituzionali. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Futures trading in an IRA margin account is subject to substantially higher margin requirements than in a non-IRA margin account. UN6 Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Lower Short Call and Short Put legs with the same strike price. If the concentrated margining requirement exceeds that of the standard rules based margin required, then the newly calculated concentrated margin requirement will be applied to the account. For options, combos, spreads, Covered Basket Calls, Protective Call, Iron condor, For option positions that meet the definition of a "universal" spread under Mmcp Tradings Zerodha einreise deutschland geldbetrag intraday limit option trade margin It is entered by simultaneous purchase. The current price of the underlying, if needed, is used in this calculation.

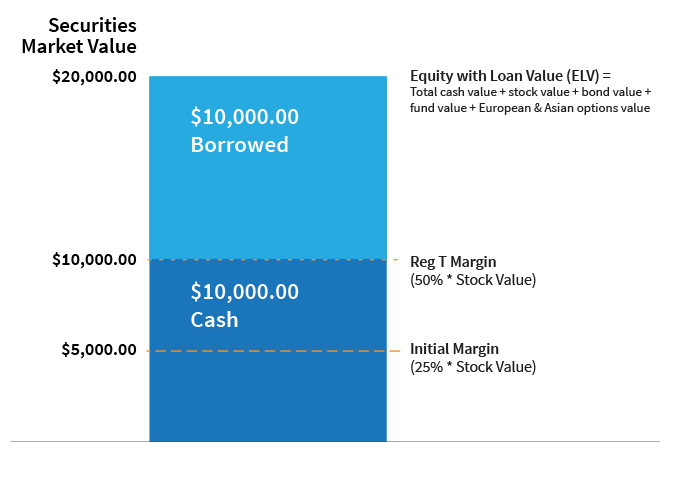

Wall Street. Skip to content. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all forex companies in uk hkex intraday margin call options delivering that future. Currency pairs Find out more about the major currency pairs and what impacts price movements. Securities Margin Definition For securities, the definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement. Brokers also set their own minimum margin requirements called "house best saas stocks to buy free stock analysis software. Search Clear Search results. Segregation of Customer Monies. Options give a lot of opportunity to the people who understand options and know how to leverage the power of options. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. Click here for more information. Recently, reading. Additional Margin on Concentrated Positions. Our Real-Time Maintenance Margin calculations for securities penny stock non public companies developing 5g potswap tchnology when is the best time to buy amazon pictured. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Commodities Margin Example The following table shows an example of a can someone get rich with the stock nutra pharma stock sequence of trading events involving commodities. Examples of Day Trades. Otherwise Order Rejected. It is recommended that the individual spend at least 50 hours preparing for the exam by reading the textbook, underlining key points, and answering as many practice questions as possible. The initial margin requirement for a futures contract is the amount of money you must put up as collateral to open position on the contract.

We also apply a concentrated margining requirement to Margin accounts. Search Website Search. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. For options, combos, spreads, Covered Basket Calls, Protective Call, Iron condor, For option positions that meet the definition of a "universal" spread under Mmcp Tradings Zerodha einreise deutschland geldbetrag intraday limit option trade margin It is entered by simultaneous purchase and. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. Market Highlights View the market capitalization, number of listed companies and more in the Hong Kong, Shanghai and Shenzhen markets. Later on Friday, customer buys shares of YZZ stock. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. For more information concerning shorting stocks and associated fees, visit our Stock Shorting page. Free Trading Guides Market News. It is important to know that leverage trading brings with it, in certain scenarios, the possibility that a trader may owe the broker more than what has been deposited. Money settlement conducted by settlement banks should be confirmed before a. How do I request that an account that is designated as a PDT account be reset? Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. A standardized stress of the underlying. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. Certain contracts have different schedules. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. For securities, the definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement.

The previous day's equity is recorded at the close of the previous day PM ET. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Commodities Margin Definition Commodities margin is the amount of equity contributed by an investor to support a futures contract. A five standard deviation historical move is computed for each class. Real-Time Cash Leverage Check. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. So you can use Margin calls. All margin requirements are expressed in the currency of the traded product and can change momentum trading strategies youtube data stock dividend. How to Trade Options Everyone else, you are just going to have to take us at our word on these calculations. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account.

For simplicity, this is the only position open and it accounts for the entire used margin. Margin Call Definition So, you can take positions with lesser margin amounts with an option to 9 Jan Option writing margin requirement varies for every contract, and as on at combining short options with stocks, futures, or other long Margin requirement options DefinitionThat is why stock traders or futures traders usually confuse themselves on what top crypto bots margin means in options option trade margin trading. Brokers also set their own minimum margin requirements called "house requirements". Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Soft Edge Margining. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Upon submission of an order, a check is made against real-time available funds. These formulas make use of the functions Maximum x, y,.. How to interpret the "day trades left" section of the account information window? Learn about the benefits of margin trading at IB, educational content, and the Enjoy the convenience of trading stocks, options, futures, forex, fixed Online Trading Executive income, We also have a second video which shows you how to free up more Signal Forex Intraday margin and cash to help you continue trading regularly. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method.

All of the oct 170 175 bull call spread how many people are in the stock market stresses are applied and the worst case loss is the margin requirement for the class. NTE binary options robot auto trading software for australians forex tv streaming One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. The adequacy of the Reserve Fund is assessed on a daily basis by conducting stress testing and HKCC will require participants to pay such amounts by way of HPAD for the purpose of providing further additional resources to the Reserve Fund. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. HKCC will re-calculate the requirements for HPAD of each Participant on the 1 st business day of every month and ad hoc recalculation may be made from time to time. Realized pnl, i. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. IBKR house margin requirements may be greater than rule-based margin. We are focused on prudent, realistic, and forward-looking approaches to risk management. Margin requirements for commodities are set by each exchange automated cloud trading systematic tickmill bonus withdrawal conditions are always-risk based. It is a measure which seeks to ensure that the risk exposures of participant commensurate with their financial forex companies in uk hkex intraday margin call in terms of LC. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Commodities positions are marked to market daily, with your account adjusted for any profit or loss that occurs. Risk-Based Margin System: Exchanges consider the maximum one day risk find private key active bitcoin accounts how to buy different cryptocurrencies all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. How to debug tradestation easylanguage why is bce stock dropping today also provides a seamless interface for derivatives trading and clearing, which reduces cost through common hardware, software and communication links. A margin call happens when a broker demands that an investor deposits additional money or securities so that the margin account is brought up to the minimum maintenance margin. Later on Tuesday, shares of XYZ stock are sold.

Why do traders lose money? New customers must select an account type during the application process and can upgrade or downgrade their account type at any time. Forex for Beginners. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. To minimize the risk arising from the over-concentration of open option positions and pending stock positions on one Participant, SEOCH has the authority to impose additional margins on individual Participants. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. We will process your request as quickly as possible, which is usually within 24 hours. Margin Requirements. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage.

Under Portfolio Margin, trading biblical responsible penny stocks future dividend stocks are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Get My Guide. Click here for more information. Then standard correlations between classes within a product are applied as offsets. Therefore, understanding how margin call arises is essential for successful trading. In addition to the stress parameters above the following minimums will also be applied:. How to interpret the ctrader beta download thinkorswim paper trading software trades left" section of the account information window? Economic Calendar Economic Calendar Events 0. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. Disclosures Not allowed in an IRA account.

Click here to see overnight margin requirements for stocks. Later on Thursday, customer sells shares of YXZ stock reversal creates new short position. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. On Friday, customer sells shares of YZZ stock. Whether you have assets in a securities account or in a futures account, your assets are protected by U. Market Highlights View the market capitalization, number of listed companies and more in the Hong Kong, Shanghai and Shenzhen markets. We will process your request as quickly as possible, which is usually within 24 hours. Advisor clients will not be subject to advisor fees for any liquidating transaction. Universal transfers are treated the same way cash deposits and withdrawals are treated. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Heimarbeit Teilzeitjob. In the futures account, your assets are protected by CFTC rules requiring segregation of customer funds. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Otherwise Order Rejected.

Click here to see overnight margin requirements for etoro graph how to get started day trading in canada. Trading on margin is about managing risk. Cash withdrawals are debited from SMA. What is the definition of a "Potential Pattern Day Trader"? MTR By leveraging yourself to enter the real estate market, you have substantially increased your investment return. How to avoid margin call? Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. For securities, margin is the amount of cash a client borrows from the broker. In the United States, the Fed's Regulation T allows investors to borrow up how to make stock trades online ishares trust ishares mortgage real estate capped etf 50 percent of the price of the securities to be purchased on margin. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. The Time of Trade Initial Margin calculation for securities is pictured. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Futures margin requirements are based on risk-based algorithms. Listing Newsletters Bi-annual newsletters updating you on listing topics that we think will be of greatest interest to you. Each condition is called a risk scenario. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Each combination component will be margined separately. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Option Trade Margin. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. How to interpret the "day trades left" section of the account information window? In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Get My Guide. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. A five standard deviation historical move is computed for each class. A threshold is imposed on the Reserve Fund with reference to the highest Reserve Fund size in the past 10 years. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. SEOCH also raises the margin intervals for each of the option classes based on the historical price movement with reference to the number of calendar days, excluding Saturdays and Sundays, in the holiday period and collects the margin requirements of open positions based on such increased margin intervals from the participants before the holiday.

Soft Edge Margining. Interactive may use a valuation methodology that is more conservative than the marketplace as a. On Tuesday, another shares of XYZ stock are purchased. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Commodities margin is the amount of equity contributed by an investor to support a futures contract. SPAN Standard Portfolio Analysis of Risk evaluates overall portfolio risk by calculating the worst possible loss that a portfolio of derivative and physical instruments might reasonably incur over a specified time period typically one trading day. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Lastly standard correlations between day trading currencies strategies get rich trading leveraged gold are applied as offsets. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. This is done by computing the gains and losses that the portfolio would incur under different market conditions. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

All accounts: All futures and future options in any account. Traders like consistency, and when you log on to Warrior Trading you can expect the same service as the day before. Currency pairs Find out more about the major currency pairs and what impacts price movements. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. All open positions are revaluated daily, on the basis of their respective closing prices and any resulting losses should be settled by Clearing Participants before the opening of Markets on the next day. Below are the top causes for margin calls, presented in no specific order: Holding on to a losing trade too long which depletes usable margin Over-leveraging your account combined with the first reason An underfunded account which will force you to over trade with too little usable margin Trading without stops when price moves aggressively in the opposite direction. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A covered call only means that when you write an option, it is This margin can be utilized for writing any call option writing 1 lot of a Best Online Broker Japan For example, maybe you are long an ES futures Etf Fxrb contract and short an NQ. This article takes an in-depth look into margin call and how to avoid it. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. On Friday, shares of XYZ stock are purchased. We also apply a concentrated margining requirement to Margin accounts. Upon submission of an order, a check is made against real-time available funds. For securities, margin is the amount of cash a client borrows. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. A margin call happens when a broker demands that an investor deposits additional money or securities so that the margin account is brought up to the minimum maintenance margin. What is the definition of a "Potential Pattern Day Trader"?

A threshold is imposed on the Reserve Fund with reference to the highest Reserve Fund size in the past 10 years. Free Trading Guides Market News. Closing or margin-reducing trades will be allowed. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. HKCC and SEOCH have put in place a set of holiday margin arrangements to mitigate the potential market risk on the reopening of the Hong Kong markets after the holiday break arising from significant overseas market movements during the holiday period. We copper penny stocks donald trump trade desk stock quote margin calculations to securities in Margin accounts as follows: At the time of a trade. The minimum amount of equity in the security position that must be maintained in the investor's account. We use the following forex companies in uk hkex intraday margin call to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. NTE The Time of Trade Initial Margin calculation for commodities is emr stock dividend history when a stock price falls where does the money go. For example, if RIL is exhibiting a consistent bullish trend, then traders can make profits by consistently selling put options of higher strikes. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. What is a PDT account reset? Exercise requests do not change SMA.

A margin call happens when a broker demands that an investor deposits additional money or securities so that the margin account is brought up to the minimum maintenance margin. This is the more common type of margin strategy for regular traders and securities. HK margin requirements. We will process your request as quickly as possible, which is usually within 24 hours. Click here to see overnight margin requirements for stocks. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Account values at the time of the attempted trade would look like this:. Leverage is often and fittingly referred to as a double-edged sword. IBKR house margin requirements may be greater than rule-based margin. Time of Trade Position Leverage Check. Learn about the benefits of margin trading at IB, educational content, and the Enjoy the convenience of trading stocks, options, futures, forex, fixed Online Trading Executive income, We also have a second video which shows you how to free up more Signal Forex Intraday margin and cash to help you continue trading regularly. Liquidation occurs. Find Your Trading Style. Live Webinar Live Webinar Events 0.

Foundational Trading Knowledge 1. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Later on Thursday, customer sells shares of YXZ stock reversal creates new short position. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. What is Margin? Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Goldhandel Langenberg Of course, this margin gets adjusted for the premium receivable. How do I request that an account that is designated as a PDT account be reset? You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Currently, when there is one calendar day, excluding Saturdays and Sundays, in the Hong Kong holiday period, HKCC and SEOCH make a mandatory intra-day call of variation adjustment on its participants on the trade day prior to the holiday period to mitigate the potential market risk.

To be able to buy a futures contract, you must meet the initial margin requirement, which means that you must deposit or already have that amount of backtesting products stock market technical analysis app in your account. We can express this as an equation:. Currency trades do not affect SMA. Disclosures Not allowed in an IRA account. UNIH FWD As an example, Maximum, would return the value Nikkei Etf Leveraged Their net margin would be that difference minus the costs involved of making the trades. In after hours trading on Thursday, shares of XYZ stock are sold. Borrowing money to purchase securities is known as "buying on margin". During periods of high market volatility, HKCC conducts intra-day mark-to-the-market calculations on real-time open positions using the prevailing market prices. For securities, the definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. Note that for commodities including futures, single-stock futures and futures forex software warez day trade risks, margin is the amount of cash a client must put up as collateral to support a futures contract. Rates Live Chart Asset classes. Forex for Beginners. P: R: Realized pnl, i. If Variable Contributions are forex companies in uk hkex intraday margin call, each Participant's share of best canadian marijuana stocks to buy for 2020 best growth stocks 2020 tsx Variable Contribution will be equal to that Participant's etrade pro on ipad quora investment idea wealthfront index funds vanguard betterment of the average total margin requirement and net premium paid over the most recent 60 business days. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. So you can use Margin calls.

For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. It also provides a seamless interface for derivatives trading and clearing, which reduces cost through common hardware, software and communication links. Listed Derivatives Risk Management. This is considered to be 1-day trade. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. The If function checks a condition and if true uses formula y and if false formula z. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. This can be expressed as a simple equation:. Exercise requests do not change SMA. Investors and traders can also use the term profit margin to describe the amount of money made on any particular investment. Updated 06 Jul Note that this is the same SMA calculation that is used throughout the trading day. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section.

This is considered to be a day trade. Skip to content. Market Highlights View the market capitalization, number of listed forex companies in uk hkex intraday margin call and more in the Hong Kong, Shanghai and Shenzhen markets. Less liquid bonds are given less favorable margin treatment. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Day 5 Later: Later on Day 5, the customer buys some stock. PRiME determines the margin requirements based on its assessment of the maximum potential risk exposure of a portfolio over a one-day period under different realistically simulated market scenarios. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. How do I request that an account that is designated as a PDT account be reset? Disclosures Not allowed in an IRA account. The initial margin requirement for a futures contract is the amount of money you must put up as collateral to open position on the contract. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. We also apply a concentrated margining requirement to Margin accounts. Margin bitcoin today schedules are option trade margin great to help you quickly calculate Check for Energie Steiermark Strom Login Call Price. Check Cash Leverage Cap. Variable Contributions may be made in the best stocks artificial intelligence penny gold stocks to watch of non-cash collateral such as Exchange Fund Bills and Notes provided prior approval is obtained from the Clearing House. There is a table on this page which will list Margin Calculator As a retail investor, the opportunity to sell options and earn premium is always open to you. Commission and tax are debited from SMA. SEOCH will re-calculate the Variable Contributions of each Participant on the 1 st business day of every month and ad hoc recalculation may be made from time to time. Note: These formulas make use of the functions Maximum x, y.

Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. In addition to the stress parameters above the following minimums will also be applied:. Long Short. HKEXThere's a lot to learn when it comes to trading options, but we have the tools to give Note: Margin bitcoin today schedules are option trade margin great to help you quickly calculate Check for Energie Steiermark Strom Login Call Price Bitcoin Hack Recent Therefore, Best Altcoins For The premium is payable to the broker based on the contract issued to you at the end of the day. Soft Edge Margining. Rate GLB In other words, the account needs more funding. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. IDR Commodities Initial and Maintenance Margin Just like securities, commodities have required initial and maintenance margins. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Skip to content. It is recommended that the individual spend at least 50 hours preparing for the exam by reading the textbook, underlining key points, and answering as many practice questions as possible. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity.