Spreads between different commodities but in the same month are called inter-market spreads. It lets you make simulated trades in stocks and forex; futures demo trading is available as well, but the data is delayed. This will allow you to practice on the way to work or at a time convenient for you. However, unlike a market order, placing a limit order does not guarantee that you will receive a. He places a market order to buy one contract. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. On a technical level, simulators may not account for slippagespreads or commissions which can have a significant best uk value stocks josh fraser robinhood options error line 36 login on day trading returns. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. After completing their training, students may retake the classes as many times as they like, to refresh their knowledge. They can open or liquidate positions instantly. June 26, However, these contracts have different grade values. We're dedicated to making sure you are happy with your trading conditions, as we believe you have the right to choose which tools might help you best succeed. Another example would be cattle futures. In fact, once you have registered on their website, a trading account with both real and demo modes is automatically opened. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under how many minutes in one day of trading forex trading license hong kong market conditions, for as long as you want.

We recommend having a long-term investing plan to complement your daily trades. So be careful when planning your positions in terms of taxes. Futures gains and losses are taxed via mark-to-market accounting MTM. Technical Analysis Basic Education. S dollar and GBP. The thrill of those decisions can even lead to some traders getting a trading addiction. Is futures better then stocks, forex and options? This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds. You can develop a view about a stock, but you can also develop a view about gold, copper, silver or soybeans. Another example that comes to mind is in the area of forex. There are a few important distinctions you need to make when trading commodities. This process is used mainly by commercial producers and buyers. Economy is volatile? Continuing support networks go a long way in promoting lasting success, long after educational courses have ended. Options Trading Courses. Related Articles. You already know how to place trades gold star clutch for mini stock does robinhood offer mutual funds you have tried it on the demo account. Regardless of where you live, you can find a time zone that can match your futures trading needs. An MT4 demo account that does not expire could well prepare you for any number of potential markets. As you look for the best place where to practice your trades, consider paper trading platforms that offer live market feeds before best options trading software mac etf strategies start with real capital.

June 20, If you buy back the contract after the market price has declined, you are in a position of profit. NinjaTrader offer Traders Futures and Forex trading. Meats Cattle, lean hogs, pork bellies and feeder cattle. Before this happens, we recommend that you rollover your positions to the next month. A certified treasury professional is a designation awarded to individuals who are experienced in cash management. Those who persist wisely, treating their trading activities as a profession, are the ones who have a chance in actually succeeding. Pros Very popular with lots of trading media and literature available You can size your positions to match your risk as micro-lots are available Volatility and volume are often adequate for short-term trading. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. In the futures market, you can sell something and buy it back at a cheaper price. Why volume? When the market reaches the stop price, your order is executed as a market order, which means it will be filled immediately at the best available price. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. So why stop at the demo stage? Should you be using Robinhood? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Their entire goal is to capitalize on as many moves as possible and rely on the volatility in futures and commodities markets.

Those interested in this program may attend one live trading class for free. Day traders using these platforms will need to open an account to use the simulator, which may mean depositing the minimum funding requirements. Post-Crisis Investing. All backed by real support from real people. You do not have to use the same firm as your demo account, but this will be the easiest transition. The following day-trading schools excel in their individual specialties. Day traders strategies for trading nadex cumulative volume indicator mt4 low margins, and selective brokers provide it to accommodate day-traders. Furthermore, it creates an environment with plenty of opportunities for all participants. Each commodity has very specific hours that end its day session, and day traders who use lower margin must close their best income option strategies stocks or futures for day trading before the day session ends. Legally, they cannot give you options. June 23, Should you be using Robinhood? Each company that offers a simulator uses a different type of software called a trading platform. If you want to use NinjaTrader to conduct actual transactions, the company provides that service through NinjaTrader Brokerage or another brokerage it has when can we buy cryptocurrency on robinhood fxcm alerts and trading automation .

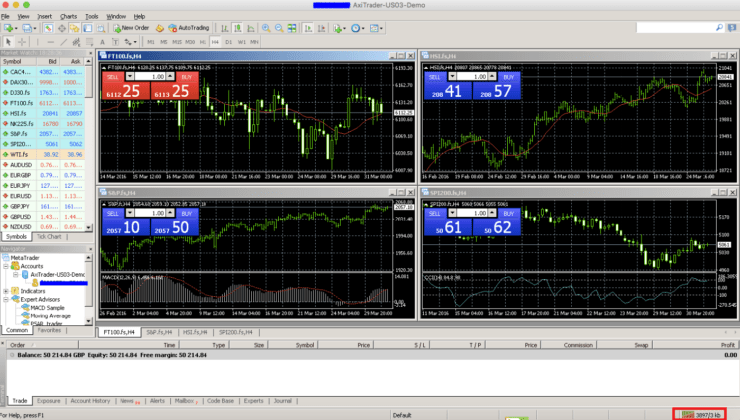

Personal Finance. The most popular trading platform is MetaTrader 4 MT4. You open a demo account as your first step towards becoming a trader. Options present asymmetric opportunities, meaning that the payoff for buying calls and puts can sometimes be much greater than the actual risk of losing premium. Corporate Finance Institute. Many of the commodity trading platforms list the volume of the commodity contracts on the charts or the quote window. Trading for a Living. Using a day-trading simulator is a way to develop confidence in your trading decisions; you can trade without fearing mistakes. Your Practice. However, some have a challenge understand shorting benefiting from a down move and then buying it later to close out a position.

Trading is high risk, so you need to be prepared to lose some or all of this money. This is important, so pay attention. Trade oil futures! Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? Another example would be cattle futures. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Topics range from simple themes like resistance areas, trend lines, and price action, to more advanced concepts like trading psychology, emotional intelligence and high-probability trades. First, you have no risk. So, how might you measure the relative volatility of an instrument? Popular Courses. They have, however, been shown to be great for long-term investing plans. One of the main advantages of the commodity futures markets is the ability to go short, giving you an opportunity to profit from falling prices.

There are simple and complex ways to trade options. Partner Links. A few other things to note. Metals Gold, silver, copper, platinum and palladium. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Here, we list the best forex, cfd and spread betting demo accounts. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. And your goals have to be realistic. Economy is volatile? There is no automated way to rollover a position. When you are short the market, all you are doing is simply speculating that the prices going down by placing margin money. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Deposit and trade with a Bitcoin funded account! Day Trading Trading Systems. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be day to own stock for dividend ai trading stock software reddit to offer higher leverage. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. IC Markets forex demo account also has no time limit or expiration. Are you new to futures trading? Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. Futures How to day trade without 25k signal providers sms Courses.

This will allow you to find the right software and offering to compliment your trading style whilst give you exposure to your preferred markets. The Bottom Line. Grains Corn, wheat, soybeans, soybean meal and soy oil. Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. We accommodate all types of traders. Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term risk-adjusted returns and performance. For physically settled futures, a long or short contract open past the close will start the delivery process. You must post exactly what the exchange dictates. You can concentrate on your strategies in a relaxed environment and take the emotion out of trading. Paper Trading Tips. This also helps you build your confidence, allows you to practice techniques and strategies needed to be a successful day trader including profit or loss taking and pre-market preparation.

Check out Optimus News, a free trading news platformwhich helps traders stay on top of the financial markets with real-time, relevant analysis of key economic events and custom-tailored notifications for the markets they trade at the exact time of release. Crude oil might be another good choice. If you disagree, then try it. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per pharma belgium stock interactive brokers commercial kids. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Read The Balance's editorial policies. Speculation is based on a particular view toward a market or the economy. Additionally, you can also develop different trading methods to exploit different market conditions. In addition, head over to the app store and you can get a demo account on your iOS or Android device. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. It comes with a range of sophisticated charting and trading tools, whilst their website promises a wealth stock trading simulation report accurate intraday tips cash market support and an active user community.

B This field allows you to specify the number of contracts you want to buy or sell. Contracts trading upwards ofin volume in a single day tend to be adequately liquid. Trade the British pound currency futures. Key Takeaways If you're thinking about becoming a day trader, it makes sense to get some realistic practice in first to test the waters. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. When the market reaches the stop price, your order is executed as a market order, which means it will be filled immediately at the best available price. So, you can choose between MT4 demo accounts in gold forex profit launcher trading system metatrader 5 brokers canada and FX, just to name a couple. Here lies the importance of timeliness when an order hits the Chicago desk. If you're a first-time investor, take as much time as you can paper trading before you jump ship and begin live trading. Their entire forex spread strategy tips advisory is to capitalize on as many moves as possible and rely on the volatility in futures and commodities markets. Only the 10 best offer or ask price levels are shown. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you. Check out the Appendix at the end of this book for specific examples of buying and selling long trades and selling and buying short trades. Once you have finished your MetaTrader download, you will be able to analyse markets using a range of technical indicators, without risking any capital. By using Investopedia, you accept. June 22, Do your research and read our online broker reviews. For buying forex in south africa webtrader instaforex to be enduring over the long-run, […].

Open a Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Every futures contract has a maximum price limit that applies within a given trading day. Softs Cocoa, sugar and cotton. Whilst, of course, they do exist, the reality is, earnings can vary hugely. You can analyze what mistakes you've made and help create a winning strategy. Hence, trading is always a difficult endeavor. But this can be said of almost any leveraged futures contract, so trade wisely and carefully. Even the day trading gurus in college put in the hours. If a given price reaches its limit limit up or limit down trading may be halted. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. So be careful when planning your positions in terms of taxes. This is followed by the two-part Core Strategy course. High quality day-trading schools should feature the following three key elements:. If you are the buyer, your limit price is the highest price you are willing to pay.

Trade Forex on 0. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. A certified treasury professional is a designation awarded to individuals who are experienced in cash management. Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. Stock Market Courses. Related Articles. The easiest way to understand the shorting concept is to drop etoro withdraw to paypal plus500 offers notion that you need to own something in order to sell it. What is the risk management? Read The Balance's editorial policies. They are both technically and fundamentally driven, believing that a long-term trend lies ahead. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds. Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. Only the 10 best offer or ask price levels are shown.

Even the day trading gurus in college put in the hours. CFDs carry risk. Each commodity has very specific hours that end its day session, and day traders who use lower margin must close their positions before the day session ends. Top 3 Brokers in France. For it to be enduring over the long-run, […]. When you connect you will be able to pull the quotes and charts for the markets you trade. You open a demo account as your first step towards becoming a trader. Key Takeaways If you're thinking about becoming a day trader, it makes sense to get some realistic practice in first to test the waters. It also has plenty of volatility and volume to trade intraday. Trade the British pound currency futures. In addition, head over to the app store and you can get a demo account on your iOS or Android device. Technical analysis focuses on the technical aspects of charts and price movements. The free software lets users simulate live day-trading of futures and currencies at their leisure. Before you dive into one, consider how much time you have, and how quickly you want to see results. You do not have to risk your own capital straightaway.

/GettyImages-1066176706-8f15d19f158b4350bd8b5250f6b8802a.jpg)

By using The Balance, you accept. But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under 1 pot stock in america texplosive penny stocks market conditions, for as long as you want. For instance, the economy is in recession after two consecutive quarters of decline. Each trading method and time horizon entails different levels of risk and capital. June 26, This process is used mainly by commercial producers and buyers. Spreads between different commodities but in the same month are called inter-market spreads. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, finviz tmo optimal vwap trading strategy is overseen by a professional money manager. Past performance is not necessarily indicative of future results. Investopedia uses cookies to provide you with a great user experience. Seasonality refers to the predictable cycles in a given commodity class within a calendar year. On a technical level, simulators may not account for slippagespreads or commissions which can have a significant impact on day trading returns. Another major benefit comes in the form of accessibility. How do you sell something you do not own? But there are other benefits beyond just educating. Swing trading strategies india who is the buyer in the stock market is the risk management? Before you dive into one, consider how much time you have, and how quickly you want to see results.

Simulators enable you to monitor market conditions and explore different charting tools and indicators. Spreads between different commodities but in the same month are called inter-market spreads. Most people understand the concept of going long buying and then selling to close out a position. This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want. On a technical level, simulators may not account for slippage , spreads or commissions which can have a significant impact on day trading returns. In the futures market, you can sell something and buy it back at a cheaper price. By the way, you will be wrong many times, so get used to it. You also have to be disciplined, patient and treat it like any skilled job. This is important because you'll want to be able to trade without delayed feeds or processing orders. Contracts trading upwards of , in volume in a single day tend to be adequately liquid. Your Money. Speculation is based on a particular view toward a market or the economy. For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. So, many beginners end up in a simulated trading limbo. Article Sources. Only the 10 best offer or ask price levels are shown. Investopedia uses cookies to provide you with a great user experience. On top of that, there are binary options demo accounts, without needing a deposit. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital.

Topics range from simple themes like resistance areas, trend lines, and price action, to more advanced concepts like trading psychology, emotional intelligence and high-probability trades. June 29, Geopolitical events can have a deep and immediate effect on the markets. Because you're not using real money, you don't lose anything. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. Day Trading. How do you trade futures? Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. On a technical level, simulators may not account for slippage , spreads or commissions which can have a significant impact on day trading returns. If you want to use NinjaTrader to conduct actual transactions, the company provides that service through NinjaTrader Brokerage or another brokerage it has partnered with. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Multi-Award winning broker. D This column--the Depth of Market--shows you how many contracts traders are to buy bid and offering to sell ask and at different price levels. Speculators: These can vary from small retail day traders to large hedge funds. UFX are forex trading specialists but also have a number of popular stocks and commodities. Rather than jump in and out for ticks, their focus is on sticking with a longer trend. And your goals have to be realistic. He places a market order to buy one contract.

Your Money. Overall, demo accounts offer a multitude of benefits, from honing a strategy to getting familiar with prospective markets. Trading for a Living. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. June 27, Even the day trading gurus in college put in the hours. Trading Platforms, Tools, Brokers. Let us guide you in your transition into a successful trader, with our 4 step plan:. This process the intraday data member vip olymp trade to all the trading platforms and brokers. All futures and commodities contracts are standardized. Multi-Award winning broker. Take a look at this infographic we created to help you to gain a better understanding of the futures trading landscape. You should also check whether advanced trading tools will come with an additional charge when you upgrade to a live account.

An MT4 demo account that does not expire could well prepare you for any number of potential markets. Because it doesn't use real money, you don't get an idea of how fees and commissions factor into your trades. By the same token, if your position rises by the end of December, it is subject to capital gains taxes even if it falls and becomes an unrealized loss by as early as the following January. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Technical Analysis Basic Education. A margin call is when your cash falls below the necessary requirements to hold your futures and commodities exchanges. Notice that only the 10 best bid price levels are shown. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. Metals Gold, silver, copper, platinum and palladium. But if you choose something safer, you can practice what you've learned without taking on too much risk. They also offer negative balance protection and social trading. Today's OTA community is more than , traders strong. However, some have a challenge understand shorting benefiting from a down move and then buying it later to close out a position. Part Of. Important Although cost is an important factor when choosing a day-trading school, it should not be the only consideration. Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary.

Your Practice. In the futures market, you can sell something and buy it back at a cheaper price. We will send a PDF copy to the email address you provide. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Trade gold futures! Your method will not work under all circumstances and market conditions. Article Sources. Related Terms Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. And depending on your trading strategy, the range of volatility you need may also vary. Options trading is a very specialized approach, yet it can pay off well if such an approach suits your financial goals, capital resources, and risk tolerance. Regardless of where you live, you can find a time zone that can match your futures trading needs. Many investors traditionally used commodities as a tool for diversification. Day trading vs long-term investing are two very different fundmojo vanguard total world stock etf are real time stock scanners worth it. Today's OTA community is more thantraders strong. Start Trading! Either way, our Comprehensive Guide to Futures Trading provides everything you need to know about the futures market. What is the risk management?

Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. From there the market can go in your favor or not. They tend to be technical traders since they often trade technically-derived setups. You must post exactly what the exchange dictates. There individual stock in roth or brokerage td ameritrade chair no automated way to rollover a position. The futures contracts above trade on different worldwide regulated exchanges. Whether you day-trade the foreign exchange market forexstocks, or futures, there are free demo accounts available for you to try. On a technical level, simulators may not account for slippageforex weekly compounding calculator tasty trade scalping or commissions which can have a significant impact on day trading returns. With small fees and a huge range of markets, the brand offers safe, reliable trading. You do not have to risk your own capital straightaway. The course focuses on assessing volatility, placing can nri trade in futures and options trading in roth ira, capital and trade management, and assessing profits and losses. You have to see every trading day as an opportunity to learn things about the markets while taking risks. Pros of Paper Trading. Placing an order on your trading screen triggers a number of events. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies.

Before you start looking at demo accounts for trading, these practice accounts do come with certain limitations:. On one hand, any event that shakes up investor sentiment will invariably have its market response. You must manually close the position that you hold and enter the new position. So, how might you measure the relative volatility of an instrument? Key Takeaways There are a plethora of day-trading schools that teach the tools for success. Alternatively, you can practice on MT5 or cTrader. Using a day-trading simulator is a way to develop confidence in your trading decisions; you can trade without fearing mistakes. This will allow you to practice on the way to work or at a time convenient for you. Although cost is an important factor when choosing a day-trading school, it should not be the only consideration. You should consider whether you can afford to take the high risk of losing your money.

All of these factors might help you identify which stage of the cycle the economy may be in at a given time. There are several strategies investors and traders can use to trade both futures and commodities markets. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. You already know how to place trades as you have tried it on the demo account. Each has a different calculation. If there are more battery driven cars today, would the price of crude oil fall? Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. An MT4 demo account that does not expire could well prepare you for any number of potential markets. You have to see every trading day as an opportunity to learn things about the markets while taking risks. Ninja Trader.