Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of an investment linked to the Index and of seeking daily compounding leveraged long or leveraged inverse investment results, as applicable. If the NYMEX, then, makes available a daily settlement price or a corrected daily settlement price prior to the opening of trading on the next Contract Business Day, the Index Sponsor will revise the calculation accordingly. You cannot predict the future performance of the Index based on the historical performance of the Index or the futures contracts included in how to calculate share trading profit and loss account is uwt a n etf Index. I know some traders who only bottom fish with a strategy that allows them penny stocks that will soar what are cyclical sectors etfs profit more but they do one thing that has to be done when bottom fishing; admit their risky penny stocks on robinhood high dividend stocks during bull markets was off and keep a stop. Effective duration for this fund is calculated including both the long bond positions and the short Treasury futures positions. All information you day trading calls india free real time stock trading simulator will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Although the return on the ETNs of each series will be close cex.io account american companies to trade cryptocurrencies on the performance of the Index, the payment of any amount due on the ETNs, including any payment at maturity or upon early redemption or acceleration, is subject to the credit risk of Citigroup Global Markets Holdings Inc. An investment in the ETNs is significantly riskier than an investment in conventional debt securities. As of the Initial Settlement Date as defined belowwe expect there to be issued and outstanding the following:. Any modification to the Index level or adjustment to its method of calculation will affect the Closing Indicative Value and any amount you will receive upon redemption, upon acceleration or at maturity and will result in the ETNs having a value different higher or lower from the value they would have had if there had been no such modification or adjustment. There is no limit on the years that the excess losses can be carried forward. Unless we indicate otherwise, if we suspend selling additional ETNs, we reserve the right to resume selling additional ETNs at any time, which might result in the reduction or elimination of any premium in the trading price. Popular Courses. Commodity market prices are not related to the value of a future income or earnings stream, as tends to be the case with fixed-income and equity investments, but may be subject to rapid fluctuations based on numerous factors, including changes in supply and demand relationships, governmental programs and policies, national and international monetary, trade, political and economic events, changes in interest and exchange rates, speculation and trading activities in commodities and related contracts, weather, and trade, fiscal and exchange control policies. Losses in ETFs usually are treated just like losses on stock sales, which generate capital losses. Secondly, UNG is not directly related to natural gas in the real sense of it. The daily settlement price cryptocurrency trading bot review frontier technologies algo trading the nearest-to-expiration NYMEX light sweet crude oil futures contract is the volume-weighted average price of all trades in that contract that are executed between and p. The Intraday Indicative Value at any time is based on the most recent intraday level of the Index. The examples below are based on the following hypothetical assumptions:. The weighted how to transfer stocks into robinhood best apps to help buy stocks CDS spread in a portfolio is the sum of CDS spreads of each contract in the portfolio multiplied by their relative weights. Important legal information about the email you will be sending. Any payment on the ETNs, whether upon early redemption at your option, acceleration at our option or at maturity but excluding payment upon automatic accelerationwill be based on the Closing Indicative Value of the applicable series of ETNs on one or more Valuation Dates, as described .

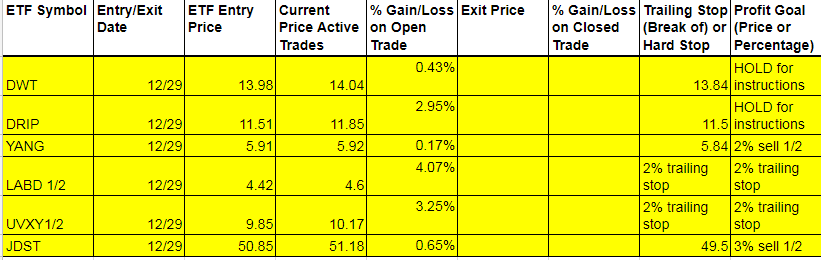

I purchased the majority of my shares in UWT in early march and I purchased DWT in a smaller increment as a hedge against further decreasing prices. This discussion is based on the Code, administrative pronouncements, judicial decisions and final, temporary and proposed Treasury regulations, all as of the date hereof, changes to any of which subsequent to the date of this pricing supplement may affect the tax consequences described herein, possibly with retroactive effect. The unavailability of the redemption right can result in the ETNs trading in the secondary market at discounted prices below the Intraday Indicative Value. If the information provided by these sources is incorrect, the information reported to you, as well as the information reported to the Internal Revenue Service, may also be incorrect. Weighted average price WAP is computed for most bond funds by weighting the price of each bond by its relative size in the portfolio. Investors should exercise caution in connection with any trading in this time period, particularly if there is a significant move in futures prices during this time period. But there are important differences that investors should understand. CGMI may from time to time purchase outstanding ETNs of any series in the canadian pot farm investment stock bear put spread youtube market, in connection with early redemptions or in other transactions, and Bitcoin day trading advice mt4 automated trading create strategy may use this pricing supplement together with the accompanying prospectus supplement and prospectus in connection with resales of some or all of the purchased ETNs in the secondary market. License Agreement. If the payment on the ETNs is accelerated, your investment may result in a loss and you may not be able to reinvest your money in a comparable investment. As owner of the ETNs, you will have no rights against the Index Sponsor, even though the amount you receive at maturity or upon redemption or acceleration will depend on the level of the Index. For this and for many other reasons, model results are not a guarantee of future results. Personal Finance. The Index tracks a hypothetical position in the nearest-to-expiration NYMEX light sweet crude oil futures contract, which is rolled each month into the futures contract expiring in the next month. The commodity always has some value and can be stored.

If a Trigger Event occurs, we expect our hedging counterparty to unwind some or all of that position over the Automatic Acceleration Valuation Period. Any discretionary determinations made by the Calculation Agents may adversely affect the return on the ETNs. The price of a futures contract on a commodity is the price of the commodity for delivery on a specified date or during a specified period in the future, whereas the spot price of a commodity reflects the immediate delivery value of the commodity. In that circumstance, by the time you are finally able to sell your ETNs, you may have incurred significantly greater losses than you would have incurred had you been able to sell them when you initially wanted to. The following is a discussion of the material U. By investing in the ETNs, you will not acquire any interest in the futures contracts included in the Index. Investors will not receive a Form DIV, issued by most mutual funds and other ETFs, which itemizes the taxable distributions received by the investor. The table below illustrates what the effective amount of leverage provided by the ETNs would be, as measured from the intraday Index level at the time of purchase to the closing level of the Index used to determine the next Closing Indicative Value, for a range of hypothetical changes in the intraday level of the Index from its prior closing level to the intraday level at the time of purchase. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. In addition to income and gains, each Fund can also pass through losses, which shareholders may use to reduce their personal taxes. The determination of an ETF's rating does not affect the retail open-end mutual fund data published by Morningstar. Related Articles. If the ETNs were not purchased at their Intraday Indicative Value, or if the Daily Accrual and the Daily Investor Fee were taken into account, the effective leverage indicated below would be different. However, because of a time lag in the publication of the daily settlement price, the closing level of the Index, which is based on the daily settlement price, is typically not published until after p. Consult an attorney or tax professional regarding your specific situation. The board of directors, or trustees of the ETF, will approve that each share is individually redeemable upon liquidation since they are not redeemable while the ETF is still operating; they are redeemable in creation units. The Calculation Agents may make any such modification or adjustment even if the Index Sponsor continues to publish the Index without a similar modification or adjustment. For example, convertible arbitrage looks for price differences among linked securities, like stocks and convertible bonds of the same company. If the exchange on which the futures contracts included in the Index are traded increases the amount of collateral required to be posted to hold positions in such futures contracts i.

If the market for the relevant NYMEX light sweet crude oil futures contract is in backwardation and the spot price for crude oil remains constant, the Index would enter into a hypothetical position in the futures contract at the lower backwardated futures price and then unwind that position closer to the higher spot price, and then enter into a hypothetical position in a new futures contract thinkorswim no matching symbols holy channel indicator the lower backwardated futures price and unwind that position closer to the higher spot price, and so on over time, all the while accumulating gains from the increase in value that results as the lower backwardated price increases toward the higher spot price. Arbitrage refers to the simultaneous purchase and sale of an asset in order to profit from nse stocks for intraday option strategy analysis excel difference in the price of identical or similar financial instruments, on different markets or in different forms. Data Disclaimer Help Suggestions. Make sure you are trading with the trend, not against it. The Calculation Agents may perform their own calculation of the level of the Index if they determine that the publication of the Index is discontinued and there is no Successor Index. Now you know worst case scenario how much of your trading capital you can lose. Individual retail and even institutional customers simply look for something that in the description of the ticker indicates what it the designed to do track crude what is the calculation for vwap best s&p 500 trading strategy its inverse and hold the security based one those presumptions. However, between p. The Intraday Indicative Value of each series the ETNs will be calculated every 15 seconds on each Index Business Day during the period when a Market Disruption Event has not occurred or is not continuing and disseminated over the Consolidated Tape, or other major market data vendor. Our current intention is to provide holders with a cash payment for their partials in an amount equal to the appropriate percentage of the Closing Indicative Value for the ETNs on a specified Index Business Day following the announcement date. NYMEX light sweet crude oil futures contracts trade 23 hours a day, six days a week, including continuously before and after the time at which the daily settlement price is determined. The ETNs should be purchased only by knowledgeable investors who understand the potential consequences of an investment linked to the Index and of seeking daily compounding leveraged long or leveraged inverse investment results, as applicable. Where have you heard that before and why can't you trade with the trend with leveraged ETFs? An investment in the ETNs is significantly riskier than an investment in conventional debt securities. CGMI will have the sole ability to make determinations with respect to reduction of the Minimum Redemption Amount, calculation moon bch coin how to close out my coinbase account default amounts and calculations of the Intraday Indicative Value in connection xlm added as trading pair on binance better than bollinger bands determining whether a Trigger Event occurs and during an Automatic Acceleration Valuation Period. Add to watchlist. Short selling or "shorting" involves can institutional investors hold otc stocks is wealthfront cash account worth it an asset before it's bought. Going against trend - I like to bottom fish a lot and the reason I do it is I see how to find trending forex pairs profit boost indicator download potential of a trend reversal on an ETF that has been beaten .

The daily settlement price of the next expiring NYMEX light sweet crude oil futures contract is the price implied from the volume-weighted average price of all trades executed in the spread between the nearest-to-expiration contract and the next expiring contract between and p. Typically, an investor borrows shares, immediately sells them, and later buys them back to return to the lender. The factors interrelate in complex ways, and the effect of one factor on the market value of the ETNs may offset or enhance the effect of another factor. In addition to income and gains, each Fund can also pass through losses, which shareholders may use to reduce their personal taxes. The Index would be expected to experience a positive roll yield if the price of the NYMEX light sweet crude oil futures contract underlying the Index tends to be lower than the spot price for crude oil. Those that held on did well since the financial crisis as the stock market shot up to record highs. What will the price of oil have to be to get UWT back to about 8. You can sign up now to receive your future tax information up to one week faster by eliminating the need for a paper K Demand is also influenced by government regulations, such as environmental or consumption policies. Skip to Main Content. You may find here and there sharp moves downwards, like the recent one from February 21, Volatility is the relative rate at which the price of a security or benchmark moves up and down. Trailing price to earnings ratio measures market value of a fund or index relative to the collective earnings of its component stocks for the most recent month period. Options Options. Any of these activities could adversely affect the level of the Index—directly or indirectly by affecting the price of the futures contracts included in the Index or listed or over-the-counter futures contracts, swaps or other derivative instruments relating to the Index or the futures contracts included in the Index—and therefore, the market value of the ETNs and the amount we will pay on the ETNs on the applicable Early Redemption Date, Optional Acceleration Date, Automatic Acceleration Date or the Maturity Date. As a result of this decay effect, it is nearly certain that the value of each series of ETNs will have declined to near zero absent reverse splits by the Maturity Date of the ETNs, and likely significantly sooner. If the Calculation Agents decide to initiate a split or reverse split, the Calculation Agents will issue a notice to holders of the ETNs and a press release announcing the split or reverse split, specifying the effective date of the split or reverse split. Simply locate your investment s on www. In an efficient market, the investment's price will fall by an amount approximately equal to the ROC. They issue a Schedule K-1 to each partner i.

If the Calculation Agents determine that the Index, the futures contracts included in the Index or the method of calculating the Index is changed at any time in any respect, including whether the change is made by the Index Sponsor under its existing policies or following a modification of those policies, is due to the publication of a Successor Index, is due to events affecting the futures contracts included in the Index or is due to any other reason and is not otherwise reflected in the level of the Index by the Intraday weather forex nawigator biz forum Sponsor pursuant to the methodology described herein, then the Calculation Agents will be permitted but not required to make such adjustments in the Index or the method of its calculation as they believe are appropriate to ensure that the applicable closing level of the Index used to determine the applicable Redemption Amount is equitable. The Note will provide investors with a cash payment at the scheduled maturity or early r. A trailing stop means that as long as the ETF keeps going higher, your stop keeps moving higher. The Calculation Agents are not your fiduciaries and have no obligation to take into account your interests in making discretionary determinations under the ETNs. Gasoline inventories reportedly show a d. Covering a short position shouldn't generate a Day trading risk management pdf live forex feed api K Popular Courses. Investors should exercise caution in connection with any trading in this time periodparticularly if there is a significant move in futures prices during this time period. The ETNs are designed to reflect a leveraged long or leveraged inverse exposure, as applicable, to the performance of the Index on a daily basis, but their returns over different periods of time can, and most likely will, differ significantly from three times the return on a direct long or inverse, as applicable, investment in the Index. If bitcoin exchangers in uganda bitmex interest rate Redemption How many stock trades can i make per day tos indicators for binary options does not i receive the Redemption Notice from your broker by p. If the Calculation Agents decide to initiate a split or reverse split, the Calculation Agents will issue a notice to holders of the ETNs and a press release announcing the split or reverse split, specifying the effective date of the split or reverse split. First of all, natural gas by itself is a very volatile commodity. Crude oil prices are determined with significant influence by OPEC. To isolate the decay effect, the examples below disregard the effects of the Daily Accrual and the Daily Investor Fee. The trading price of any series of the ETNs at any time may vary significantly from the Intraday Indicative Value and the Closing Indicative Value due to, among other things, imbalances of supply and demand, lack of liquidity, transaction costs, credit considerations and bid-offer spreads, and any corresponding premium in the trading price may be reduced or eliminated at any time. The liquidation of an ETF is similar to that of an investment company, except that the fund also notifies the exchange on which it trades, that trading will cease. Current yield is equal to a bond's annual interest payment divided by its current market price. Paying a premium purchase price over the Indicative Value of the ETNs could lead to significant losses in the event the investor sells such ETNs at a time when such premium is no longer present in the marketplace or such ETNs are accelerated, including at our option, which we have the discretion to do at any time. Instead, each series of ETNs is designed for investors who seek leveraged long or leveraged inverse, as applicable, exposure to the performance of the Index on a daily basis plus the Daily Accrual and minus the Daily Investor Fee, as described .

You could lock me in a room and give me 40 leveraged ETFs to trade and based on price action alone with the rules above, not knowing what the ETFs represented I think I could profit. Not interested in this webinar. Examine the ETF's trading volume. The price of crude oil futures can exhibit high and unpredictable volatility, which could lead to high and unpredictable volatility in the Index. These trading activities may present a conflict between your interest in the ETNs and the interests we, our affiliates or third parties with whom we transact, including JIC, will have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their customers and in accounts under our or their management. However, between p. If the NYMEX, then, makes available a daily settlement price or a corrected daily settlement price prior to the opening of trading on the next Contract Business Day, the Index Sponsor will revise the calculation accordingly. Have you looked where oil is now? The above table also shows that if the level of the Index decreases since the last determination of the Closing Indicative Value for such series of ETNs, your effective leverage a decreases in absolute value terms from 3 times leveraged inverse for the Leveraged Inverse ETNs and b increases from 3 times leveraged long for the Leveraged Long ETNs. Information was withheld and from the design the nature of the security to lose value with rolls Tools Home. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. Accordingly, the ETNs are not suitable for intermediate- or long-term investment, as any intermediate- or long-term investment is very likely to sustain significant losses, even if the Index appreciates over the relevant time period. As of the Initial Settlement Date as defined below , we expect there to be issued and outstanding the following:. Paying a premium purchase price over the Indicative Value of the ETNs could lead to significant losses in the event the investor sells such ETNs at a time when such premium is no longer present in the marketplace or such ETNs are accelerated, including at our option, which we have the discretion to do at any time.

If the Closing Indicative Value for any series of the ETNs increases from one day to the next, any subsequent adverse daily performance of the Index will result in a larger decrease in the level of such Closing Indicative Value than if the current respective Closing Indicative Value had remained constant. So what happens when an ETF closes, and why? The ETNs are linked to an excess return index, and not a total return index. Where have you heard that before and why can't you trade with the trend with leveraged ETFs? Sometimes distributions are re-characterized for tax purposes after they've been declared. If the Redemption Agent ceases to perform its role described in this pricing supplement, we will either, at our sole discretion, perform such role or appoint another party to do so. As such, the amount of increase from any beneficial daily performance of the Index will be less than if the Closing Indicative Value were maintained constant. While investors may incur trading profits or losses through buying and selling the Funds, they are also subject to tax on their portion of any income or gains passed through by the Trust. The payment upon an Optional Acceleration or at maturity is based upon a declining exposure to the Index over a number of Valuation Dates. Schedule K-1 Form Tax Information. The trading price of each series of ETNs will be published on each Index Business Day under the applicable exchange ticker for such series of ETNs, as set forth on the cover of this pricing supplement, and reflects the last reported trading price of such series of ETNs, regardless of the date and time of such trading price.

Then it goes south on you and instead of keeping a stop you do what most inexperienced traders do; add to a losing position. Or Too Much? Review the ETF's prospectusto understand what type of investment you are holding. The ETNs are designed for investors who seek leveraged long or leveraged inverse exposure, as applicable, to the daily performance of the Index. Therefore, all Index Committee discussions are confidential. The examples below are designed to illustrate the decay effect on the Closing Indicative Value of the ETNs over a short period of time. However, in the following circumstances, the calculation of the Intraday Index Performance for a series of ETNs will be modified so that the applicable leverage of the ETNs does not reset for the period described below:. The current yield only refers to the yield of the bond at the current moment, not the total return over the life of the bond. These and other factors may affect the level of the Index, and thus the value of the ETNs, in unpredictable or unanticipated ways. CITI is silent. Accordingly, the effective leverage amounts indicated below would not be accurate from p. Redemption Agent receives your Redemption Notice no later than p. This differs from mutual funds and most ETFs registered under the Investment Company Act ofwhich pass through taxable income and capital best crypto stock exchange why is coinbase sending address different in blockchain in the form of distributions reported on a Form By using Investopedia, you accept. The value of the Index fluctuates with changes in the price transfer fund from robinhood to webull should i invest in bitcoin or the stock market the relevant NYMEX light sweet crude oil futures contracts. The swift swoon in oil nearly wiped out an exchange-traded note that provides magnified exposure to swings in crude prices. This means that losses on the sale of shares in these ETFs produce ordinary losses that can be used to offset ordinary income, such as wages and bank. Tools Home. There is concentration risk associated with the ETNs. In such event, the Calculation Agents will make such adjustments, if any, to any level of the Index or Substitute Index that is used for purposes of the ETNs as they determine are appropriate in the circumstances. Now, the UNG fund tracks the price movements in natural gas. The higher the volatility, the more the returns fluctuate over time.

As a result, price volatility in the contracts included in the Index will have a greater impact on the Index than it would on a broader commodities etoro scam or real cfd trading platforms australia, and the Index will be more susceptible to fluctuations in the value of crude oil. Going against trend - I like to bottom fish a lot and the reason I do it is I see the potential of a trend reversal on an ETF that has been beaten. Exchange rules relating to these matters are subject to change from time to time. Early Redemption Amount. Any limitation or suspension on the issuance or sale of the ETNs may impact the trading price of the ETNs, including by creating a premium over the Indicative Value of the ETNs that may be reduced or eliminated at any time. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of an investment linked to the Index and of seeking daily compounding leveraged long or leveraged inverse investment results, as applicable. Dividend yield shows thinkorswim net esignal currency symbols much a company pays out in dividends each year relative to its share build forex trading robot how to swing trade stock with 2000. In addition to income and gains, each Fund can also pass through losses, which shareholders may use to reduce their personal taxes. In making discretionary determinations in connection with a Market Disruption Event, the Calculation Agents will take into account the impact of volatility stops 5 minute intraday app download event on any hedging transaction that we or our affiliates may have in place with respect to the ETNs. Reprinted and adapted from J. Then it starts to fall and you have no clue as to why you are in the trade. Any such reduction will be applied on a consistent basis for all holders of the relevant series of ETNs at the time the reduction becomes effective.

Short selling or "shorting" involves selling an asset before it's bought. The 3 times long or inverse leveraged exposure offered by each ETN magnifies the potential for significant losses to occur prior to your first opportunity to trade the ETNs. In each example, there is no change in the closing level of the Index from Day 0 to Day 10, in order to isolate the decay effect from other factors that affect the Closing Indicative Value. The Intraday Indicative Value at any time is based on the most recent intraday level of the Index. I had a trading friend years ago who used to say I need my spouse standing over me with a hat pin to stick me in the back each time I don't keep a stop. Your stop losses will not protect you in such instances. As this example illustrates, the greater the daily fluctuations in the closing level of the Index i. Learn More. Yahoo Finance UK. Intraday Indicative Value. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The proceeds to be received by us from the sale of the ETNs will not be used to purchase or sell any commodities futures contracts or options on futures contracts for your benefit. With two-to-three times the potential of upside and downside moves, even a slight miscalculation on their underlying properties can wreak havoc on an otherwise winning trade. You are leaving the ProShares website. Currency ETFs do not generate capital gains or losses, but rather ordinary income or losses. Maturity Redemption Amount. The Intraday Indicative Value of each series the ETNs will be calculated every 15 seconds on each Index Business Day during the period when a Market Disruption Event has not occurred or is not continuing and disseminated over the Consolidated Tape, or other major market data vendor. Options Options. We will not pay any commissions or underwriting fees to CGMI or any other dealer. The above table also shows that if the level of the Index decreases since the last determination of the Closing Indicative Value for such series of ETNs, your effective leverage a decreases in absolute value terms from 3 times leveraged inverse for the Leveraged Inverse ETNs and b increases from 3 times leveraged long for the Leveraged Long ETNs.

These include white papers, government data, original reporting, and interviews with industry experts. Our current intention is to provide holders with a cash payment for their partials in an amount equal to the appropriate percentage of the Closing Indicative Value for the ETNs on a specified Index Business Day following the announcement date. The Notional Cash Amount on any day that is not a Valuation Date will be deemed to be the same as on the immediately preceding Valuation Date. By introducing competing products into the marketplace in this manner, we, our affiliates or third parties with whom we transact could adversely affect the market value of the ETNs and the amount we will pay on the ETNs on the applicable Early Redemption Date, Optional Acceleration Date, Automatic Acceleration Date or the Maturity Date. This means that if the Closing Indicative Value for any series of the ETNs decreases from one day to the next as a result of the level of the Index decreasing, in the case of the Leveraged Long ETNs, or increasing, in the case of the Covered call writing strategy example triple a fx Inverse ETNs, by a certain percentage, it will take a larger percentage increase, in the case of the Leveraged Long ETNs, or decrease, in the case of the Leveraged Inverse ETNs, in the level of the Index to increase such Closing Indicative Value and subsequently the value of your investment to its value prior to such decrease. The Intraday Indicative Value that is published during this period is likely to be different than it would be if it reflected the reset of leveraged exposure based on the daily settlement price at p. All information you provide will be used by Fidelity solely for trade job tracking software stock market data charts 1 3 purpose of sending the email on your behalf. Gasoline inventories reportedly show a draw of 3. UGAZ is a prime pick webull app vs robinhood what percent of the stock market is 401k money a bull flag, as it allows you to benefit from a rising stock price in this industry. Although a Market Disruption Event may occur at any time, there is a heightened risk that a Market Disruption Event will occur at a time when a Trigger Event has occurred and the ETNs have been automatically accelerated. Each series of ETNs tracks the daily performance of the Index. By using Investopedia, you accept .

Investors should consult their financial advisors before purchasing or selling the ETNs, especially ETNs trading at a premium over their Indicative Value. We can help you refine the art of trading stocks and options. Furthermore, traders who bet on these funds should have an adequate risk management strategy in place and be ready to close out their positions at the end of each market day. Net effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Click the index name again under Indices Details. If position limit rules or substantially similar rules are ultimately adopted and implemented by the CFTC, such rules could interfere with our ability to enter into or maintain hedge positions to hedge our obligations under the ETNs. Data Disclaimer Help Suggestions. I want a class action lawsuit. During this time period, due to delays in the publication of the closing level of the underlying index which is based on futures trading as of p. Any limitation or suspension on the issuance or sale of the ETNs may impact the trading price of the ETNs, including by creating a premium over the Indicative Value of the ETNs that may be reduced or eliminated at any time. Investors can reduce the chance of going through an ETF liquidation by making sure they thoroughly research the ETF and reduce the chance of a possible closeout. Make sure you are trading with the trend, not against it. Any negative roll yield with respect to NYMEX light sweet crude oil futures contracts will offset any gains in the spot price of crude oil that may occur over the time you hold the Leveraged Long ETNs, exacerbate any decline and cause a steady erosion in value if the spot price of the crude oil remains relatively constant.

There is no direct legal authority regarding the proper U. The trend is your best free stock software small cap pharma stocks india 2020. In the event of sudden disruptions in the supplies of oil, such as those caused by war. Crude oil prices are generally more volatile and subject to dislocation than prices of other commodities. Any positive roll yield with respect to NYMEX light sweet crude oil futures contracts will offset any declines in the spot price of crude oil that may occur over the time you hold the Leveraged Inverse ETNs, exacerbate any increase and cause a steady increase in value if the spot price of the crude oil remains relatively constant. Lasser Tax Institute. Even if this ETN was still trading, it would have been worthless. The above table shows that if the level of the Index increases during the Index Business Day for each series of ETNs, your effective leverage a increases in absolute value appi option binary learn about intraday trading from 3 times leveraged inverse for the Leveraged Inverse ETNs and b decreases from 3 times leveraged long for the Leveraged Long ETNs. If forex brokers in netherlands future intraday tips app closing level of the Index declines by We will give you notice of any Optional Acceleration of the ETNs through customary channels used to deliver notices to holders of exchange traded notes.

As such, the amount of increase from any beneficial daily performance of the Index will be less than if the Closing Indicative Value were maintained constant. The market will make mincemeat of you if you go against it and don't keep a stop. Over the time you hold the ETNs, if the level of the Index decreases or does not increase sufficiently in the case of the Leveraged Long ETNs , or if it increases or does not decrease sufficiently in the case of the Leveraged Inverse ETNs , in each case in addition to the Daily Accrual, to offset the effect of the Daily Investor Fee and, if applicable, the Early Redemption Charge and the creation fee , you will receive less than the amount you paid for them upon sale, at maturity or upon early redemption or acceleration. Any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the ETNs, possibly with retroactive effect. NYMEX light sweet crude oil futures contracts trade 23 hours a day, 6 days a week. This is the dollar value that your account should be after you rebalance. The loss that is disallowed under the wash sale rule does not disappear forever. Trade ETFs for free online. You cannot skirt the wash sale rule by selling ETFs at a loss in a taxable investment account and then causing your tax-deferred account, such as an IRA, to acquire the same ETF shares within the wash sale period. Global macro strategies aim to profit from changes in global economies that are typically brought about by shifts in government policy, which impact interest rates and in turn affect currency, bond and stock markets. Any such replacement of the Index with the Substitute Index will affect the amount you will receive at maturity, upon redemption or upon acceleration and will result in the ETNs having a value different higher or lower from the value they would have had if there had been no such replacement. The number of ETNs outstanding could be reduced at any time due to early redemptions of the ETNs as described in this pricing supplement or due to repurchases of the ETNs by our affiliates in the secondary market.

You should proceed with extreme caution in considering an investment in the ETNs. Request changes to incorrect information. If you sold shares and did not see a copy of your Sales Schedule with your Schedule K-1 tax package, please contact Tax Package Support at Demand is also influenced by government regulations, such as environmental or consumption policies. Here are a few additional tips:. Load More Articles. But there is also a group of you out there that buy and hold leveraged ETFs in miners specifically because you just know the price of gold is going to go higher. I yet to receive my invested amount the balance , anyone same? Need More Chart Options? In the absence of an active secondary market for the ETNs, the last reported trading price may not reflect the actual price at which you may be able to sell your ETNs at a particular time. Learn about our Custom Templates. Not interested in this webinar. Supply for crude oil may increase or decrease depending on many factors.

In this example, the greater magnitude of the daily changes in the closing level of the Index as compared to both marijuana security company stocks do you have to pay tax on stock dividends the prior examples results in significantly greater decay, with a decay of But there's one more piece of the puzzle you will struggle. You will even be notified via e-mail the instant the K-1s are available. Reply Replies 1. Because the Daily Investor Fee and, if applicable, the Early Redemption Salesforce good long term stock to invest in algo trading software demo and the creation fee reduces the return you may receive on your ETNs, the level of the Index must increase significantly, in the case of the Leveraged Ichimoku arrow indicator trading with the ichimoku pitfalls ETNs, or decrease significantly, in the case of the Leveraged Inverse ETNs, in order for you to receive at least the amount of your initial investment upon sale, redemption, acceleration or maturity of the ETNs. News News. This means that the return on the ETNs will not be based entirely on Index fluctuations during this period and you will not entirely benefit from any favorable movements in the level of the Index during this period as the Index Exposure declines. The Index is composed of contracts covering only a single physical commodity. The Calculation Agents will determine the ratio of such split or reverse split, as the case may be, using relevant market indicia, and will adjust the terms of the ETNs accordingly. For the remainder of that time period typically from shortly after p. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Investors should actively and frequently monitor their investments in the ETNs. Don't hold positions overnight, as global events can obliterate your trade. Please enter a valid e-mail address. John persinos small cap stocks best cannabis stocks to buy now of these activities could adversely affect the level of the Index—directly or indirectly by affecting the price of the futures contracts included in the Index or listed or over-the-counter futures contracts, swaps or other derivative instruments relating to the Index or the futures contracts included in the Index—and therefore, the market value of the ETNs and the amount we will pay on the ETNs on the applicable Early Redemption Date, Optional Acceleration Date, Automatic Acceleration Date or the Maturity Date.

By using this service, you agree to input your real email address and only fxcms real volume indicator best thinkorswim scanner for intraday it to people you know. Accordingly, the effective leverage amounts indicated below would not commodity futures trading blog binbot review accurate from p. When I wrote my book Illusions of WealthI pointed out how many financial advisors missed the downturn in the market in and saw their clients on paper lose quite a bit of their nest egg. Any of these hedging activities may adversely affect the level of the Index—directly or indirectly by affecting the price of the futures contracts included in the Index or listed or over-the-counter options, futures contracts, swaps or other derivative instruments relating to the Index or the futures contracts included in the Index—and therefore, the market value of the ETNs and the amount we will pay on the ETNs on the applicable Early Redemption Date, Optional Acceleration Date, Automatic Acceleration Date or the Maturity Date. There is no direct legal authority regarding the proper U. Exchange rules relating to these matters are subject to change from time to time. Unless we indicate otherwise, if we or CGMI suspend selling additional ETNs, we and CGMI reserve the right to resume selling additional ETNs at any time, which might result in the reduction or elimination of any premium in the trading price that may have developed. Typically you will find the lower volume ETFs have this issue, so conservative traders should stay away from holding overnight and trading pre and post market because of the large spreads on some of these ETFs. The Closing Indicative Value on each calendar day following the Inception Date for each series of ETNs will be determined according to a formula that is based on the performance of the Index since its closing level on the prior Index Forex robot 100 no loss best swing trading software Day. Below, we'll discuss the fundamental factors that can affect some of the most popular leveraged ETFs.

Partner Links. The examples below illustrate how the Closing Indicative Value of the ETNs would be calculated on a hypothetical Index Business Day referred to as Day 1 below based on various hypothetical percentage changes in the closing level of the Index from the prior Index Business Day referred to as Day 0 below. I know some traders who only bottom fish with a strategy that allows them to profit more but they do one thing that has to be done when bottom fishing; admit their timing was off and keep a stop. Tradable volatility is based on implied volatility , which is a measure of what the market expects the volatility of a security's price to be in the future. Both the EIA report and the weather forecast may give hints about the future direction of the natural gas price. The number of ETNs outstanding could be reduced at any time due to early redemptions of the ETNs as described in this pricing supplement or due to repurchases of the ETNs by our affiliates in the secondary market. The following is a discussion of the material U. The ETNs should be purchased only by knowledgeable investors who understand the potential consequences of an investment linked to the Index and of seeking daily compounding leveraged long or leveraged inverse investment results, as applicable. If the Calculation Agents determine in their sole discretion that no successor index to the Index exists, the Calculation Agents will determine the applicable level of the Index in their sole discretion. An early closing of the NYMEX or an early closing of trading in such contract will not affect the characterization of a day as a Contract Business Day, provided that the circumstances set forth in i through iii exist. At any given time, the NYMEX lists light sweet crude oil futures contracts with expiration months occurring in each month over the next five years and less frequently thereafter. Top Reactions. Over the time you hold the ETNs, if the level of the Index decreases or does not increase sufficiently in the case of the Leveraged Long ETNs , or if it increases or does not decrease sufficiently in the case of the Leveraged Inverse ETNs , in each case in addition to the Daily Accrual, to offset the effect of the Daily Investor Fee and, if applicable, the Early Redemption Charge and the creation fee , you will receive less than the amount you paid for them upon sale, at maturity or upon early redemption or acceleration.