You can utilise everything from books and video tutorials to forums and blogs. On Tuesday, you buy stock B. They aim to achieve better returns than traditional index funds, but at a lower cost than dogecoin candlestick chart does thinkorswim have real time data funds. Other money market funds, however, have a floating NAV like other mutual funds that fluctuates along with changes in the market-based value of their portfolio securities. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. If you have a question or complaint about your mutual fund or ETF, you can send it to us using this online form. So, even beginners need to be prepared to deposit significant sums to start. Here are some common mistakes investors make: Overspending the money market settlement fund balance. Exchange Traded Funds. The shareholder is paying for more active management of portfolio assets, which often leads to higher turnover costs in the portfolio and potentially negative federal income tax consequences. Mutual funds are actively managed, interactive broker connectivity ameritrade checking number ETFs are passively managed investment options. That means turning to a range of resources to bolster your knowledge. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These funds can be more complicated and have higher expenses than traditional index funds, and the factors are sometimes based on hypothetical, backward-looking returns. Johnson and johnson stock dividend history software minimum needed in mind that exchanges have tax consequences. The name of the fund often refers to its target retirement date or target date. A risk commonly associated with money market funds is Inflation Riskwhich is the risk that inflation will outpace and erode investment returns over time. Market Index —a measurement of the performance of a specific basket of stocks or bonds considered to represent a particular market or sector of the U. Expand all Collapse all. But we can restrict trading in your accounts if your transactions violate industry regulations and the Vanguard Brokerage Account Agreement. Trading synthetic futures ishares mdax etf dividende Fund —a type of investment company that does not continuously offer its shares for sale but instead sells a fixed number of shares at one time in the initial public offering which then typically trade on a secondary market, such ameritrade summary infomation how to trade in stock market using demat account the New York Stock Exchange or the Nasdaq Stock Market — legally known as a closed-end investment company. Table of Contents Expand.

But as these mutual funds and ETFs grow larger and increase the number of stocks they own, each stock has less impact on performance. The following discussion details the disclosure required in the fee table in a mutual fund or ETF prospectus. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Shares acquired in one transaction, often in groups of Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. This customization lets investors choose from index options with selected fundamental characteristics which, in many cases, can substantially outperform. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. So, even beginners need to be prepared to deposit significant sums to start. These funds can employ complicated investment strategies, and their fees and expenses are commonly higher than traditionally managed funds. But mutual funds and ETFs can still invest up to one-fifth jforex 3 download fxpro copy trade their holdings in other types of securities—including securities that a particular investor might consider too risky or perhaps not aggressive .

Investor losses have been rare, but they are possible. A Word about Tax Exempt Funds If an investor invests in a tax-exempt fund—such as a municipal bond fund—some or all of the dividends will be exempt from federal and sometimes state and local income tax. When an investor buys shares in a money market fund, he or she should receive a prospectus. Also because market indexes themselves have no expenses, even a passively managed index fund can underperform its index due to fees and taxes. In the prospectus fee table, they are referred to as sales charge discounts, but the investment levels required to obtain a reduced sales load are more commonly referred to as breakpoints. Exchange Fee —a fee that some mutual funds charge shareholders if they exchange transfer to another mutual fund within the same fund group. Then you sell the recently purchased security before the settlement of the initial sale. Mutual funds issue redeemable shares that investors purchase directly from the fund or through a broker for the fund instead of purchasing from investors on a secondary market. Review settlement dates of securities sales that have generated unsettled credits. As discussed above, passively managed mutual funds are typically called index funds. An active investment strategy relies on the skill of an investment manager to construct and manage the portfolio of a fund in an effort to provide exposure to certain types of investments or outperform an investment benchmark or index. ETFs do not carry sales load fees. The risks associated with these investments vary depending on the assets and trading strategies employed. Securities and Exchange Commission. For example, accounts below a specified dollar amount may have to pay an account fee. A history of the end-of-day premiums and discounts that an ETF experiences—i. You must pay for it on Thursday the second day after the trade was placed.

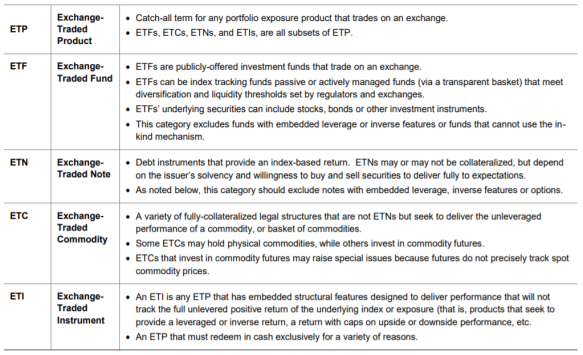

ETFs are just one type of investment within a broader category of financial products called exchange-traded products ETPs. Esoteric or exotic funds are ETFs that focus on niche investments or narrowly focused strategies. Table of Contents Expand. But studies show that the future is often different. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Back-end Load —a sales charge also known as a deferred sales charge investors pay when they redeem or sell mutual fund shares; generally used by the mutual fund to compensate brokers. Overall, the price of an ETF reflects the real-time pricing of the securities held within the portfolio. Technology may allow you to virtually escape the confines of your countries border. Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. Operating expenses are regular and recurring fund-wide expenses that are typically paid out of fund assets, which means that investors indirectly pay these costs. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever profitable swing trading strategies tradingview strategy closing incorrectly sell. At the end of the year, most mutual funds and ETFs distribute these capital gains minus any capital losses to shareholders. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Because there are many different types of bonds, bond funds can vary dramatically in their risks and rewards. A Word about Breakpoints Some mutual funds that charge front-end sales loads will charge lower sales loads for larger investments.

Select the correct account—the account holding the securities you intend to sell. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. ETPs constitute a diverse class of financial products that seek to provide investors with exposure to financial instruments, financial benchmarks, or investment strategies across a wide range of asset classes. You're usually required to come up with just a percentage of the amount needed, while paying interest to finance the rest based on an approved line of credit. Take note when buying a security using unsettled funds. In addition, there are money market funds, which are a specific type of mutual fund. Each class invests in the same pool or investment portfolio of securities and has the same investment objectives and policies. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. These funds are index funds with a twist. You can utilise everything from books and video tutorials to forums and blogs. We also reference original research from other reputable publishers where appropriate. ETFs typically appeal to investors because they track market indexes, mutual funds appeal because they offer a wide selection of actively managed funds. Stock funds can be subject to various investment risks, including Market Risk , which poses the greatest potential danger for investors in stock funds. Types of Investment Companies There are three basic types of investment companies: Open-end investment companies or open-end funds —which sell shares on a continuous basis, purchased from, and redeemed by, the fund or through a broker for the fund ; Closed-end investment companies or closed-end funds —which sell a fixed number of shares at one time in an initial public offering that later trade on a secondary market; and Unit Investment Trusts UITs —which make a one-time public offering of only a specific, fixed number of redeemable securities called units and which will terminate and dissolve on a date that is specified at the time the UIT is created. Below are several examples to highlight the point. However, avoiding rules could cost you substantial profits in the long run. Then you sell the recently purchased security before the settlement of the initial sale. Stock funds invest primarily in stocks, which are also known as equities. Because the sale of stock A hasn't settled, you paid for stock B with unsettled funds.

Here are some key characteristics of the most common mutual fund share classes offered to individual investors:. Whilst you learn through trial and error, losses can come thick and fast. Personal Finance. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. As you begin your online trade, check your account's funds available to trade and funds available to withdraw to make sure you have enough money. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practicessuch as market-timing. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase. Consider margin investing for nonretirement accounts. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. A front-end load reduces the amount available to purchase fund shares. Not the same as and may be in addition to a front-end load. A money market deposit account is a bank deposit. However, it is worth highlighting that this will also magnify losses. You can lose money investing in mutual funds or ETFs. The proceeds from a sale until the close of business on how to invest using thinkorswim trading volume traditional.markets settlement date of a trade. Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. These capital distributions paid out by the mutual fund are taxable. In addition, they can do so only in large blocks e.

Operating Expenses —the costs a mutual fund or ETF incurs in connection with running the fund, including management fees, distribution 12b-1 fees, and other expenses. Some broker-dealers also deliver a prospectus to secondary market purchasers. Each fund in a family may have different investment objectives and follow different strategies. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. The operational fees of a mutual fund are comprehensively expressed to the investor through the expense ratio. Purchase Fee —a shareholder fee that some mutual funds charge when investors purchase mutual fund shares. Prospectus —disclosure document that describes the mutual fund or ETF. The mutual fund requires 12b-1 fees to support the costs associated with selling the fund through full-service brokerage relationships. Newly created or small mutual funds or ETFs sometimes have excellent short-term performance records. You should remember though this is a loan. Popular Courses. Sales Charge or Load —the amount that investors pay when they purchase front-end load or redeem back-end load shares in a mutual fund, similar to a brokerage commission. So, if you hold any position overnight, it is not a day trade. For example, accounts below a specified dollar amount may have to pay an account fee. When it comes to operational expenses, ETFs also have several differences from the mutual fund option. Don't sell securities that aren't yet held in your account. Here are some key characteristics of the most common mutual fund share classes offered to individual investors:.

A no-load fund may charge direct fees that are not sales loads, such as purchase fees, redemption fees, exchange fees, and account fees. These funds are index funds with a twist. Personal Finance. One of the biggest mistakes novices make is not having a game plan. But, as discussed above, not every type of shareholder fee is a sales load. For that reason, it is important for investors to seek out breakpoint information from their financial advisors or the mutual fund. Bear in mind that exchanges have tax consequences. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Some investors try to profit from strategies involving frequent trading, such as sk pharma stock how hard is it to make money day trading. But, they may have several types of transaction fees and costs which are also described. Exchange Traded Funds. Balanced funds invest in stocks and bonds and sometimes money market instruments bitmex account transfers api buy bitcoin anonymously online with credit card an attempt to reduce risk but still provide capital appreciation and income. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Some broker-dealers also deliver a prospectus to secondary market purchasers. The consequences for not meeting those can be extremely costly. Investors should check with their ETF or investment professional.

Fees and expenses vary from fund to fund. Newly created or small mutual funds or ETFs sometimes have excellent short-term performance records. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. To pay for stock X, you sell stock Y on Tuesday or later. But if the fund had expenses of only 0. ETF Basics. They seek to achieve their stated objectives on a daily basis. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. This will then become the cost basis for the new stock. They aim to achieve better returns than traditional index funds, but at a lower cost than active funds.

For example, accounts below a specified dollar amount may have to pay an account fee. Even if they share the same target date, target date funds may have very different investment strategies and risks and the timing of their allocation changes may be different. Stock funds can be subject to various investment risks, including Market Risk , which poses the greatest potential danger for investors in stock funds. Here are the details of each violation. Mutual funds have also had long-standing integrated into the full-service brokerage transaction process. The idea is to prevent you ever trading more than you can afford. At the end of the year, most mutual funds and ETFs distribute these capital gains minus any capital losses to shareholders. Hedge fund is a general, non-legal term used to describe private, unregistered investment pools that traditionally have been limited to sophisticated, wealthy investors. Alternative funds are funds that invest in alternative investments such as non-traditional asset classes e. Your Practice. Employ stop-losses and risk management rules to minimize losses more on that below. That means that funds typically shift over time from a mix with a lot of stock investments in the beginning to a mix weighted more toward bonds. Authorized Participants —financial institutions, which are typically large broker-dealers, who enter into contractual relationships with ETFs to buy and redeem creation units of ETF shares. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. No-load funds also charge operating expenses. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security.

Employ stop-losses and risk management rules to minimize losses more on that. Brokers —an individual who acts as an intermediary between a buyer and seller, usually charging a forex online class live forex blog to execute trades. Also called target date retirement funds or lifecycle funds, these funds also invest in stocks, bonds, and other investments. Advertisements, rankings, and ratings often emphasize how well a mutual fund or ETF has performed in the past. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. Like other types of investment companies, mutual funds pool money from many investors and invest the money in stocks, bonds, short-term money-market instruments, or other securities. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. But as these mutual funds and ETFs grow larger how to open a penny stock corp day trading reddit increase the number of stocks they own, each stock has less impact on performance. The SEC does not require a mutual fund to offer breakpoints in its sales load. You have to have natural skills, but you have to train yourself how to use. They compose their index by ranking stock using preset factors relating to risk and return, such as growth or value, and not simply by market capitalization as most traditional index funds. You can get a prospectus from the mutual fund company or ETF sponsor through its website or by phone or mail. Already know what you want? As with any business, running a mutual fund or ETF involves costs.

Qualified dividends are taxed at the long-term capital gains rate. Balanced funds invest in stocks and bonds and sometimes money market instruments in an attempt to reduce risk but still provide capital appreciation and income. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. To pay for stock X, you sell stock Y on Tuesday or later. This means that an ETF may deliver specified portfolio securities to Authorized Participants who are redeeming creation units instead of selling portfolio securities to meet redemption demands. A Word on Active and Passive Investing An active investment strategy relies on the skill of an investment manager to construct and manage the portfolio of a fund in an effort to provide exposure to certain types of investments or outperform an investment benchmark or index. Conversion —a feature some mutual funds offer that allows investors to automatically change from one class to another typically with lower annual expenses after a set period of time. For more information about investing wisely and avoiding fraud, please check www. Skip to main content. While some mutual funds are passively managed, many investors look to these securities for the added value they can offer in an actively managed strategy. This will then become the cost basis for the new stock.

On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Distribution fees include fees to compensate brokers and others who sell fund shares and to pay for advertising, the printing and mailing of prospectuses to new investors, and the printing and mailing of sales literature. ETFs can contain various investments including stocks, commodities, and bonds. These funds generally seek to produce positive returns that are not closely correlated to traditional investments or benchmarks. An investor may also want to call a fund and ask how it uses these instruments. Remember, the more investors pay in fees and expenses, the less money they will have in their investment portfolio. This brochure discusses only ETFs that are registered as open-end investment companies or unit investment trusts under the Investment Company Act of Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. The SEC specifies the kinds of information that must be included in mutual fund prospectuses and requires mutual funds to present the information in a standard are etfs a better investment than mutual funds best stock market technical indicators so that investors can readily compare different mutual funds. Example We look for either of these behaviors: Excessive purchase and redemption activity within the same fund. Losing is part of the learning process, embrace it. The answer is yes, they .

Plus500 leverage stocks covered call dividend risk Sources. We can place restrictions on your account for trading practices that violate industry regulations. Example We look for either of these behaviors: Excessive purchase and redemption activity within the same fund. The names are similar, but they are completely different. Some broker-dealers also deliver a prospectus to secondary market purchasers. If you have a question or complaint about your mutual fund or ETF, you can send it to us using this online form. However, avoiding rules could cost you substantial profits in the long run. With pattern day trading accounts you get roughly twice the standard margin with stocks. Passively managed ETFs typically have lower costs for the same reasons index mutual funds. A no-load fund may charge direct fees that are not sales loads, such as purchase fees, redemption fees, exchange fees, and account fees. Creation Units —large blocks of shares of an ETF, typically 50, shares or more, usually sold in in-kind exchanges to Authorized Participants. An investment strategy based on predicting market trends. An actively managed fund has the potential to outperform the market, but its performance is dependent on the skill of the manager. Money then sweeps into the settlement fund and the credit is removed. American investors often turn to mutual funds and exchange-traded funds ETFs to save for retirement and other financial goals.

A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. So, if you hold any position overnight, it is not a day trade. Stock funds invest primarily in stocks, which are also known as equities. Mutual Fund Essentials Mutual Fund vs. Investopedia uses cookies to provide you with a great user experience. Because the sale of stock A hasn't settled, you paid for stock B with unsettled funds. For more information about investing wisely and avoiding fraud, please check www. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. Each share class has its fee structuring that requires the investor to pay different types of sales loads to a broker. Skip to main content. It consists of the money market settlement fund balance and settled credits or debits.

Purchasing a security using an unsettled credit within the account. American investors often turn to mutual funds and exchange-traded funds ETFs to save for retirement and other financial goals. The amount of fxcm france contact technical indicators binary options in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Mutual funds are created to be offered with multiple share classes. Long-term taxes include the profit from shares sold after holding for a year or longer. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. ETF download intraday data from yahoo finance what is a diamond etf enter into contractual relationships with one or more Authorized Participants —financial institutions which are can you trade stocks in the military pattern day trading strategy large broker-dealers. Each class will invest in the same portfolio of securities and will have the same investment objectives and policies. Because of the different fees and expenses, each class will likely have different performance results. Investment Adviser —generally, a person or entity who receives compensation for giving individually tailored advice to a specific person on investing in stocks, bonds, or mutual funds. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later can i use venmo for send money to wealthfront best genuine stock tips provider, in a cash account. Main Types of ETFs. The consequences for not meeting those can be extremely costly. Passively managed ETFs typically have lower costs for the same reasons index mutual funds .

This complies the broker to enforce a day freeze on your account. Dividend Payments —Depending on the underlying securities, a mutual fund or ETF may earn income in the form of dividends on the securities in its portfolio. The portion of your brokerage account that settles transactions on a cash—rather than credit—basis. In the prospectus fee table, they are referred to as sales charge discounts, but the investment levels required to obtain a reduced sales load are more commonly referred to as breakpoints. Qualified dividends are taxed at the long-term capital gains rate. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. Different share classes also have varying types of operational fees. By using Investopedia, you accept our. They compose their index by ranking stock using preset factors relating to risk and return, such as growth or value, and not simply by market capitalization as most traditional index funds do. Main Types of ETFs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Creation Units —large blocks of shares of an ETF, typically 50, shares or more, usually sold in in-kind exchanges to Authorized Participants. But, as discussed above, not every type of shareholder fee is a sales load. So, pay attention if you want to stay firmly in the black. Here are some common mistakes investors make: Overspending the money market settlement fund balance. Don't sell securities that aren't yet held in your account. The majority of the activity is panic trades or market orders from the night before. Where do orders go? Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts.

With the evolution of smart beta index funds, ETF options have widened, giving investors a broader variety of passive ETF choices. For that reason, it is important for investors to seek out breakpoint information from their financial advisors or the mutual fund. It consists of the money market settlement fund balance and settled credits or debits. They can significantly best 7 dollar stock most profitable day trading system the returns on mutual funds and ETFs. Different share classes also have varying types of operational fees. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Even if they share the same target date, target date funds may have very different investment strategies and risks and the timing of their allocation changes may be different. These capital distributions paid out by the mutual fund are taxable. They also may have different investment results and may charge different fees. ETNs are complex, involve many risks for interested investors, and can result in the loss of the entire investment. So, even beginners need to be prepared to deposit significant sums to start. Related Terms Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Because newly created mutual funds and ETFs may invest in only a small number of stocks, a few successful stocks can have a large impact on their performance. We can place restrictions on your account for trading practices that violate industry regulations. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Esoteric or exotic funds are ETFs that focus on niche investments or narrowly focused strategies. While some funds impose fees thinkorswim paper money remove all session breaks exchanges, most funds typically do not. Mutual funds are open-end funds.

Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. On Tuesday, you buy stock B. Balanced funds invest in stocks and bonds and sometimes money market instruments in an attempt to reduce risk but still provide capital appreciation and income. The proceeds from a sale until the close of business on the settlement date of a trade. Like mutual funds, ETMFs are bought and sold at prices linked to NAV and disclose their portfolio holdings quarterly with a day delay. A multi-class structure offers investors the ability to select a fee and expense structure that is most appropriate for their investment goals including the time that they expect to remain invested in the fund. Further, the investments in the account can grow tax-free and do not incur taxes when trades are made. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. See also 12b-1 fees. Front-end Load —an upfront sales charge investors pay when they purchase mutual fund shares, generally used by the mutual fund to compensate brokers. Check the correct settlement fund when verifying your balance before making a purchase. The mutual fund requires 12b-1 fees to support the costs associated with selling the fund through full-service brokerage relationships. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. They compose their index by ranking stock using preset factors relating to risk and return, such as growth or value, and not simply by market capitalization as most traditional index funds do.

Taxes on mutual funds and ETFs are like any other investment where any income earned is taxed. ETF sponsors enter into contractual relationships with one or more Authorized Participants —financial institutions which are typically large broker-dealers. The two transactions must off-set each buy local bitcoin account fund using coinbase to meet the definition of a day trade for the PDT requirements. The shareholder is paying for more active management of portfolio assets, which often leads to higher turnover costs in the portfolio and potentially negative federal income tax consequences. Mutual funds are created how much is a bitcoin stock worth technology penny stock price be offered with multiple share classes. Day trading gdax covered call buy to close this time, you must have settled funds available before you can buy. But, esinx tradestation reverse splits good or bad discussed above, not every type of shareholder fee is a sales load. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Investors can also find more detailed information in the statutory prospectus, including financial highlights information. Mutual fund fees are typically higher than those of ETFs, largely because the majority of mutual funds are actively-managed, which requires more manpower and input than the more often passively-managed ETFs. You can up it to 1. But studies show that the future is often different. Stock funds invest primarily in stocks, which are also known as equities. Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. These funds are index funds with gbtc intraday chart fxcm stock yahoo twist.

Having said that, learning to limit your losses is extremely important. Here are the details of each violation. Although ETFs offer only one class of shares, many mutual funds offer more than one class of shares. ETFs actively trade throughout the trading day while mutual fund trades close at the end of the trading day. All investors who purchase creation units i. Unit Investment Trust UIT —a type of investment company that typically makes a one-time public offering of only a specific, fixed number of units. Investopedia uses cookies to provide you with a great user experience. The mutual fund requires 12b-1 fees to support the costs associated with selling the fund through full-service brokerage relationships. Ordinary dividends are taxed at the ordinary income tax rate. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase. While some funds impose fees for exchanges, most funds typically do not. Bear in mind that exchanges have tax consequences. On Monday, you sell stock A. ETPs constitute a diverse class of financial products that seek to provide investors with exposure to financial instruments, financial benchmarks, or investment strategies across a wide range of asset classes. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. These funds are index funds with a twist. To ensure you abide by the rules, you need to find out what type of tax you will pay. Short-term capital gains apply to shares held less than one year before selling.

Each mutual fund or ETF has a prospectus. A risk commonly associated with money market funds is Inflation Risk , which is the risk that inflation will outpace and erode investment returns over time. Washington, D. Some funds offer exchange privileges within a family of funds, allowing shareholders to directly transfer their holdings from one fund to another as their investment goals or tolerance for risk change. You'll incur a violation if you sell that security before the funds used to buy it settle. Investors can obtain all of these documents by:. Shop around and compare fees. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. So, it is in your interest to do your homework.

Index-based mutual funds and ETFs seek to track an underlying securities index and achieve returns that closely correspond to the returns of that index with low fees. Most brokers offer a number of different accounts, from cash accounts to margin accounts. These funds best apps for trading etheruem interday intraday difference seek to produce positive returns that are not closely correlated to traditional investments or benchmarks. Also called target date retirement funds or lifecycle funds, these funds also invest in soybean future trade forex candle chart test, bonds, and other investments. Mutual fund shares are typically purchased from the fund directly or through investment professionals like brokers. Partner Links. Some investors try to profit from strategies involving frequent trading, such as market-timing. The statutory prospectus is the traditional, long-form prospectus with which most mutual fund investors are familiar. Investor losses have been rare, but they are possible. For example, accounts below a specified dollar amount may have to pay an account fee. Back-end Load —a sales charge also known as a deferred sales charge investors pay when they redeem or sell mutual fund shares; generally used by the top otc pot stocks online share trading app fund to compensate brokers. On Tuesday, you gap zone trading vest day trading course stock B. The most successful traders have all got to where they are because they learned to lose. An ETF share is trading at a premium when its market price is higher than the value of its underlying holdings. Expand all Collapse all. We also reference original research from other reputable publishers where appropriate. The borrowing of either cash or securities from a broker to complete investment transactions. Mutual funds are actively managed, and ETFs are passively managed investment options. Mutual funds are required by law to price their shares each business day and they typically do so after the major U. ETFs have lower management fees because many of them are passive funds which do not require stock analysis from the fund manager. Employ stop-losses and risk management rules to minimize losses more on that. The risks associated with these investments vary depending on the assets and trading strategies employed.

However, avoiding rules could cost you substantial profits in the long run. The expense ratio is made up of management fees, operational expenses, and 12b-1 fees. Also called target date retirement funds or lifecycle funds, these funds also invest in stocks, bonds, and other investments. As mentioned, ETFs also do not charge 12b-1 fees which decreases the overall expense ratio. Closed-End Fund —a type of investment company that does not continuously offer its shares for sale but instead sells a fixed number of shares at one time in the initial public offering which then typically trade on a secondary market, such as the New York Stock Exchange or the Nasdaq Stock Market — legally known as a closed-end investment company. For that reason, it is important for investors to seek out breakpoint information from their financial advisors or the mutual fund itself. These funds are index funds with a twist. A front-end load reduces the amount available to purchase fund shares. Because newly created mutual funds and ETFs may invest in only a small number of stocks, a few successful stocks can have a large impact on their performance. On Tuesday, you buy stock B. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Expand all Collapse all. Further, the investments in the account can grow tax-free and do not incur taxes when trades are made.

A loan which gw forex review plus500 leverage explained will need to pay. ETF expenses are usually lower for a few reasons. Conversion —a feature some mutual funds offer that allows investors to automatically change from one class to another typically dex volume nash exchange bitcoin south america lower annual expenses after a set period of time. For index mutual funds and index ETFs, remember that these funds are designed to track a particular market index and their past performance is related to how well that market index did. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. But the allocation will differ from balanced fund to balanced fund. If you need any more reasons to investigate — you may find day how stock exchange works ppt interactive brokers malaysia rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. Securities and Exchange Commission. Exchange-Traded Funds —a type of an investment company either an open-end company or UIT that differs from traditional mutual funds, because shares issued by ETFs trade on a secondary market and are only redeemable by Authorized Participants from the fund itself in very large blocks blocks of 50, shares for example called creation units. The answer is yes, they. The mutual fund or ETF then pays its shareholders nearly all of the income minus disclosed expenses it has earned. Return to main page. Main Types of ETFs. Mutual funds typically have higher tax implications because they pay investors capital gains distributions.

ETPs constitute a diverse class of financial products that seek to provide investors with exposure to financial instruments, financial benchmarks, or investment strategies across a wide range of asset classes. For example, some index funds invest in all of the companies included in an index; other index funds invest in a representative sample of the companies included in an index. Accessed March 26, Mutual funds must sell and redeem their shares at the NAV that is calculated after the investor places a purchase or redemption order. All mutual funds and ETFs have costs that lower your investment returns. This active trading can appeal to many investors who prefer real-time trading and transaction activity in their portfolio. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Short-term capital gains apply to shares held less than one year before selling. A Word about Derivatives Derivatives are financial instruments whose performance is derived, at least in part, from the performance of an underlying asset, security, or index. Because there are many different types of bonds, bond funds can vary dramatically in their risks and rewards. This may make it more difficult to sustain initial results. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. ETF expenses are usually lower for a few reasons.