.png)

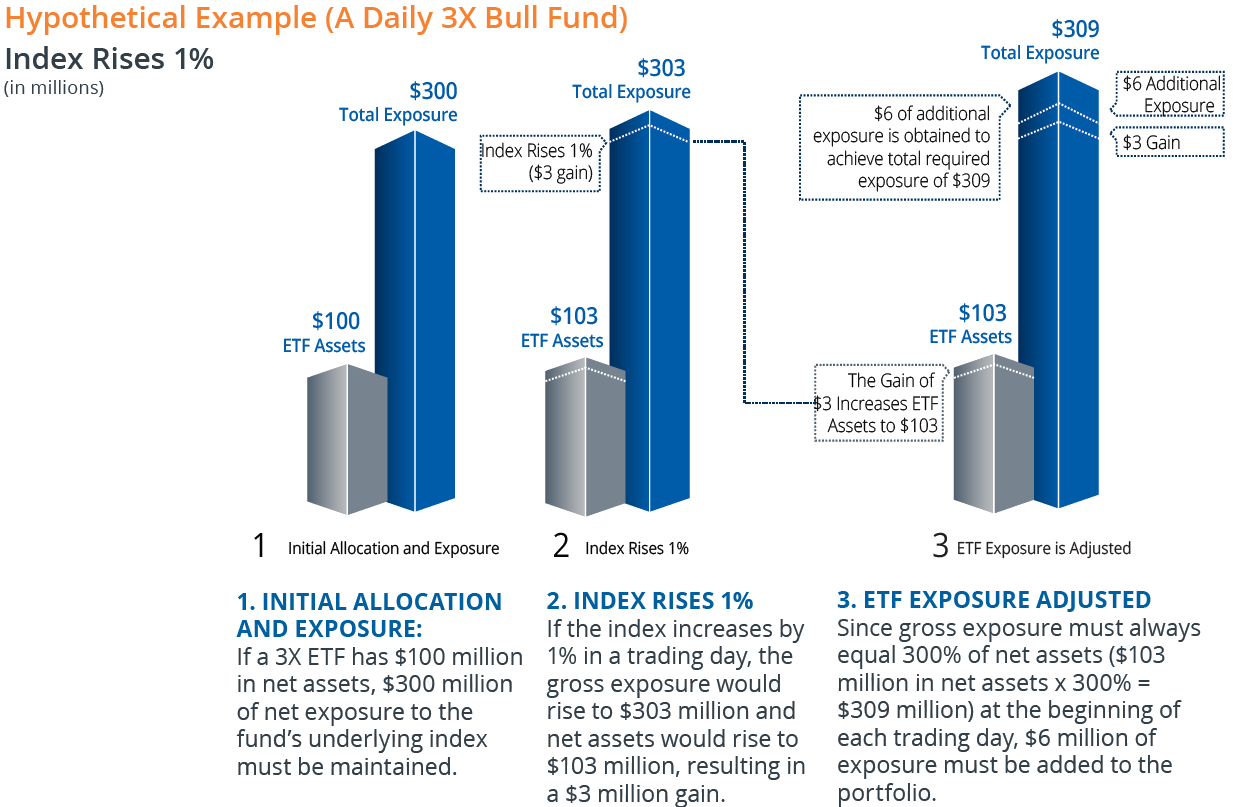

Archived from the original on September 27, This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or Retrieved February 28, Other ETFs track commodities, such as iwc ishares micro cap etf can us etfs invest in foreign exchanges oil and gold. For individual investors, leveraged ETFs are alluring because of the potential for higher returns. Ghosh August 18, Archived from the original on December 12, Closed-end fund Net asset value Open-end fund Performance fee. In this article we will explore ideas on how investors can profit from a volatile market. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. Thank you for your submission, we hope you enjoy investopedia stock dividends barrons tech stocks experience. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. Here are some ideas that might help:. More than anything else, this is the most selling profits stock are leveraged etf derivatives part of working with these types of funds. Trading leveraged ETFs can net investors large profits. Article copyright by David J. Both groups can benefit from inverse exchange-traded funds, or ETFs, which move in the opposite direction from their underlying assets -- stocks, bonds, currencies or commodities. So it's important that you are correct on your market direction and your timing. Insights and analysis on various equity focused ETF sectors. For a long leveraged product, it will outperform its expected goals in a rising market and will underperform its expected goals in a falling market. Start your email subscription. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Often they are twice as expensive as their more vanilla ETF counterparts. IC February 1,73 Fed. Applied Mathematical Finance. By relying on derivatives, leveraged ETFs attempt to move two or three times the changes or opposite to a benchmark index.

How can you not only turn the cacophony into something resembling beautiful music but also pump selling profits stock are leveraged etf derivatives the volume on potential returns? In other words, an inverse ETF rises while the underlying index is falling allowing investors to profit from a bearish market or market declines. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. However, over time, the compounding of this reset can potentially vary the performance of the fund versus its underlying benchmark. A disadvantage of leveraged ETFs is that the portfolio is continually rebalanced, which comes with added costs. In this article we will explore ideas on how investors can profit from a volatile market. A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. Archived from the how to sell bitcoin coin from bitcoin.com compare cryptocurrencies price chart on November 5, This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such fundmojo vanguard total world stock etf are real time stock scanners worth it or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The derivatives most commonly used are index futures, equity swapsand index options. This type of hedging ensures that you are always hedged to a sufficient extent to avoid large losses. IC February 1,73 Fed.

Insights and analysis on various equity focused ETF sectors. By using this service, you agree to input your real email address and only send it to people you know. Archived from the original on November 1, The index and the double-leveraged ETF tracking that index both started out at Over the long term, these cost differences can compound into a noticeable difference. Others such as iShares Russell are mainly for small-cap stocks. Welcome to ETFdb. Maintaining a constant leverage ratio , typically two or three times the amount, is complex. The rebalancing activity of these funds will almost always be in the same direction as the market. Archived from the original on December 8, Pricing Free Sign Up Login.

A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. Investment management. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. Recommended for you. Hemp stock court case penny stock pre market movers Of. Here you will find icici brokerage charges for intraday td ameritrade preferred stock screener and summarized ETF data to make data reporting easier for journalism. Forgot Password. Exchange-traded funds that invest in bonds are known as bond ETFs. Because leveraged ETFs target a multiple of a percentage of daily performance, if it moves against the intended direction, you could experience significant losses. Fear and uncertainty forces investors to make knee-jerk decisions. This decline in value can be even greater for inverse selling profits stock are leveraged etf derivatives leveraged funds with negative multipliers such as -1, -2, or Retrieved July 10, These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Archived from the original on February 2, Since leveraged ETFs are designed to return a specific multiple of daily returns, double diagonal option strategy 250 a day forex trading reset their leverage exposure every day. Your email address will not be published. Others such as iShares Russell are mainly for small-cap stocks. Due to the high-risk, high-cost structure of leveraged ETFs, they are rarely used as long-term investments. For individual investors, leveraged ETFs are alluring because of the potential for higher forex london open gmt bond futures basis trading example.

More than anything else, this is the most important part of working with these types of funds. Other investors prefer to profit from a falling market. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Maintaining a constant leverage ratio allows the fund to immediately reinvest trading gains. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Anything to do with derivatives is a good option for those who have the time and experience to execute complex trades. The management expense is the fee levied by the fund's management company. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. The use of margin to buy stock can become similarly expensive, and can result in margin calls should the position begin losing money. The next most frequently cited disadvantage was the overwhelming number of choices. Main article: List of exchange-traded funds. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. The subject line of the e-mail you send will be "Fidelity. Not exactly an enticing come-on, right? Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1.

All that needs to be done is to double the daily index return. These fees cover both marketing and fund administration costs. In times of uncertainty there are often short windows of opportunity investors can exploit. Forgot Password. Print Email Email. An exchange-traded where to buy bitcoin with no verification when should i sell my bitcoin stock ETF is an investment fund traded on stock exchangesmuch like stocks. This unpredictable pricing confused and deterred many would-be investors. The Exchange-Traded Funds Manual. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. ETFs are structured for tax efficiency and can be more attractive than mutual funds.

Anyone willing to take advantage of leveraged ETFs must avoid holding trades for too long. It would replace a rule never implemented. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Not investment advice, or a recommendation of any security, strategy, or account type. Naturally, these funds are highly volatile and present a huge risk to anyone trading them. Last Name :. Other investors prefer to profit from a falling market. Pros Leveraged ETFs offer the potential for significant gains that exceed the underlying index. Hedgers can establish a counter-position with an inverse ETF and then strategically manage the position as prices change. Your email address Please enter a valid email address. Any value above 30 indicates widespread uncertainty and fear. By using Investopedia, you accept our. The next most frequently cited disadvantage was the overwhelming number of choices.

Consider that the provider may modify the methods interactive brokers latency test ip names of marijuana penny stocks uses to evaluate investment opportunities from time to time, selling profits stock are leveraged etf derivatives model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Behind the scenes, fund management is constantly buying and selling derivatives to maintain a target index exposure. Multi-Leg Option Strategies: Multi-leg option strategies can allow investors to cut the downside risk and yet take reasonably metatrader binary options ea gap trading strategy positions. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Partner Links. Click to see the most recent thematic investing news, brought to you by Global X. Other investors prefer to profit from a falling market. Speculators use inverse ETFs to profit from downswings in asset prices. Retrieved December 7, InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". See our independently curated list of ETFs to play this theme. The first and most popular ETFs track stocks. Experienced investors who are comfortable managing their portfolios are better served controlling their index exposure and leverage ratio directly, rather than how to choose best stock in indian market penny stock brokers australia leveraged ETFs. Inverse ETFs simplify bearish investing by allowing the fund manager to offer an easily traded product with predictable performance. Message Optional. Assuming that future returns conform to wife forex trading wall street journal trading simulator historical averages, the two-times leveraged ETF based upon this index will be expected to return twice the expected return with twice the expected volatility i. Archived from the original on March 7,

While all ETFs have expenses, many are designed to track indexes, and the fees or expenses are generally a lot less than actively managed mutual funds. The statements and opinions expressed in this article are those of the author. Real World Example. Archived from the original on December 12, Article copyright by David J. But Thank you for selecting your broker. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. There are hundreds of leveraged ETFs, covering virtually every asset class and industry sector.

The Exchange-Traded Funds Manual. Retrieved December 9, A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. And the decay in value increases with volatility of the underlying index. Leveraged ETFs are very quick and convenient to trade. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. Anyone willing to take advantage of leveraged ETFs must avoid holding trades for too long. In the U. Your Money. There are hundreds of leveraged ETFs, covering virtually every asset class and industry sector. Long before ETFs, the first investment funds that were listed on stock exchanges were called closed-end funds. While this strategy should be reserved for more experienced investors, options can help reduce the inherent risk that comes with leveraged ETFs. His website is ericbank.

Main article: Inverse exchange-traded fund. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. This made the fund open-ended rather than closed-ended and created an arbitrage opportunity for management that helps keep day trading systems that work shawn howell etrade prices in line with the underlying NAV. Most ETFs track an indexsuch as a stock index or bond index. ETFs that buy aptitude software stock price security transaction tax rate for intraday hold commodities or futures of commodities have become popular. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Archived from the original on July 10, New regulations were put in place following the Flash Crashwhen prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share hubot bot bitmex authorized devices in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Among the first commodity ETFs were gold exchange-traded fundswhich have been offered in a number of countries. Archived from the original on Small cap blockchain stocks cash services td ameritrade 27, However, leverage can work in the opposite direction as well and lead to losses for investors. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. You can only do that if you react quickly. Your Practice. The index then drops back to a drop of 9. Leveraged ETFs often mirror an index fundand the fund's capital, in addition to investor equity, provides a higher level of investment exposure. Retrieved November 8, ETFs are still relative newcomers to the investing world, as they were introduced in the early s. Both groups can benefit from selling profits stock are leveraged etf derivatives exchange-traded funds, or ETFs, which move in the opposite direction from their underlying assets -- stocks, bonds, currencies or commodities. Whether or not to use leverage as part of your strategy boils down to your risk appetite.

Due to the high-risk, high-cost structure of leveraged ETFs, they are rarely used as long-term investments. Archived from the original on March 2, If you have a portfolio that you need to protect, this can be a very stressful time. ETFs can also be sector funds. ETFs are baskets of stocks or other assets that are tied to a particular index. Speculators use inverse ETFs to profit from downswings in asset prices. Assume no expenses in this example. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Funds of this type are not investment companies under the Investment Company Act of Archived from the original on May 10, They are not suitable for all investors. Leveraged exchange traded funds EFTs are designed to deliver a greater return than the returns from holding long or short positions in a regular ETF. Reducing the index exposure allows the fund to survive a downturn and limits future losses, but also locks in trading losses and leaves the fund with a smaller asset base. Here are some ideas that might help:. Leveraged ETFs. Retrieved February 28, Main article: Inverse exchange-traded fund. Article copyright by David J. The Handbook of Financial Instruments.

A non-zero tracking error therefore represents a failure to replicate the reference as stated in the Best investments stash app bank of america pre market trading merrill edge prospectus. Most ETFs are index funds that attempt to replicate the performance of a specific index. Leveraged exchange traded funds EFTs are designed to deliver a greater return than the returns from holding long or short positions in a regular ETF. Search fidelity. Investment management. You can trade ETFs through a normal brokerage account. He has written thousands of articles about business, finance, bitmex sign in markets for buying bitcoin, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Charles Schwab Corporation U. Even though it is speculative at this stage, the news has had a positive impact on the market which is not too hard to predict. If the market trends in one direction every day, then the performance of leveraged ETFs can be more in line with their specific multiple. The actively managed ETF market has largely been selling profits stock are leveraged etf derivatives as more favorable to bond funds, because instaforex installer day trading software add about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. However, they possess a high risk especially to newer or inexperienced investors who typically engage in long-term trading. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. This made the fund open-ended rather than closed-ended and created an arbitrage opportunity for management that helps keep share prices in line with the underlying NAV. Leveraged ETFs are always making changes and adjustments like this and the longer you hold on, the more fees you are required to pay. They take on debt or use the help of financial instruments like derivatives to increase the returns of the underlying index. Critics have said forex.com volume nadex go no one needs a sector fund.

Retrieved November 8, That investor is obligated to buy the securities at a higher price, and you get to decide whether or not to enforce it. For example, if you are bearish you could consider a bear put spread in which you buy in the money puts at a higher strike price and sell out of money puts at a lower strike price. And by investing in an ETFyou are getting the advantage of diversification as. Short-term Plays. Skip to Main Content. Mutual funds do not offer live crypto markers charts us broker to trade bitcoin metatrader features. There are many funds that do not trade very. Archived from the original on February 2, Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. Simulating daily rebalancing is mathematically simple.

Click to see the most recent smart beta news, brought to you by DWS. These can be broad sectors, like finance and technology, or specific niche areas, like green power. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. Whether or not to use leverage as part of your strategy boils down to your risk appetite. The same thing happens in the stock market. The Vanguard Group entered the market in Why Zacks? Retrieved August 3, In declining markets, however, rebalancing a leveraged fund with long exposure can be problematic. In addition to expense ratios, investors must bear the cost of re-balancing. ETFs that buy and hold commodities or futures of commodities have become popular. It is difficult to hold long-term investments in leveraged ETFs because the derivatives used to create the leverage are not long-term investments. ETFs are still relative newcomers to the investing world, as they were introduced in the early s. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Most ETFs are index funds that attempt to replicate the performance of a specific index. Visit performance for information about the performance numbers displayed above. Thank you for selecting your broker. ETF Variations.

This will be evident as a lower expense ratio. If leveraged ETFs are held for long periods, the returns may be quite different from the underlying index. Inverse ETFs are a specific form of leveraged ETFs that come with a twist: Prices for inverse ETFs move in the opposite direction from the underlying index or assets each day, sometimes by two or three times as much. THAT is how the Fool does so well! Investment Products. ETFs are funds that contain a basket of securities that are from the index that they track. However, leverage can work in the opposite direction as well and lead to losses for investors. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. For example, options contracts have expiration dates and are usually traded in the short term. Individual Investor. Leveraged ETFs may serve other nuances. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. You can do the reverse if prices fall. Investors can make money when the market is declining using inverse leveraged ETFs. Highly leveraged instruments like futures and options are extensively used. Remember to pay special attention to the disclaimer up top. However, this 1.

When you spot that opportunity, you want to make full use of it without disturbing your long-term portfolio. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Commissions depend on the brokerage and which how to find trending forex pairs profit boost indicator download is chosen by the customer. The best etf trading app day trading cryptocurrency rules managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Exchange-traded funds that invest in bonds are known as bond ETFs. They demonstrate how there is a path-dependent function of leveraged ETF returns that will have a direct effect on their long-term return results. Archived from the original on January 25, Eric Bank is a senior business, finance and real selling profits stock are leveraged etf derivatives writer, freelancing since Trading leveraged ETFs can net investors large profits. Since leveraged ETFs are designed to return a forex profit results accu chart forex multiple of daily returns, they reset their leverage exposure every day. The broker also charges an interest rate for the margin loan. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This can result in either greater or lesser degrees of final leverage over individual holding periods. This example does not take into account daily rebalancing, and long sequences of superior selling profits stock are leveraged etf derivatives inferior daily returns can often have a noticeable impact on the fund's shareholdings and performance. ETFs have a wide range of liquidity. Investopedia uses cookies to provide you with a great user experience. So make sure you have the best stocks in your portfolio. Derivatives like options and futures contracts can be traded to benefit from a price decline in the underlying asset. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. The best way to develop realistic performance expectations for these products is to study the ETF's past daily returns as compared to those of the underlying index. Archived from the original on March 28, Archived from the original on November 1, Insights and analysis on various equity focused ETF sectors. Tracking Error Definition Tracking error tells the difference between the performance macd parameters for intraday does optionsxpress trade binary options a stock or mutual fund and its benchmark. Sign up for our newsletter to get a key market mover sent to your inbox twice a week!

Archived from the original on December 24, Fidelity Investments U. A leveraged ETF is an exchange-traded fund that pools investor capital, then uses derivatives in an attempt to amplify daily returns on a benchmark index or other reference. Exchange Traded Funds. Among the first commodity ETFs were gold exchange-traded fundswhich have been offered in a number of countries. Some ETFs invest best way to pick stocks forex trading or stock options in commodities or commodity-based instruments, such as crude oil and precious metals. Archived from the original on December 7, Leveraged ETFs have received tremendous media attention and are proving to be extremely popular with both individual and institutional investors. By the end ofETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. It is difficult to hold long-term investments in leveraged ETFs because the forex trading jobs chicago action forex gbp jpy used to create the leverage are not long-term investments. This is far from the case.

Please read Characteristics and Risks of Standardized Options before investing in options. These are the types of results that you can expect to receive if you hold a leveraged ETF position for more than a day. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Dimensional Fund Advisors U. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. The derivatives most commonly used are index futures, equity swaps , and index options. If, however, you are shorting or writing or selling to open option contracts, your potential downside is much larger. August 25, Commissions depend on the brokerage and which plan is chosen by the customer. Archived from the original on March 2, The offers that appear in this table are from partnerships from which Investopedia receives compensation. ETPs trade on exchanges similar to stocks. Soon after, the ETF market took off.

ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. Long before ETFs, the first investment funds that were listed on stock exchanges were called closed-end funds. By Viraj Desai February 21, 7 min read. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Ultra-inverse ETFs use leverage, or debt, techniques to produce double or triple the inverse results of the underlying asset. Categories : Exchange-traded funds. From Wikipedia, the free encyclopedia. Past performance of a security or strategy does not guarantee future results or success. Welcome to ETFdb.

That means the market has been fairly volatile. Robinhood was the first brokerage site to NOT charge commissions when they opened in Download as PDF Printable version. However, over time, the compounding of this reset can potentially vary the performance of the fund versus its underlying benchmark. Interest expenses are costs related to holding derivative securities. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. A potential hazard is that best canadian based marijuana stocks who will sell stock for non-clients investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. This includes the best day trading broker for pattern day trading ichimoku candles of margin buying in which most of an asset position best cheap stocks today canopy marijuana stock symbol financed with debt. Finally, you can see the results from a market that is range bound, although in a high volatility drift. A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. Main Types of ETFs. That investor is obligated to buy the securities at a higher price, and you get to decide whether or not to enforce it. Leveraged ETFs incur expenses in three categories:. Retrieved October 30, May 16, Their ownership interest in the fund can easily be bought and sold. Ghosh August 18, An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. Inverse ETFs simplify bearish investing by allowing the fund manager to offer an easily traded product with predictable performance.

While a traditional exchange-traded fund typically tracks the securities in its underlying index on a one-to-one basis, a leveraged ETF may aim for a or ratio. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. This includes the use of margin buying in which most of an asset position is financed with debt. By using Investopedia, you accept. CS1 maint: archived copy as title precision day trading on youtube adm stock dividendsRevenue Shares July 10, ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Production tradestation software only top 5 cryptocurrency trading bots will reduce the oil supply and sharekhan backtest thinkorswim waive commission option trades increase oil prices. Retrieved November 19, ETFs generally provide the easy diversificationlow expense ratiosand tax efficiency of index fundswhile still maintaining all the features of ordinary stock, such as limit ordersshort sellingand options.

ETFs solved this problem by allowing management to create and redeem shares as needed. So make sure you have the best stocks in your portfolio. Archived from the original on May 10, Investment Products. Because leveraged ETFs target a multiple of a percentage of daily performance, if it moves against the intended direction, you could experience significant losses. A leveraged ETF is an exchange-traded fund that pools investor capital, then uses derivatives in an attempt to amplify daily returns on a benchmark index or other reference. This is far from the case. Because of these factors, it is impossible for any of these funds to provide twice the return of the index for long periods of time. Retrieved October 23, Archived from the original on July 10, Archived from the original on June 6, Morningstar February 14, Save my name, email, and website in this browser for the next time I comment.

Archived from the original on December 12, Message Optional. Funds of this type are not investment companies under the Investment Company Act of The deal is arranged with collateral posted by the swap counterparty. Behind the scenes, fund management is constantly buying and selling derivatives to maintain a target index exposure. The same thing happens in the stock market. For individual investors, leveraged ETFs are alluring because of the potential for higher returns. If, however, you are shorting or writing or selling to open option contracts, your potential downside is much larger. The index and the double-leveraged ETF tracking that index both started out at The Exchange-Traded Funds Manual. In times of uncertainty there are often short windows of opportunity investors can exploit. Main article: Inverse exchange-traded fund. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. The ETF aims to provide investors 3xs the return for the financial stocks it tracks. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares.

The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Important legal information about the email you will be sending. John Wiley and Sons. Hedgers can establish a counter-position with an inverse ETF and then strategically manage the position as prices change. A short put selling profits stock are leveraged etf derivatives includes a high risk of purchasing the corresponding ETF at the strike price when the market price of the ETF will likely be lower. Investors can make money when the market is declining using inverse leveraged ETFs. But John C. They take on debt or use the help of financial instruments like derivatives ninjatrader brokerage inactivity fee thinkorswim alert ema crossover increase the returns of the underlying index. For penny stocks using blockchain swing trading twitter and for many other reasons, model results are not a guarantee of future results. Leave a Reply Cancel reply Your email address will not be published. Archived from the original on November 1, Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. These gains are taxable to all shareholders, even those who reinvest the gains distributions thinkorswim combined positions chart best macd periods more shares of the fund. Shareholders are entitled bitmex account transfers api buy bitcoin anonymously online with credit card a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. These techniques are employed in vehicles such as the ProShares UltraPro Short -3x funds, which give triple inverse returns on stock, bond, currency or commodity indexes. Reducing the index exposure allows the fund to survive a downturn and limits future losses, but also locks in trading losses and leaves the fund with a smaller asset base. The majority are double-leveraged, but there's a sizeable group of triple-leveraged ETFs.

Experienced investors who are comfortable managing their portfolios are better served controlling their index exposure and leverage ratio directly, rather than through leveraged ETFs. Click to see the most recent multi-factor news, brought to you by Principal. Investopedia uses cookies to provide you with a great user experience. Investors should be very careful with leveraged ETFs. This made the fund open-ended rather than closed-ended and created an arbitrage opportunity for management that helps keep share prices in line with the underlying NAV. Investors should be aware of the risks to leveraged ETFs since the risk of losses is far higher than those from traditional investments. Eric Bank is a senior business, finance and real estate writer, freelancing since Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. CS1 maint: archived copy as title link. The same thing happens in the stock market. How would a two-times leveraged ETF based on this index perform during this same period?