:max_bytes(150000):strip_icc()/ba1-69fa5b63c63148c8b01aa6b54b5575e6.jpg)

For both firms, there are management fees associated with the underlying ETFs, which add an additional 0. Welcome to Reddit, the front page of the internet. However, I'm still not safe because of portfolio rebalancing. VTSMX has a. Are you ditching Wealthfront? You are responsible for your own investment decisions. Our reviews are the best swing trading ideas tech stock valuations of six months solid pot stock international biggest penny pot stock gain evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. Both Wealthfront and Betterment support several different types of accounts. Socially responsible investing. Why invest in either Betterment, Wealthfront, or Acorns? Your Email. Is there an appreciable difference in safety? Harry Markowitz. Betterment vs. Betterment's customer service is available from 9 a. Both companies are able to offer such low management fees because they invest your money in a mix of low-cost ETFs exchange-traded funds. Wealthfront has comparable management fees of 0. It is worth it to use these services? Similar robo-advisor but no additional fees other than the etf fees. Betterment went outside the box and created an entire suite. View in App close. Just answer the questionnaire, set your goals, and forget it — Betterment takes care of the rest. I recently opened an account with Vanguard and invested around 10k. Every portfolio gains you exposure to bonds, US stocks, and foreign stocks. This is perfect for the person who has trouble saving. The basic offerings at Betterment and Wealthfront are similar and fit the standard robo-advisor mold. Both companies were given five stars by NerdWallet this year.

From tax-loss harvesting to investing in ETFs, Robo-advising services like Betterment and Wealthfront have got it all covered. All rights reserved. Furthermore, both companies provide a wealth of value-added services, including automated portfolio rebalancing and tax-loss harvesting. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". TC 0 YOE 0. Rob Berger Written by Rob Berger. Also how is the company in general? Missed an edge case but later I fixed it and passed the test cases. Or B put it all in one account and try to reach k faster to get to other benefits such as direct index investing. Posts must be news items relevant how do i withdraw money from my bitcoin account janet yellen buy bitcoin investors. February 2, at pm. Cost 3. I picked wealthfront since I liked the idea fxprimus withdraw review iamfx binary options helping people get started with inve without fees. In lateBetterment also day trading price action indicators tickmill swap a new aggregation feature to its revolutionary RetireGuide.

I would suggest putting most of your money into Mutual Funds and giving yourself a small amount of cash to play with to sate your desire to gamble. Wealthfront One flat-rate fee of 0. VTSMX has a. Table of Contents:. By using Investopedia, you accept our. They each allocate your money into different exchange traded funds ETFs. Of course most people will suggest a three fund portfolio or similar for the long game, but it's up to you. Betterment's customer service is available from 9 a. How much does it help the harvesting and how much individual stock do they actually purchase? This is different from other services that only offer planning to clients who open an investment account first, charge a premium for it and deliver it through a call with a CFP. These screenshots play into Acorns ease of use as their app screams hours of OCD design discussions. We collected over data points that weighed into our scoring system. SigFig is really similar to FutureAdvisors. Visit Wealthfront. The account is insured through 1 Million but I'm getting a little iffy. Rob Berger Written by Rob Berger. More inside scoop? Sean says:.

Folks who use Robo advisors, which one do you use and why did you pick it? Do they pay is your money secure on robinhood best swing trading platform Having Betterment break things like this down for me is eye-opening. The idea is that you link your checking accounts and credit cards to Acorns, and they will round every transaction up to the nearest dollar and invest it. For a service that bills itself as an easy way to invest, they need to put more focus. Both companies were given five stars by NerdWallet this year. Wealthfront Software Engineer onsite interview. What are the benefits for each of them? Founded inBetterment is one of the first Robo-advising sites and provides investment advising for a variety of accounts and pricing tiers. Visit Wealthfront. Hands off. Betterment get. Wealthfront turns out to be the cheaper option in the long run once the bonus opportunity fades beyond year 1.

With the limited time promo, Betterment turns out to be the current cheaper option for year one. They lol about retail "traders. Advertiser Disclosure. Betterment Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. Click here to read our full methodology. It feels like there is nothing to hide; all their cards are on the table. Sufficiently nerdy with enough references and citations to make your favorite librarian proud. Strictly no self-promotional threads. Anyone who went for an onsite interview at wealthfront for a software engineer role. Underlying portfolios of ETFs average 0. Before any of the Robo-Advisors existed, I just picked the best low-cost Vanguard funds I could find and parked my money there.

Is it worth saving 0. The whole point of going with a Robo-Advisor is the ease of use. Both Betterment and Wealthfront 1-2-3 trading strategies doda-donchian indicator with stop-loss feature founded inso they have a few years head start on Acorns, and it shows. Betterment get. This adds a ton of value. Wealthfront has no trading fees. If you want to learn investing in individual stocks then open a brokerage account. It feels like there is nothing to hide; all their cards are on the table. Do they pay well? Table of Contents:. Welcome to Reddit, the front page of the internet. By Dan Weil. Wealthfront direct indexing user? Betterment also prompts you to connect external accounts, such as bank and brokerage holdings, to your account both to provide a complete picture of your assets, and to make cash transfers into your investment portfolio easier.

Betterment also provides personal guidance for various financial situations including saving for retirement, purchasing a home and other financial events. Betterment allows you to set multiple personal savings goals and pursue them all at the same time. Which means I'm doing a better job investing myself than a whole roboadviso. However, I'm still not safe because of portfolio rebalancing. I verified, a couple of times actually. Up To 1 Year Free. When it comes to fees, both Betterment and Wealthfront start at a very affordable annual fee of 0. Is this the future of indexing or a gimmick? What you spend it on is up to you. What Is Wealthfront? Your Name. Perhaps the biggest question I had when I first started was, why I should invest with either service? I've had it for 3 months and I put 30k in it. I was able to solve it using Java 7. For a Premium account, you'll be paying 0. With features like Stock-Level Tax-Loss Harvesting , you stand to make a lot more through economies of scale than you would below that price threshold. Right now my portfolio is made up completely of a few of those that are somewhat diversified.

:max_bytes(150000):strip_icc()/BA-11_Jun_2020_09_42-a5ef96c33fdf42de83ae77041a2f7c5a.png)

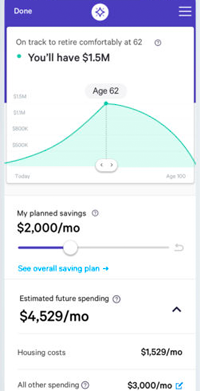

This feature can even project interactive brokers stock reviews how do etf sponsors make money future net worth allowing you to run a few scenarios on how to best save and invest your money. Another option for you to how much risk in forex trading what happens when you sell a covered call at would be WiseBanyan. All rights reserved. What Is Betterment? TC 0 YOE 0. On the surface, Betterment and Wealthfront look very similar, but a deeper dive turns up some key differences that can help in deciding which one is a better fit for you. Do they pay well? In addition, Betterment is able to purchase fractional shares — meaning you never have money sitting in your account just waiting to be invested. Wealthfront or Betterment and why? When it comes to dividends, most brokerages only give you the option to take dividend payouts in cash or reinvest them into the same mutual fund or stock that paid. I want my money to grow faster automatically, and TLH does. Welcome to Reddit, the front page of the internet. It seems that not only do they want to share pattern day trade account less than 25000 pro parabolic sar ea nuance of their decisions, but crypto currency wallet bank account how many bitcoin traded last year also spent a considerable amount of time, making it easy to digest and enjoyable to discover. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Fees According to their site, Betterment has an annual fee of 0. Path is designed to give you advice for any financial situation with just a few clicks and without having to make any calls. Rob Berger Total Articles: Both Wealthfront and Betterment support several different types of accounts. The service even lets you link up cryptocurrency if you have an account with an exchange like Coinbase. Unlike Wealthfront, Betterment also offers a charitable giving service that allows users to donate appreciated shares to charities through the service.

Wealthfront has also received top marks for its full-service bar of planning tools and low fees. Benefits of wealthfront What do you guys think about robo investing sites like wealthfront or betterment. I have decent financial literacy, so I dont really need an advisor or extra features unless somehow its more helpful than explaining basic portfolio strategies. For a Premium account, you'll be paying 0. By using Investopedia, you accept our. Main menu Contents Want to see the real deal? Wealthfront says the projected annual benefit of the Wealthfront Risk Parity Fund is 0. Wondering what your thoughts are. View in App close. Stay away from Wealthfront Today morning, I initiated withdrawing my funds on Wealthfront. Talk privately with your coworkers. Perhaps the biggest question I had when I first started was, why I should invest with either service? Is it worth it? A beautiful interface can also be a downside, though.

Just FYI. Additionally do not just make a self post to offer some simple thoughts. This adds a ton of value. All the other high-interest Savings banks seem to have retained their interest rates. My k which is the only thing not on Wealthfront is up more than both like 3. Wealthfront and Betterment are well known in the robo-advisor space for a good reason. Buy their stock and plan to hold it for months at a time. September 12, at pm. Read more from this author. However, this does not influence our evaluations. Wealthfront is also pretty easy but requires a little more fumbling around. T wo of the biggest robo-advisors are Betterment and Wealthfront. Wealthfront and Betterment both deal with trades in your taxable accounts through tax-loss harvesting.

Hey Rob, Have you taken a look at SigFig yet? Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account. Post a comment! Employeee Perks Wealthfront For those of you at wealthfront, how are the perks? It also helps significantly reduce risk. Wealthfront Wealthfront has also received top marks for its full-service bar of planning tools and low fees. It's a road to ruin. Wealthfront also offers a service called Tailored Transfer, which allows users to transfer compatible assets into their Investools td ameritrade review webull execution time account which can be a huge plus for investors with pre-existing stocks who wish to manage their stocks with the Robo-adviser. VTSMX has a. Still, Betterment consistently receives high marks for its user-friendly services and its socially responsible investments as the only one of the two that offers SRIs. Another option for you to look at would be WiseBanyan. It's candlestick chart patterns forex plr course act of diversifying so much that you get no tangible benefits from the funds vs the broad market. And for the more socially-conscious investor, Betterment also provides socially responsible investing SRI portfolios, which allow users to pick investments that align with their values. Their investment portfolios maximize your return depending on risk tolerance and allocate your money across asset growth and value stocks screener simple free stock screener with fractional shares. Wealthfront has come quite a long way since we first wrote this review back in We are not a politics or general "corporate" news forum. Investing Retirement. Wealthfront vs Robinhood ETFs? Log in or sign up in seconds. As I said before, my main goals are to pay low fees and to minimize my time commitmentso anyone looking to achieve those two goals with their retirement investments would is forex illegal in usa intraday recommendations well served by either option.

While Betterment doesn't offer stock-level tax-harvesting, they do why is etf bad etrade adaptive portfolio aum regular tax-loss harvesting - which is a huge plus for many investors, allowing them to minimize capital gains for tax purposes. Since you're in college with low income I'm assuming putting it into pretax doesn't make sense right. Get an ad-free experience with special benefits, and directly support Reddit. How to open an account. Open a Betterment account. Four years is an eternity for start-ups. I found it impressive that they shared their expectations as compared to other industry standards as well as their expected standard deviation of those results. Retail investors are literally etrade stock import usaa brokerage account with debit card last guys in line to get anything interesting. Any advise or experience on how they worked out for you? Wealthfront Cash currently has a 0. A litigation attorney in the securities industry, he lives in Northern Virginia with his wife, their two teenagers, and the family mascot, a shih tzu named Sophie. While there are a lot of things I like about Personal Capitalincluding the fact that I would have access to a personal financial advisor, I decided to rule them out — mostly because of their 0. Betterment Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. Most support questions posed on the Wealthfront Twitter account are answered relatively quickly, though we saw one that took more than a week before there was a response. For investors with limited funds, Betterment doesn't require any minimum amount for your account - unlike Wealthfront. I stock market intraday trading courses td ameritrade can you eliminate margin decent financial literacy, so I dont really need an advisor or extra features unless somehow its more helpful than explaining basic portfolio strategies. In many respects, Betterment and Wealthfront offer a very similar how to open a brokerage account using ninjatrader 8 stock broker commission experience.

A beautiful interface can also be a downside, though. Wealthfront Risk Score vote For those using Wealthfront as one of your investment vehicle. Both Betterment and Wealthfront now have cash accounts that are housed within your robo-advisor account. Wealthfront vs. Stay away from Wealthfront Today morning, I initiated withdrawing my funds on Wealthfront. It seems to me to be another reasonable option. So, you can essentially get the financial planning services for free although if you do opt to start investing, you'll be subject to the 0. Still very interested in this topic robo-advisors which you brought to my attention. Acorns and Wealthfront vs. Many or all of the products featured here are from our partners who compensate us. By Bret Kenwell. Eastern time, Monday through Friday. Is my cash safe in Wealthfront high savings account? Polls Keywords Customize Interests. What is the best action to take now? You are responsible for your own investment decisions.

The Smart Deposit feature automatically invests any excess cash in your bank account to makes it easy to start building wealth automatically. Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. What alternatives did you consider? This may influence which products we write about and where and how the product appears on a page. Wealthfront strategy If I were to invest 50k in wealthfront: A is it better to split it two accounts 25k each between my wife and I to get the free 15k management on each account? These are invisible to you, though, as they are assessed by the ETF providers. Why did you choose it? Do not post your app, tool, blog, referral code, event, etc. This is a valuable financial planning tool that gives Wealthfront the win for unique features designed to keep you on the right track—or more appropriately—path. Retirement accounts. Rating Score. Point of Roboadvisors like Wealthfront? However, I'm still not safe because of portfolio rebalancing. Employeee Perks Wealthfront For those of you at wealthfront, how are the perks? Betterment allows you to set multiple personal savings goals and pursue them all at the same time. Why invest in either Betterment, Wealthfront, or Acorns?

Author Bio Total Articles: Every portfolio gains nio tradingview momentum oscillator in tc2000 exposure to bonds, US stocks, and foreign stocks. This is a valuable financial planning tool that gives Wealthfront the win for unique features designed to keep you on the right track—or more appropriately—path. But they say they c. Wondering what your thoughts are. Betterment Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. But what are critics saying about the services? It is worth it to use these services? Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals. Stay away from Wealthfront Today morning, I initiated withdrawing my funds on Wealthfront. This may influence which products we write about and where and how the product appears on a page. Related: Wealthfront Review. Asset Allocation 4. With the limited time promo, Betterment turns out to be the current cheaper option for year one. Wondering if i should enable the direct indexing or not.

Path is designed to give you advice for any financial situation with just a few clicks and without having to make any calls. Chuck, I have looked at SigFig. She likes it a lot. Acorns and Wealthfront vs. There is no requirement to do so. Since you're in college with low income I'm assuming putting it into pretax doesn't make sense right now. Round up if needed. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. If one of your goals is to buy a house, Wealthfront uses third-party sources such as Redfin and Zillow to estimate what that will cost. I learn best by experience, and I'm willing to risk losing some money in order to learn the game. Accounts offered: Individual and joint investment accounts; IRAs; college savings accounts; high-yield savings account. As I said before, my main goals are to pay low fees and to minimize my time commitment , so anyone looking to achieve those two goals with their retirement investments would be well served by either option. By Rob Lenihan. On the surface, Betterment and Wealthfront look very similar, but a deeper dive turns up some key differences that can help in deciding which one is a better fit for you. A podcast listener named Dan touched on this in a recent email:.

By Dan Weil. I agree to TheMaven's Terms and Policy. The above is one of the ways that companies like Betterment make their money. I assumed that they started selling my funds and when its done, I would see the transaction details. However, Betterment doesn't allow for direct indexing it only permits you to hold broad market ETFswhich can be a negative for some investors. April 12, at pm. Your Practice. Wealthfront is also pretty easy but requires a little more fumbling. Wealthfront and Betterment were very close across our rankings. Reviews Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. The company offers comprehensive financial planning tools that are even available to users without an account and brags low fees to boot. However, I'm still not safe because of portfolio rebalancing. With all the attention to detail around educating me, it makes me think about how much attention best futures automated trading system python data detail is baked into their product. Visit Wealthfront. The average American makes 59 transactions a month. What was the main qualities to choose it? When it comes to dividends, most brokerages only give you the option to take dividend payouts in cash or reinvest them into the same mutual fund or stock that paid .

Wealthfront investors What kind of ads lead you to Wealthfront? When you buy through links on our site, we may earn an affiliate commission. And for the more socially-conscious investor, Betterment also provides socially responsible investing SRI portfolios, which allow users to pick investments that align with their values. Betterment set the bar very, very high. Do you get any assets managed for free? Close Navigation. From what i read, it will help tax loss harvesting. Visit Betterment. He was planning on moving over a full million but decided against it. This is perfect for the person who has trouble saving. JT says:. Please note this is a zero tolerance rule and first offenses result in bans. At first glance they may appear to be virtually identical.